Options trading within a 401k has emerged as a strategic tool for investors seeking enhanced returns and risk management. Understanding the intricate dynamics of options trading can empower you to delve into this market with confidence, harness its potential, and protect your hard-earned retirement savings.

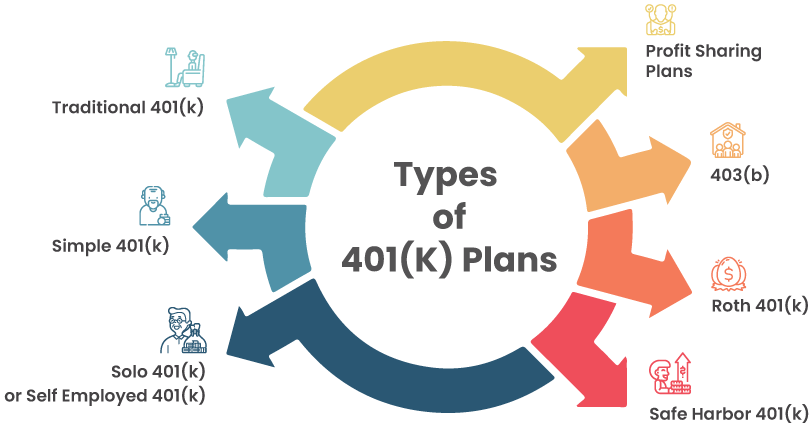

Image: www.sdretirementplans.com

Delving into Options Trading: What’s at Stake?

An option contract grants the buyer (holder) the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price on or before a specific date. In essence, you’re purchasing flexibility with options, giving yourself the opportunity to capitalize on market fluctuations or safeguard your investments against downturns. However, options trading carries inherent risks, making it crucial to tread cautiously and with a comprehensive understanding.

A Step-by-Step Guide to Options Trading in 401k

1. Assessing Eligibility: Determine if your 401k plan permits options trading. Contact your plan administrator or financial advisor for specific guidelines and limitations.

2. Understanding Types of Options: Call options grant you the right to buy, while put options give you the right to sell an underlying asset. American options can be exercised at any time before expiration, whereas European options can only be exercised on the expiration date.

3. Striking the Right Price: The strike price is the predetermined level at which you can buy or sell the underlying asset. Choosing the optimal strike price is key to successful options trading, balancing risk and potential returns.

4. Mastering Expiration: Each option contract has a specific expiration date. Options that are “in the money” by the expiration date can be exercised for a profit.

5. Knowing Your Premiums: The premium is the price you pay for the option contract, representing its value and potential profit or loss. Premiums can fluctuate based on variables like market demand, volatility, and time to expiration.

Unlocking the Potential of Options Trading

1. Enhancing Returns: Options provide leveraged exposure to underlying assets, amplifying potential returns for experienced traders. However, it’s essential to approach this strategy with a calculated risk appetite and thorough understanding of market dynamics.

2. Hedging Against Risk: Put options can act as valuable insurance against market downturns. By purchasing a put option on a stock you own, you secure the right to sell the stock at a predetermined price, guarding against potential losses.

3. Generating Income: Selling (writing) covered calls involves selling an option contract for a stock you already own. If the stock price remains below the strike price, the option expires worthless, and you collect the premium as income.

Image: azzadasset.com

Navigating the Risks of Options Trading

1. Potential for Losses: Options trading can result in significant losses if executed without proper risk management techniques. The purchased premium represents the maximum loss on most options contracts.

2. Unpredictable Market Fluctuations: Options trading is heavily influenced by market conditions. Fluctuating stock prices, interest rates, and economic events can impact the value of options contracts.

3. Expiration Risk: If an option is “out of the money” (below the strike price for a call or above it for a put) at expiration, it will expire worthless, leading to a total loss of the premium.

Options Trading In 401k

Conclusion

Options trading within a 401k offers discerning investors a powerful tool to enhance returns and manage risks. By embracing a methodical approach, understanding the intricacies of options contracts, and embracing disciplined risk management practices, you can navigate the options market with confidence. Remember, thorough research, prudent decision-making, and aligning your strategies with your financial goals are essential for successful options trading in the context of your 401k.