The Thrill and Risk of Options Trading:

We’ve all heard the thrilling stories of overnight success in the stock market. A savvy investor, with a keen eye for the market’s volatility, placed a bold bet on an options contract, reaping substantial profits. While these tales of fortune may ignite the imagination, it’s crucial to understand the inherent risks associated with options trading. Unlike traditional buy-and-hold strategies, options contracts are time-sensitive and introduce a layer of complexity that can quickly leave the unwary investor stranded.

Image: www.pinterest.jp

Buy-and-Hold: A Steady Approach to Success

In contrast to the high-stakes world of options trading, buy-and-hold investing offers a more measured approach to wealth accumulation. This classic strategy involves purchasing stocks or other financial instruments and holding them for an extended period, allowing the power of compounding returns to work its magic. By weathering market fluctuations and staying the course, buy-and-hold investors can mitigate risk and harness the long-term growth potential of the stock market. However, this approach requires patience and discipline, as short-term gains are often sacrificed for the potential of greater returns in the future.

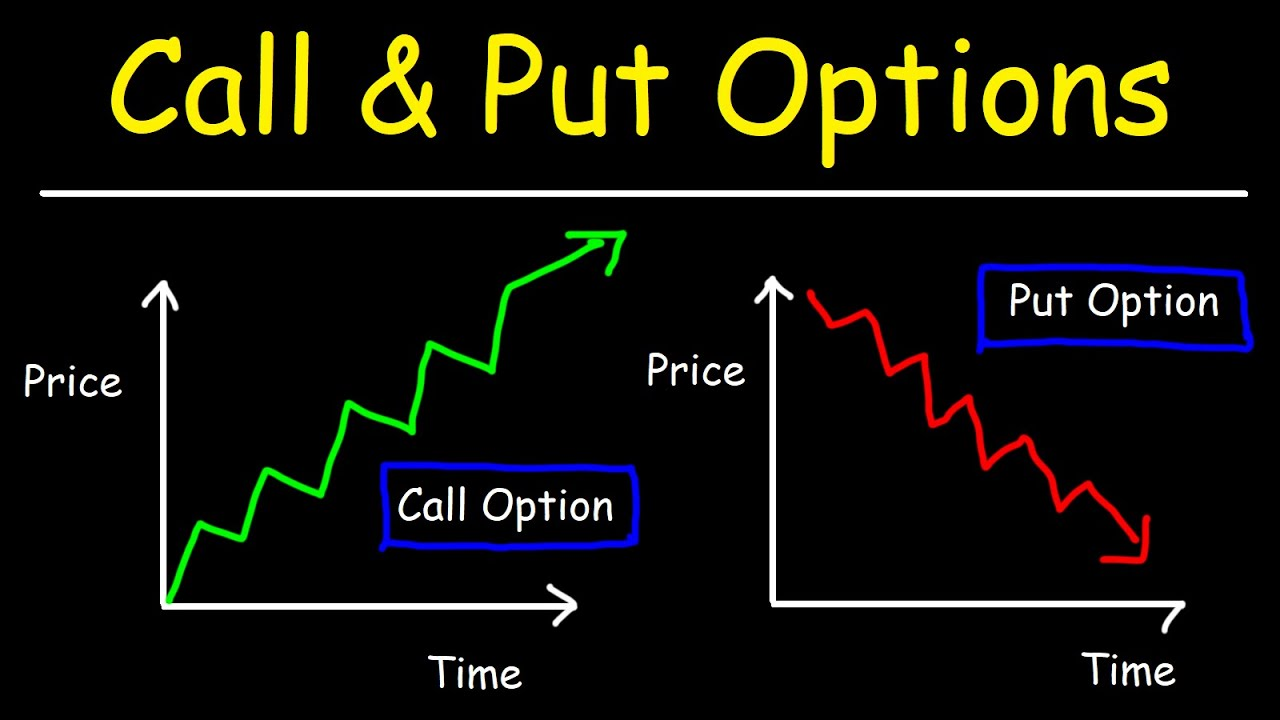

Delving into the Intricacies of Options Trading

Options contracts provide investors with a diverse range of strategies, from hedging risks to speculating on price movements. They offer the potential for significant gains, but they also come with substantial risk. Understanding the intricacies of options contracts is paramount before venturing into this arena. Options traders must possess a thorough grasp of market dynamics, as well as the various types of options and their trading mechanics. Without this foundational knowledge, investors risk losing their capital.

Key Considerations: Risk Tolerance and Investment Goals

The choice between options trading and buy-and-hold investing ultimately hinges on an individual’s risk tolerance and financial goals. Novice investors may find solace in the relative simplicity and lower risk associated with buy-and-hold strategies. By investing in solid companies and maintaining a long-term perspective, they can build wealth gradually while minimizing potential losses.

On the other hand, seasoned investors with a higher appetite for risk may find options trading an appealing avenue to enhance their returns. However, they must approach this complex endeavor with caution, fully comprehending the potential consequences of each trade. The allure of rapid profits must be weighed against the very real possibility of significant financial loss.

Image: tradewithmarketmoves.com

Expert Insights and Practical Tips:

Navigating the equity landscape requires both theoretical understanding and practical wisdom. Seek counsel from reputable financial advisors who can provide personalized guidance tailored to your unique circumstances. By integrating insights from experts into your investment strategy, you can enhance your decision-making process and increase your chances of financial success.

Remember that investing is a marathon, not a sprint. Avoid the lure of get-rich-quick schemes and focus on building a diversified portfolio that aligns with your long-term financial objectives. Regular monitoring of your investments is essential to ensure that they remain on track and responsive to changing market conditions.

Options Trading Vs Buy And Hold

Image: filmspksmo.blogspot.com

Conclusion: Empowering Investors

The world of investing offers a myriad of opportunities, each carrying its own set of risks and rewards. Both options trading and buy-and-hold strategies can be effective vehicles for financial growth, provided investors approach them with knowledge, prudence, and a realistic assessment of their own risk tolerance. By thoroughly researching investment options, seeking expert advice, and exercising sound judgment, investors can navigate the equity landscape with confidence, working towards a future of financial prosperity.