As the allure of option trading beckons, navigating the labyrinthine landscape of available apps can be daunting. Whether you’re a seasoned trader or just dipping your toes in the waters, choosing the right platform can make all the difference. Join us on a comprehensive journey as we unravel the secrets of the best option trading apps available today.

Image: equityblues.com

Navigating the Options Trading Maze

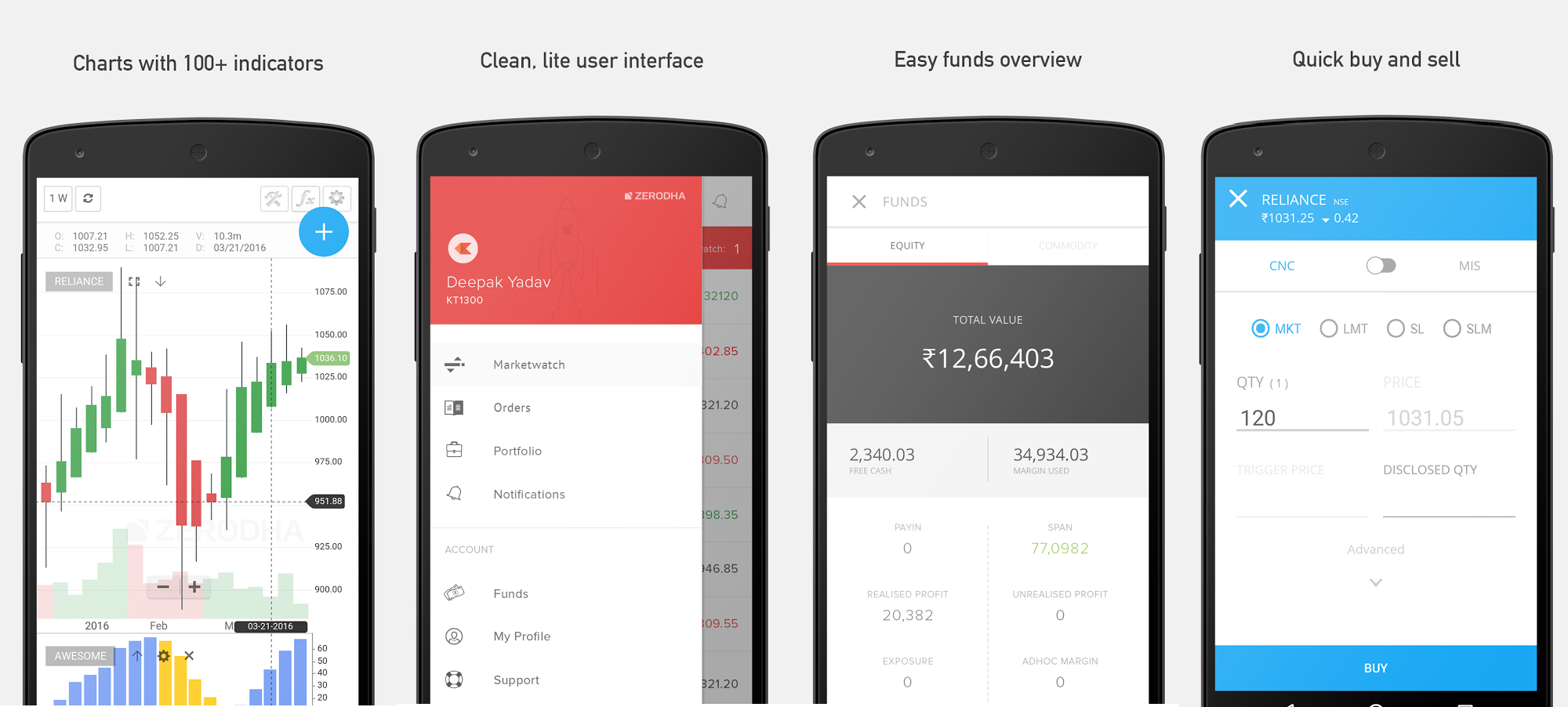

Option trading, with its inherent complexity and potential rewards, demands a reliable and intuitive platform. The right app can empower you to unleash your trading prowess, while an ill-fitting choice can hinder your progress. Several key factors set apart the best option trading apps:

- User-friendly interface: Complexity should never come at the expense of accessibility. Apps that strike the right balance between sophisticated features and effortless navigation enable traders of all levels to execute trades with confidence.

- Robust charting and analysis tools: Visual representation is indispensable for pattern recognition and informed decision-making. Advanced charting capabilities, coupled with an array of technical indicators, provide traders with invaluable insights.

- Real-time data and market information: Fast, reliable data is the lifeblood of successful trading. Apps that deliver up-to-the-second market updates, news, and earnings reports empower traders to respond swiftly to market movements.

- Flexibility and mobile access: Markets never sleep, and neither should your trading capabilities. Apps that offer round-the-clock access and seamless integration with mobile devices grant traders the freedom to monitor positions and execute trades from anywhere.

Expert Insights: Tips for Success

Mastering the intricacies of option trading requires a combination of knowledge and practical experience. Seasoned traders offer invaluable advice for navigating the complexities of this dynamic market:

- Know your risk tolerance: Before embarking on your trading journey, assess your appetite for risk and align your trades accordingly. Options magnifies both profits and losses, necessitating a realistic risk management strategy.

- Diligent research and analysis: Successful option trading hinges on thorough research and analysis. Study market trends, delve into company fundamentals, and leverage technical indicators to make informed decisions.

- Understanding the Greeks: Greeks are often touted as the alphabet of option trading. Understanding their impact on option pricing and risk is essential for effective trade management.

- Notional value and margin requirements: It’s imperative to grasp the concept of an option’s notional value and its impact on margin requirements. This understanding will guide you in managing your trading positions effectively.

Mastering Market Volatility: Managing Risks

Volatility, the hallmark of option trading, presents both opportunities and risks. Traders must adopt a proactive approach to risk management to navigate turbulent markets:

- Define your trading goals: Before executing trades, establish clear profit targets and stop-loss levels. This discipline helps prevent emotional decision-making in the heat of market movements.

- Hedging techniques: Hedging strategies can mitigate risks and protect against adverse market fluctuations. Employing appropriate hedging mechanisms, such as position balancing and diversification, can bolster your trading resilience.

- Monitoring and adjusting positions: As markets shift, constant position monitoring is essential. Adjust your trades as needed, ensuring they align with changing market conditions and your risk tolerance.

Image: jeangalea.com

FAQs: Unraveling Complexities

To dispel any lingering doubts, we present a concise FAQ section:

- Q: What differentiates option trading from other investment strategies?

A: Option trading involves acquiring the right to buy (call option) or sell (put option) an underlying asset at a predefined price within a specified time frame, offering flexibility and potential for substantial returns, but also elevated risks. - Q: What factors influence option pricing?

A: Multiple variables determine option prices, including the underlying asset’s price, time until expiration, strike price, volatility, interest rates, and supply and demand. - Q: How can I minimize trading costs?

A: Some platforms charge commission fees per trade, while others adopt a subscription-based model. Compare pricing structures and select an app that aligns with your trading volume and budget.

Best Option Trading Apps

Embark on Your Option Trading Odyssey

The world of option trading awaits your exploration. Armed with the knowledge and insights gleaned from this guide, you can confidently select the best app to elevate your trading journey. As you navigate the market’s complexities, remember to stay vigilant, manage risks prudently, and embrace the learning process. The rewards of successful option trading are within reach. Embrace the challenge and unlock your trading potential today.

Are you ready to delve deeper into the captivating world of option trading? Take the next step and discover the best option trading apps tailored to your unique needs. Empower yourself with the knowledge and tools to conquer the markets and achieve your financial aspirations.