In the realm of financial markets, options trading holds a captivating allure for both seasoned investors and aspiring traders alike. Options, with their inherent flexibility and potential for exponential returns, provide a tantalizing path toward achieving financial goals. However, navigating the intricacies of options trading demands a comprehensive understanding of the available strategies and tools at your disposal.

Image: www.projectfinance.com

This article will embark on an in-depth exploration of options trading strategies, empowering you with the knowledge and tools to make informed decisions that can potentially lead to enhanced performance. From the fundamental concepts to advanced techniques, we will delve into the intricacies of this exhilarating investment avenue, equipping you for success in the ever-evolving world of options trading.

Unveiling the Options Trading Landscape: A Comprehensive Overview

Options can be likened to contracts that bestow upon their holders the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price, known as the strike price. These versatile instruments offer traders a spectrum of possibilities, ranging from prudent risk management to the pursuit of potentially lucrative profits.

The advent of options trading has had a transformative impact on the financial markets, opening up a plethora of opportunities for investors. Whether seeking to hedge against potential losses, generate income, or amplify returns, options provide a flexible and multifaceted tool for achieving diverse financial objectives.

Essential Building Blocks of Options Trading Strategies

To fully harness the power of options trading, it is imperative to grasp the fundamental concepts that form the bedrock of this dynamic investment strategy. These concepts include:

- Underlying Asset: The underlying asset, such as a stock, bond, or commodity, serves as the basis for the option contract. The performance of the underlying asset directly influences the value of the option.

- Premium: The premium represents the price that the buyer of an option pays to the seller in exchange for the right to exercise the option. Premiums are influenced by various factors, including the volatility of the underlying asset, time to expiration, and the strike price.

- Expiration Date: Each option contract has a specified expiration date, beyond which it becomes worthless. Options traders must carefully consider the expiration date when making trading decisions.

- In-the-Money: An option is considered “in-the-money” when its exercise would result in a profit. For call options, the underlying asset price must be above the strike price, while for put options, the underlying asset price must be below the strike price for the option to be in-the-money.

- Out-of-the-Money: Conversely, an option is considered “out-of-the-money” when its exercise would result in a loss. For call options, the underlying asset price must be below the strike price, while for put options, the underlying asset price must be above the strike price for the option to be out-of-the-money.

Navigating the Spectrum of Options Trading Strategies: A Comprehensive Guide

Now that we are familiar with the core concepts of options trading, let’s delve into the diverse array of strategies employed by expert traders:

Covered Call Strategy: This conservative strategy involves simultaneously buying an underlying asset (such as a stock) and selling a call option on that same asset. It seeks to generate income through the premium received from selling the option while limiting potential losses by owning the underlying asset.

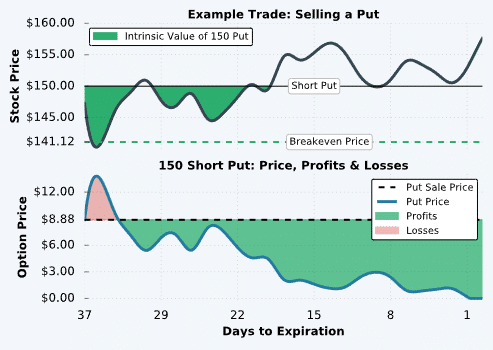

Cash-Secured Put Strategy: This strategy combines the sale of a put option with the holding of cash equal to the strike price multiplied by the number of contracts sold. It aims to generate income from the premium received for selling the put option while simultaneously obligating the trader to buy the underlying asset if the option is exercised.

Collar Strategy: The collar strategy employs a combination of a long call option and a short put option at higher and lower strike prices, respectively. It seeks to limit both the potential profits and losses of an underlying asset’s price movements.

Protective Put Strategy: This strategy involves purchasing a put option on an underlying asset that you already own. It acts as a form of insurance against potential declines in the underlying asset’s price, providing a safety net to protect your investment.

Iron Condor Strategy: The iron condor strategy is a more advanced strategy that involves selling both a call option and a put option at higher and lower strike prices, respectively, while simultaneously buying a call option and a put option at even higher and lower strike prices, respectively. It aims to profit from a narrow range of price movements in the underlying asset.

Image: www.pinterest.com

Options Trading Strategies Tools

Image: www.pinterest.com

Empowering Traders: Tools for Mastering Options Trading

Beyond a thorough understanding of options trading strategies, success in this multifaceted domain demands proficiency in utilizing the available tools. These tools can significantly enhance your decision-making process and equip you for making optimal trades:

Option Chains: Option chains provide a comprehensive overview of all available options contracts for an