In the ever-evolving world of investing, options trading has emerged as a powerful tool for astute investors seeking to navigate market dynamics and potentially maximize their returns. An options contract grants the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) before a specific date (expiration date). Understanding the intricacies of options trading covered, including its strategies, benefits, and risks, can empower you to make informed decisions and potentially enhance your financial outcomes.

Image: www.asktraders.com

Delving into the Fundamentals of Options Trading Covered

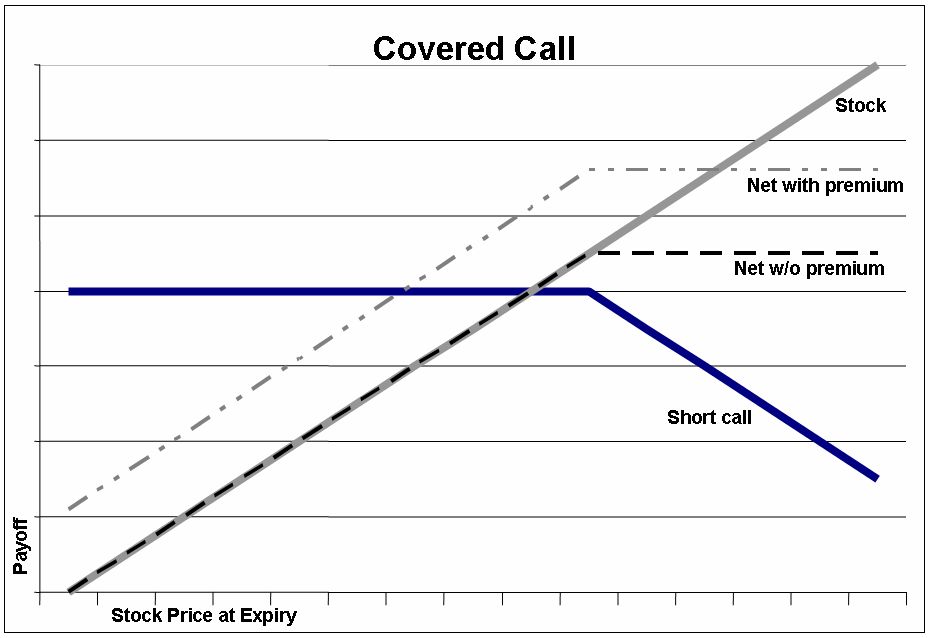

Options trading covered involves selling options, usually calls or puts, against an equivalent number of shares of the underlying asset that you own or intend to acquire. This strategy seeks to mitigate the potential risks associated with naked options trading, where the seller does not hold the underlying asset. Covered options trading hedges against potential losses should the market move against you while still offering the possibility of generating income from the premium received upon selling the options contract.

Strategies for Options Trading Covered

The versatility of options trading covered allows for the implementation of various strategies tailored to specific market conditions and investor goals. Some commonly employed approaches include:

-

Buy-Write Strategy: Involves selling covered call options against long positions in anticipation of a sideways or moderate price increase in the underlying asset.

-

Covered Call Strategy: Similar to the buy-write strategy, but the covered call options are sold against an existing long position.

-

Protective Put Strategy: The sale of covered put options against a short position in the underlying asset, aiming to protect against potential downside movements in the market.

Benefits and Advantages of Options Trading Covered

Harnessing the power of options trading covered offers several potential benefits and advantages:

-

Risk Management: Hedging against potential losses through offsetting the premiums received from selling covered options against the fluctuations of the underlying asset.

-

Income Generation: Selling covered options generates premium income, potentially providing a steady stream of returns regardless of the underlying asset’s price performance.

-

Leverage: Utilizing options trading covered allows investors to potentially control a larger number of underlying shares for a lower capital outlay compared to purchasing the shares outright.

Image: vantagepointsoftware.com

Risks and Considerations

While options trading covered can be a valuable tool, it also carries certain risks and considerations that must be duly acknowledged:

-

Opportunity Cost: Selling covered options caps potential gains from the underlying asset’s price appreciation, as it introduces a limited upside.

-

Assignment Risk: In the case of covered calls, there is the possibility of the options being exercised, obligating the sale of the underlying shares at the strike price even if the market price has risen significantly higher.

-

Margin Requirements: Options trading, including covered strategies, involves margin requirements. Margin trading carries its own set of risks and should be approached with caution.

Expert Insights and Actionable Tips

Seasoned investors and financial professionals emphasize the following insights for successful options trading covered:

-

Exercise due diligence and thoroughly research the underlying asset and options strategies before engaging in trading.

-

Determine your investment goals, risk tolerance, and time horizon to align your options trading strategies accordingly.

-

Consider consulting with a qualified financial advisor for personalized advice tailored to your specific financial situation.

Options Trading Covered

Image: www.newtraderu.com

Conclusion: A Pathway to Empowerment

Options trading covered empowers investors with a versatile and potentially lucrative tool for managing risk, generating income, and enhancing financial outcomes. Understanding the underlying principles, strategies, benefits, and risks associated with options trading covered positions you to make informed decisions and navigate the ever-changing market landscape. By harnessing the power of covered options trading with prudent risk management and continuous learning, you can unlock the potential for financial growth and stability.