Stock markets have become an integral part of modern finance, enabling individuals and organizations to invest and potentially multiply their wealth. Options trading, a sophisticated investment strategy, has gained popularity in recent times, offering a wide array of opportunities and risks. One particular type of options trading that warrants attention is covered options trading.

Image: financhill.com

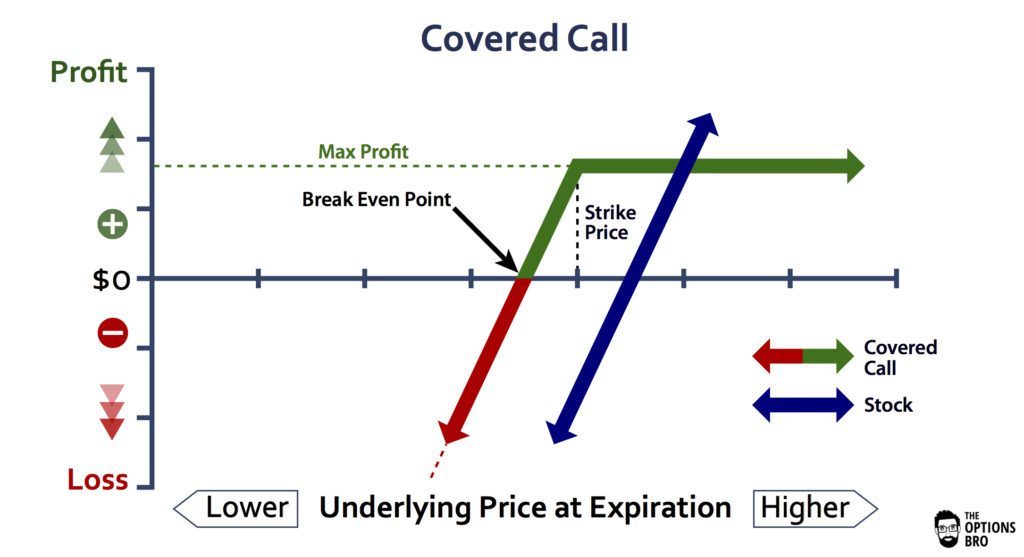

Covered options trading involves selling (writing) an option contract while simultaneously holding an underlying asset that matches the option’s specifications. This strategy aims to mitigate risk and generate income, making it particularly attractive to experienced investors.

The Mechanism Behind Covered Calls

Envision yourself owning 100 shares of Apple stock (AAPL). You anticipate that the stock’s price will rise over time but acknowledge the inherent volatility of the market. Covered options trading empowers you to capitalize on this expectation while hedging against potential losses.

By selling a covered call, you grant another party (the option buyer) the right, but not the obligation, to buy your 100 AAPL shares at a predetermined price (the strike price) on or before a specific date (the expiration date). In return, you receive a premium payment from the buyer.

Unlocking the Benefits of Covered Calls

- Income Generation: Premiums received from the sale of covered calls constitute an additional source of income, irrespective of the underlying asset’s price movement.

- Risk Mitigation: If AAPL’s price falls below the strike price upon expiration, you retain ownership of your shares without incurring any losses on the sold option.

- Flexibility: Covered calls can be adjusted or closed prior to expiration, providing flexibility to adapt to changing market conditions.

- Limited Downside: Your potential loss is limited to the difference between the strike price and the price paid for the underlying asset.

Navigating the Nuances of Covered Puts

Covered puts share similarities with covered calls but involve selling a put option instead. With a put option, the buyer acquires the right to sell shares of the underlying asset to you at the strike price.

Selling a covered put obligates you to buy a specified number of shares of the underlying asset at the strike price if the option is exercised. This strategy is suitable when you expect the stock price to rise or remain stable.

Image: fintrakk.com

Advantages and Limitations of Covered Puts

- Income Potential: Premiums received from selling covered puts add to your income stream.

- Upside Participation: Should the underlying asset’s price rise significantly, you stand to profit from the sale of the shares per the put contract.

- Downside Risk: You assume the obligation to buy the underlying asset at the lower strike price, potentially incurring losses if the market plummets.

What Is Covered Options Trading

https://youtube.com/watch?v=rNJhmFN19W0

Conclusion

Covered options trading offers a multifaceted approach to investing, allowing seasoned investors to generate income, mitigate risk, and potentially enhance returns. Understanding the intricacies of covered calls and covered puts empowers individuals to navigate the market more confidently, harnessing the full potential of these powerful financial instruments. As always, engaging in thorough research and consultation with financial professionals is crucial to making informed investment decisions. Embrace the journey, venture into the world of covered options trading, and unlock the doors to financial growth and empowerment.