Understanding the Basics of a Covered Call Strategy

In the realm of options trading, the covered call is a versatile strategy that provides income-generating opportunities for investors with existing holdings in underlying assets. By combining elements of both stock ownership and options selling, it allows investors to enhance their portfolio’s earning potential. To delve into the intricacies of this strategy, it’s imperative to grasp its essence.

Image: financhill.com

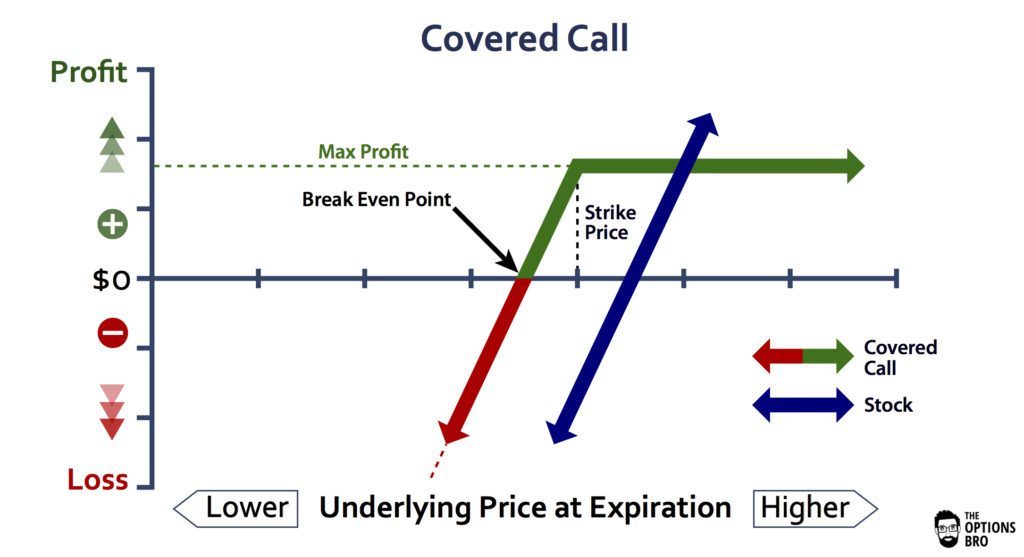

A covered call entails selling (or writing) a call option against a corresponding number of shares of the underlying asset already held by the investor. This implies that the investor grants another party the right, but not the obligation, to purchase the underlying shares at a predetermined strike price on or before a specified expiration date. In exchange for this right, the investor receives a premium, which represents the payment for selling the option.

The crux of a covered call lies in its dual nature: it blends the income-generating potential of options trading with the potential for capital appreciation from the underlying asset. By selling the call option, the investor earns an immediate premium while retaining the underlying shares. If the underlying asset’s price rises, the investor benefits from the potential for capital appreciation. Conversely, if the asset’s price falls, the investor may still retain a portion of the premium received as compensation.

Mechanics of a Covered Call

To implement a covered call strategy, an investor must have sufficient shares of the underlying asset to cover the number of call options sold. For instance, if an investor owns 100 shares of Apple stock, they can sell a covered call by granting another party the right to purchase 100 shares of Apple at a strike price of $150 per share. The strike price is the predetermined price at which the buyer of the call option can exercise their right to purchase the underlying shares.

The expiration date is another critical component of a covered call. It represents the final day on which the call option can be exercised. If the underlying asset’s price rises above the strike price before the expiration date, the buyer of the call option may choose to exercise their right to purchase the shares at the lower strike price. In such a scenario, the seller of the covered call (the investor) is obligated to deliver the underlying shares to the buyer at the specified strike price.

Benefits of a Covered Call

Covered calls offer several advantages, making them a popular strategy among income-oriented investors. Firstly, they provide an opportunity for generating income in the form of the premium received for selling the call option. This premium represents an immediate cash infusion, which can be used to supplement other income sources or offset potential losses from other investments.

Secondly, covered calls have the potential to enhance the overall return on investment. If the underlying asset’s price rises above the strike price, the investor benefits from the capital appreciation of their underlying shares while still retaining a portion of the premium earned from selling the call option.

Thirdly, covered calls can help reduce the overall risk associated with holding the underlying asset. By selling a call option against their shares, investors effectively limit their potential upside if the asset’s price rises dramatically. This can be beneficial for managing risk and protecting against potential losses.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

Image: www.kingdavidsuite.com

What Is A Covered Call In Options Trading

Considerations Before Implementing a Covered Call

While covered calls offer numerous benefits, it’s essential to be aware of their potential risks before implementing this strategy. Firstly, investors must possess a clear understanding of options trading and the risks involved. Selling options without a proper understanding of their implications can lead to substantial losses.

Secondly, covered calls may limit an investor’s potential profit from the underlying asset. If the asset’s price rises significantly above the strike price, the investor may miss out on the potential gains. This is because the buyer of the call option has the right to purchase the shares at the strike price, regardless of the current market price.

Thirdly, covered calls can result in the loss of the underlying shares if the buyer exercises the call option. If the underlying asset’s price rises above the strike price, the investor is obligated to deliver the shares to the buyer at the lower strike price, potentially incurring a loss if the current market price is higher.