Options Trading: Navigating Commissions

As a seasoned options trader, I’ve encountered various commission structures that significantly impact my profitability. Understanding and comparing these charges is essential for optimizing returns and minimizing trading costs. In this article, we’ll explore the different commission models, their pros and cons, and provide tips from industry experts to help you make informed decisions about your options trading commissions.

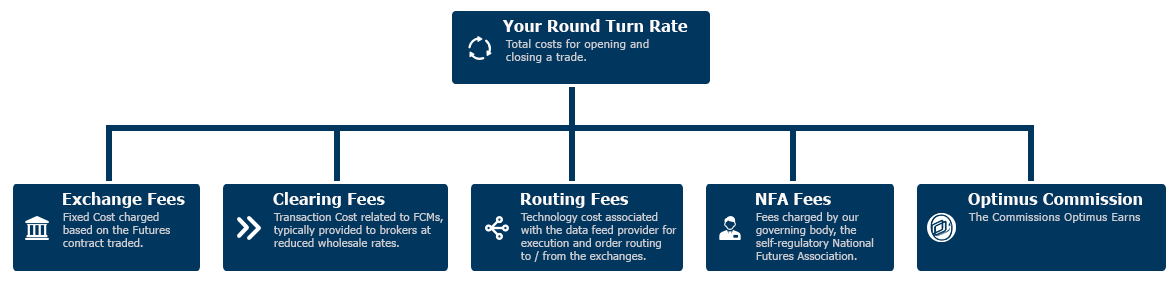

Image: optimusfutures.com

Understanding Options Trading Commissions

Options trading commissions are fees charged by broker-dealers for executing options orders. They typically consist of two components: a per-contract fee and an exchange fee. The per-contract fee varies depending on the broker and can range from a few cents to several dollars per contract. The exchange fee is a fixed charge set by the exchange where the option is traded.

Flat-Rate Commissions vs. Tiered Commissions

The two primary commission structures are flat-rate commissions and tiered commissions. Flat-rate commissions involve a fixed fee per contract, regardless of the number of contracts traded. This structure is typically beneficial for traders who execute a small number of orders. Tiered commissions, on the other hand, offer lower rates for higher trading volumes. This structure is more suitable for active traders who execute large numbers of orders.

Factors to Consider When Choosing a Commission Structure

The best commission structure for you depends on your trading activity. Here are some factors to consider:

- Trading volume: If you trade frequently, tiered commissions may provide significant cost savings.

- Option type: Commissions may vary based on the type of option (e.g., calls, puts).

- Account size: Some brokers may offer discounts on commissions for larger accounts.

- Trading platform: The commission structure may differ depending on the trading platform you use.

Image: kurskpu.ru

Expert Advice for Minimizing Commissions

- Negotiate with your broker: Inquire about potential discounts or reduced rates based on your trading volume.

- Consider bundled services: Some brokers offer bundled services that include flat-rate commissions for a fixed monthly fee.

- Look for low-cost broker-dealers: Certain brokers specialize in low-cost trading and offer competitive commission rates.

- Combine orders: If you execute multiple orders for the same option symbol, consider combining them into a single order to reduce per-contract fees.

- Optimize your trading strategy: By minimizing the number of trades and focusing on higher-probability setups, you can reduce your overall commission costs.

Frequently Asked Questions on Options Trading Commissions

Q: What is the average commission for options trading?

A: Commissions can vary depending on the broker, but typically range from a few cents to several dollars per contract.

Q: How do I compare commissions between brokers?

A: Examine the fee schedules of different brokers and consider your trading volume and option types to determine the most competitive rates.

Q: Is it possible to negotiate commission rates?

A: Yes, it’s common practice to negotiate with brokers for lower commissions, especially if you have a significant trading history.

Q: Are there any hidden fees associated with options trading commissions?

A: Some brokers may charge additional fees, such as account maintenance fees or regulatory fees. Ensure you fully understand the fee structure before choosing a broker.

Best Options Trading Commissions

Conclusion

Choosing the appropriate options trading commission structure is crucial for maximizing profitability. By exploring different commission models, understanding factors to consider, and implementing expert advice, you can optimize your trading costs and make informed decisions.

Are you interested in learning more about options trading commissions? Continue exploring our website for additional resources and insights.