As a seasoned investor, I’ve witnessed firsthand the rollercoaster ride of the stock market. In the relentless pursuit of hedging my investments and mitigating potential losses, I stumbled upon the world of option trading and its various instruments. One such instrument that has particularly piqued my interest is the option trading puts.

Image: tradebrains.in

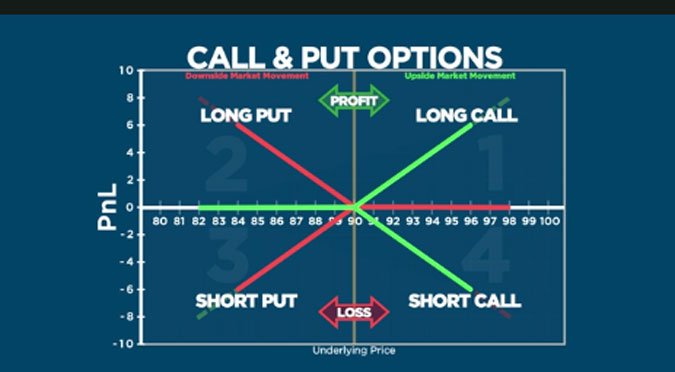

In essence, option trading puts grant traders the right, but not the obligation, to sell a certain amount of underlying shares at a predetermined price within a specified period. These options are strategically employed when the trader anticipates a decline in the underlying asset’s value, providing an effective means of capital preservation and profit realization.

Understanding Put Options: Sellers and Buyers

Option trading puts involves two parties: the seller and the buyer. The seller of the put option is essentially selling the right to sell the underlying asset, while the buyer of the put option is purchasing that right.

The seller of the put option (also known as the writer) has an obligation to purchase the asset at the specified price if the buyer decides to exercise the option before the expiration date. As compensation for taking on this obligation, the writer collects a premium from the buyer.

The buyer of the put option (also known as the holder) has no obligation to exercise the option. Instead, they have the option to let it expire worthless if the underlying asset’s value holds steady or rises. Alternatively, the holder may choose to exercise the right to sell the shares if the asset’s value falls below the strike price, locking in a profit.

Benefits of Option Trading Puts

In the right market conditions, option trading puts can offer numerous benefits to astute investors:

- Hedging against potential losses: As a protective measure, traders can utilize puts to safeguard their portfolios against adverse market fluctuations.

- Profiting from a decline in asset price: Puts empower traders to potentially profit from downward market trends, unlike straightforward stock purchases.

- Speculating on future events: Put options can be leveraged to speculate on upcoming events or economic conditions that may prompt a downturn in the market.

Expert Tips for Successful Put Trading

To enhance your put trading strategy and improve your chances of success, consider these expert tips:

- Conduct thorough research: Before making a trade, meticulously analyze market trends, company news, economic indicators, and other factors that may impact the value of the asset.

- Set clear objectives: Determine your precise trading objectives and align your put options strategy with your risk tolerance and financial goals.

- Choose the right strike price: Carefully select the strike price that aligns with your market analysis and target profit level.

- Manage risk effectively: Employ proper risk management techniques, such as limiting trade sizes and utilizing stop-loss orders.

Image: insigniafutures.com

Common Questions About Put Options

- Q: How do I determine the value of a put option?

A: The value of a put option depends on several factors, including the underlying asset’s price, strike price, time to expiration, and volatility.

- Q: What is the maximum profit I can make from a put option?

A: The maximum profit is limited to the difference between the strike price and the initial premium paid. If the underlying asset’s price falls below the strike price, an additional profit may be realized based on market movements.

- Q: What is the risk associated with put options?

A: The primary risk is losing the premium paid if the underlying asset’s price remains unchanged or rises above the strike price. Additionally, options expire worthless if not exercised before the expiration date.

Option Trading Puts

/call-and-put-options-definitions-and-examples-1031124-v5-8566395195f0403aaf5b4ad9e5cc9364.png)

Image: elearningensup.gifafrique.com

Conclusion

Option trading puts can be a valuable tool for discerning traders seeking to protect their investments or generate potential profits amid market downturns. By thoroughly comprehending the concepts, risks, and strategies involved in trading puts, you can enhance your chances of success and contribute to a robust investment portfolio. Would you like to embark on the journey of option trading puts? Embrace the challenge and explore the uncharted waters of financial markets.