Understanding Puts in the Financial Market

The world of options trading can be a complex and daunting one for those unfamiliar with its intricacies. Among the various types of options available, puts play a crucial role in providing traders with a powerful tool to mitigate risk or speculate on market downtrends. In this comprehensive guide, we delve into the intricacies of puts, exploring their definition, significance, and practical applications.

Image: www.aimarrow.com

Defining Put Options

A put option grants the holder the right, but not the obligation, to sell an underlying asset at a specified price (known as the strike price) on or before a predetermined date (the expiration date). In essence, it represents a bet that the asset’s price will decline. If the market value of the underlying asset falls below the strike price, the holder of the put option can exercise their right to sell the asset at the predefined strike price, thereby locking in a profit.

The importance of puts lies in their versatility and the distinct advantages they offer to traders. Apart from safeguarding against potential losses when anticipating market downturns, puts can also be utilized to generate income through option premiums and to speculate on market volatility.

Understanding the Mechanics of Puts

To delve deeper into the mechanics of puts, let’s consider an illustrative example. Suppose an investor anticipates a decline in the stock price of Company XYZ, currently trading at $100. To capitalize on this prediction, the investor purchases a put option with a strike price of $95 and an expiration date of three months from now. This option grants the investor the right to sell 100 shares of Company XYZ at $95 per share, regardless of the market price at the time of expiration.

Determining the Value of Puts

The value of a put option is influenced by several factors, including:

- The underlying asset’s price: As the asset’s price approaches the strike price, the put option gains value.

- Volatility: Higher market volatility amplifies the potential value of the put option.

- Time to expiration: The longer the time remaining until expiration, the more valuable the put option.

- Interest rates: Changes in interest rates can also impact the value of the put option.

Image: www.youtube.com

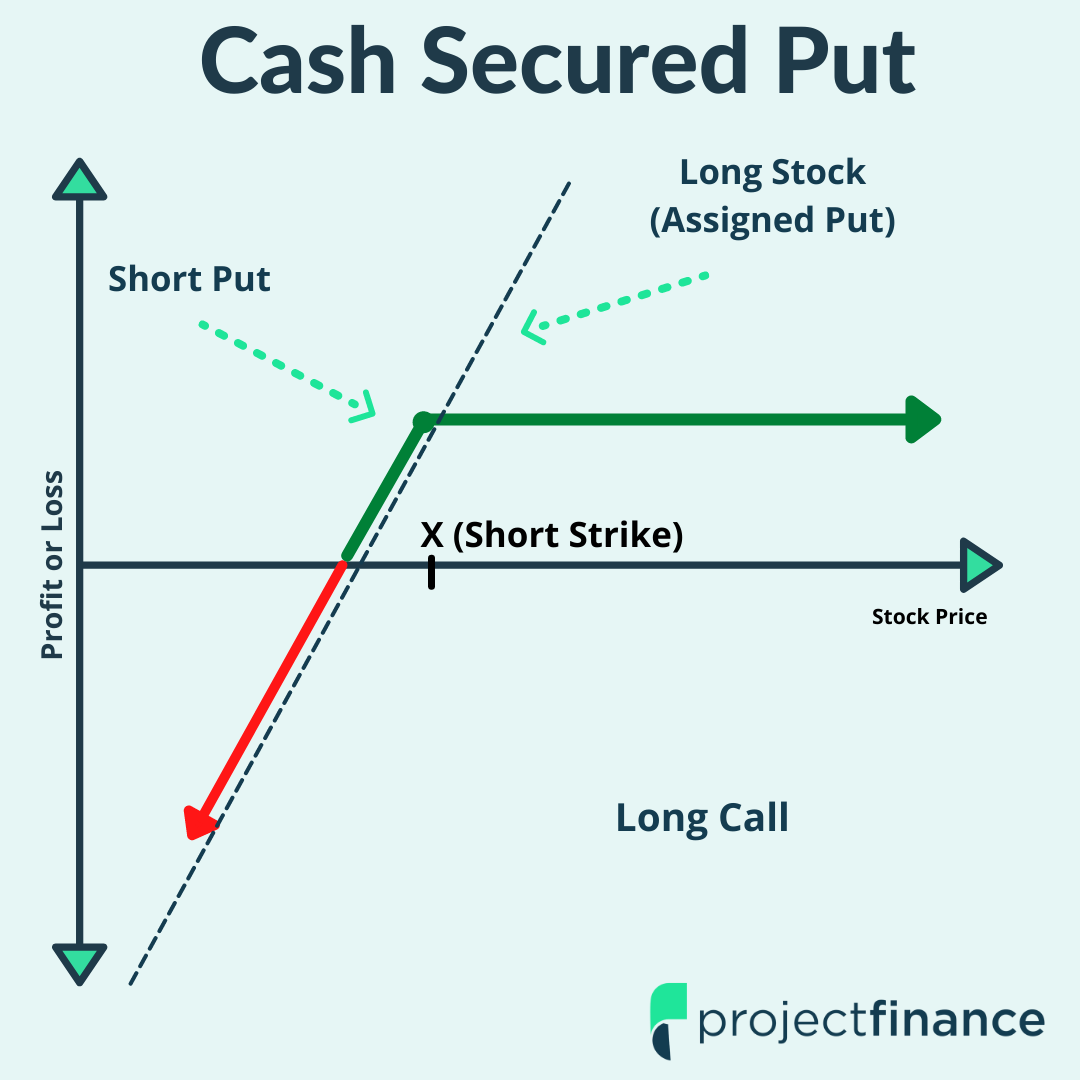

What Is A Put In Option Trading

Image: www.projectfinance.com

Conclusion

Putting the Power of Puts to Work:

Puts occupy a prominent place in the arsenal of options traders, empowering them with the flexibility to manage risk and seize opportunities in fluctuating markets. Whether employed as a defensive strategy or an offensive tactic for profiting from market downturns, a thorough understanding of puts is essential for navigating the complexities of option trading. This comprehensive guide has provided an in-depth overview of puts, laying the groundwork for traders of all levels to delve deeper into this multifaceted financial instrument.