Introduction:

Image: udilisavu.web.fc2.com

The allure of potentially lucrative gains has drawn many investors to the exciting world of options trading. However, alongside the rewards, options trading carries significant risks that novice and experienced traders alike must fully understand before venturing into this complex financial arena. This article delves into the risks associated with options trading, exploring their nature, potential consequences, and crucial strategies for risk mitigation.

Basic Concepts of Options Trading:

Before discussing the risks, it’s essential to establish a basic understanding of options trading. Options are financial contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset (e.g., stocks, indices, or commodities) at a specific price (strike price) on or before a defined date (expiration date). The potential profit or loss from an options trade depends on the price movement of the underlying asset relative to the strike price and the time remaining until expiration.

Types of Options Trading Risks:

-

Unfavorable Price Movements: The most significant risk in options trading is the potential for unfavorable price movements in the underlying asset. If the value of the underlying asset fails to move favorably, the option may expire worthless, resulting in the loss of the premium paid. For example, if an investor buys a call option, they need the underlying asset’s value to increase above the strike price to profit from the trade.

-

Time Decay: Options are time-sensitive instruments, and their value decays as time passes even if the underlying asset price remains unchanged. This is known as time decay and affects all options, regardless of their type or position. The closer an option gets to its expiration date, the faster it loses value.

-

Implied Volatility Risk: Implied volatility, a measure of expected price volatility, is a critical factor in options pricing. Changes in implied volatility can significantly impact option premiums. If volatility decreases unexpectedly, the value of options can decline, even if the underlying asset’s price remains steady or increases.

-

Liquidity Risk: Liquidity refers to the ability to buy or sell an option quickly without significantly affecting its price. Certain options may have limited liquidity, making it challenging to close out a position at a desired price or in a timely manner. This can lead to additional losses or missed opportunities.

-

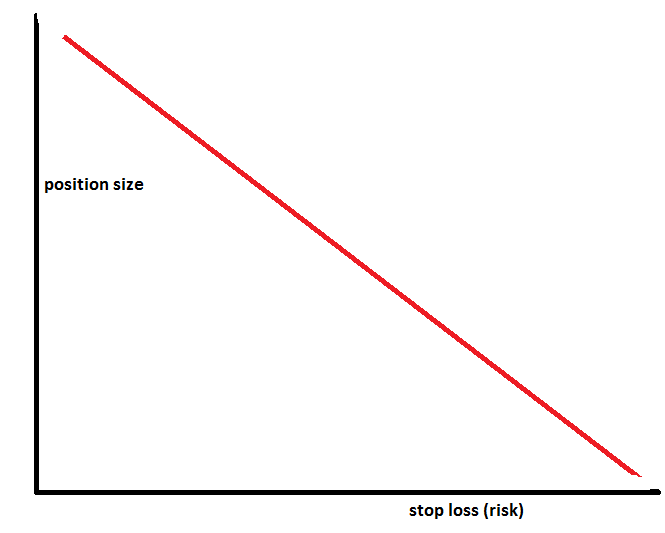

Leverage Risk: Options provide leverage, meaning investors can gain exposure to a significant underlying asset value with a relatively small investment. However, leverage can amplify both potential gains and losses. Traders who use excessive leverage may face margin calls if the underlying asset’s value moves against them, potentially leading to substantial losses.

-

Counterparty Risk: In options trading, there are two parties involved: the buyer and the seller. The buyer’s risk is the loss of their premium, while the seller’s risk is the obligation to buy or sell the underlying asset if the option is exercised. The financial health and ability of the counterparty to honor their obligations can affect the overall risk of an options trade.

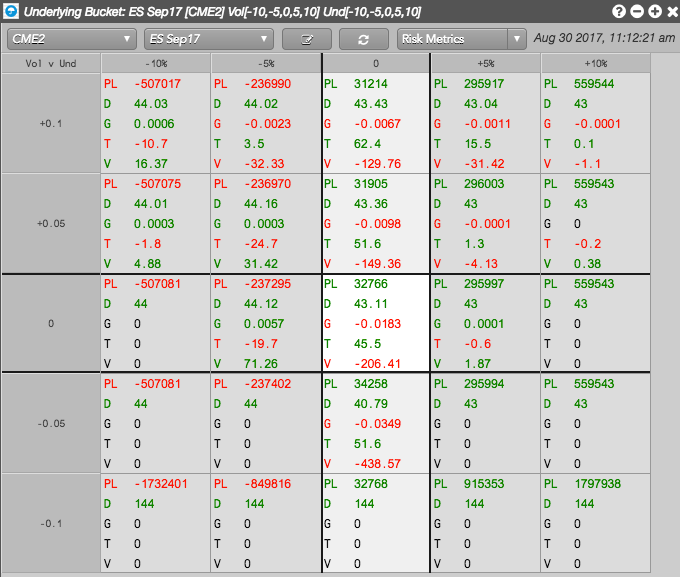

Image: library.tradingtechnologies.com

What Is The Risk Of Options Trading

Image: dotnettutorials.net