Have you ever wondered about the intricacies of options trading? This thrilling financial instrument has the potential to amplify your returns, but it’s crucial to approach it with a solid understanding of its complexities. Let’s embark on an enlightening journey into the world of options, untangling the jargon and empowering you with the knowledge to trade confidently.

Image: victorytale.com

Deciphering the Enigma of Options

An option is a contract that grants the holder the right, but not the obligation, to buy or sell an underlying asset (such as a stock or ETF) at a predetermined price (the strike price) on or before a specific date (the expiration date). Options provide traders with an array of strategic possibilities, allowing them to capitalize on market fluctuations and mitigate risk.

Types of Options and Their Usage

There are two main types of options: calls and puts. A call option gives the holder the right to buy the underlying asset at the strike price, while a put option grants the right to sell at the strike price. The choice of call or put depends on whether the trader anticipates the asset’s price to rise (call) or fall (put).

Options can also be exercised or executed (buying or selling the underlying asset) or expire unexercised. Traders can hold options to protect existing positions (hedging), speculate on market movements, or generate income through premiums.

Navigating the Options Market

Entering the options market requires a thorough understanding of its mechanics. Key concepts include: the premium (price paid for an option), the strike price, the expiration date, and the underlying asset. Traders need to analyze market indicators, such as volatility and liquidity, to make informed decisions. Moreover, options trading involves inherent risks, and traders should consistently manage their risk tolerance.

Image: www.reddit.com

Tips and Expert Advice for Mastering Options Trading

– **Start with Small Stakes:** Experiment with a small portion of your capital until you gain confidence and a deeper understanding of the market.

– **Trade Options on Liquid Underlying Assets:** Choose assets with high trading volumes to ensure sufficient liquidity for buying and selling options.

– **Understand Implied Volatility:** Volatility is a crucial factor in options pricing. Study implied volatility levels to determine optimal entry and exit strategies.

– **Consider the Time Value of Options:** The closer an option gets to its expiration date, the lower its value. Be mindful of this time decay when executing trades.

– **Consult Experienced Brokers or Advisors:** Seek guidance from reputable brokers or advisors who specialize in options trading for professional insights.

FAQs on Options Trading:

- Q: What are the risks associated with options trading?

- A: Options trading carries potential risks, including loss of capital, time decay, and unlimited potential losses in the case of certain strategies.

- Q: How do I determine the premium of an option?

- A: The premium is influenced by various factors, including the strike price, time to expiration, volatility, and underlying asset price.

- Q: What is the difference between in-the-money and out-of-the-money options?

- A: An in-the-money option is an option that can be exercised at a profit right now, while an out-of-the-money option cannot be exercised profitably immediately.

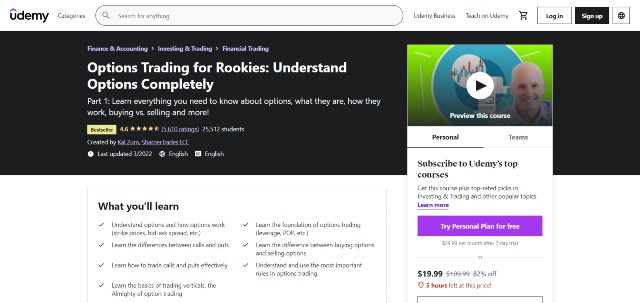

O285n.Option.Trading.For.Rookies.Understand.Options.Completely.2016.Part1.Rar

Image: www.newtraderu.com

Conclusion: Embracing the Power of Options

Venturing into options trading can be an exhilarating and potentially lucrative endeavor. However, it’s pivotal to approach it with knowledge, prudence, and a willingness to learn. By delving into the intricacies of options contracts, analyzing market dynamics, and implementing effective strategies, you can unlock the vast opportunities thatoptions trading presents. Are you ready to embrace the power of options and elevate your financial acumen?