As an avid options trader, I vividly recall the initial confusion I faced while navigating the realm of commissions. The intricate nature of options contracts, coupled with the varying fee structures offered by different brokers, made it daunting to determine the true cost of my trades. Through meticulous research and practical experience, I gained a profound understanding of options trading commissions, which I now eagerly share to empower fellow investors.

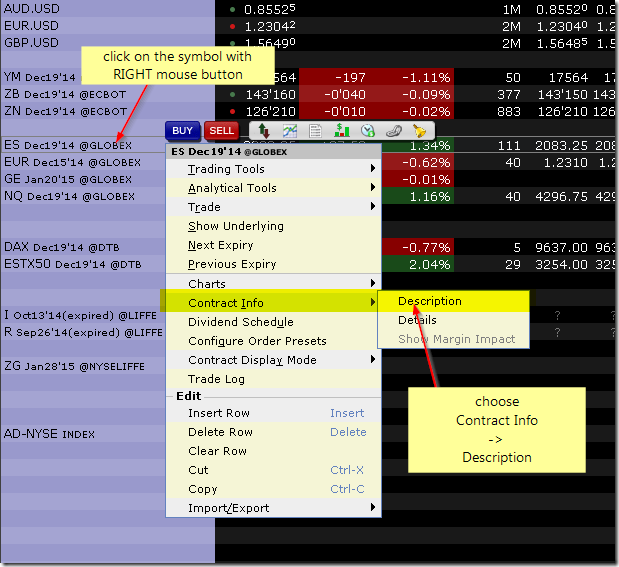

Image: www.brokerage-review.com

Unveiling Options Trading Commissions

Options trading commissions are fees charged by brokerage firms for executing options transactions. These commissions can vary significantly depending on the type of option, the number of contracts traded, the underlying asset, and the specific broker. A comprehensive understanding of commission structures is crucial for optimizing trading strategies and maximizing profitability.

Per-Contract Commissions

Per-contract commissions are a common fee structure in options trading. In this model, a fixed fee is charged for each contract bought or sold. The amount of the commission varies between brokers and can range from a few cents to several dollars per contract. For instance, a broker may charge $0.75 per contract for stock options and $1.50 per contract for index options.

Tiered Commissions

Tiered commissions impose different rates based on the volume of options contracts traded. Brokers may offer tiered commission plans with lower per-contract fees for higher trading volumes. This structure incentivizes traders to increase their trading activity to qualify for reduced commissions. For example, a brokerage may offer a commission of $1.00 per contract for traders who execute fewer than 500 contracts per month, $0.80 per contract for 501-1,000 contracts, and $0.60 per contract for over 1,000 contracts.

Image: akowedananipa.web.fc2.com

Navigating the Landscape of Commissions

The optimal commission structure depends on individual trading strategies and volume. Per-contract commissions are suitable for infrequent traders or those who trade small volumes, as the fixed fee per contract is relatively low. However, for active traders or those who execute large trades, tiered commissions can significantly reduce overall costs.

When selecting a broker, it is essential to compare commission structures to identify the most cost-effective option. Additionally, consider trading volume and type of options traded to determine the most appropriate fee structure. Brokers may also offer discounts or rebates for high-volume traders or other qualifying criteria.

Insights on Options Trading Commissions

Recent trends in options trading commissions indicate a shift towards lower fees and increased transparency. The emergence of online brokerages and the proliferation of discount brokers have intensified competition, driving down commission rates. Additionally, regulatory measures have been implemented to promote transparency and fair pricing in the industry.

While lower commissions can benefit traders, it is essential to note that hidden fees can still exist. Brokers may charge fees for additional services, such as real-time data, margin trading, or account maintenance. Carefully review the fee schedule and ask for clarification if necessary to avoid unexpected charges that erode profitability.

Expert Advice for Minimizing Commissions

Based on my experience, I recommend the following strategies for minimizing options trading commissions:

- Negotiate: Contact brokers to inquire about discounts or volume-based rebates. Some brokers are willing to negotiate commission rates for high-value accounts or traders who generate significant volume.

- Choose a broker with low commissions: Research different brokerages and compare commission structures. Online brokers and discount brokers typically offer lower fees than traditional brokerages.

- Optimize trade strategy: Consider using options with longer expirations or spreads that require fewer contracts to reduce overall commission costs.

FAQs on Options Trading Commissions

Q: What types of fees are typically charged for options trading?

A: Options trading commissions include per-contract commissions, tiered commissions, and potential hidden fees for additional services.

Q: What is the optimal commission structure for options trading?

A: The best commission structure depends on individual trading strategies and volume. Per-contract commissions are suitable for infrequent traders, while tiered commissions can save costs for active traders.

Q: How can I minimize options trading commissions?

A: Consider various strategies such as negotiating with brokers, selecting brokers with low commissions, and optimizing trade strategies to reduce overall costs.

Options Trading Commissions

Conclusion

Options trading commissions are a crucial factor that can directly impact trading profitability. Understanding commission structures and implementing strategies to minimize fees empower investors to make informed decisions and maximize their returns. Are you interested in further exploring options trading and becoming a successful trader?