Covered call option trading is a sophisticated options strategy that empowers investors to potentially generate income while hedging against potential losses in their underlying stock position. By selling (writing) call options against stocks they own, investors can harness the power of options to maximize returns while mitigating risks. In this article, we delve into the intricacies of covered call option trading, providing a comprehensive guide to this lucrative strategy.

/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

Image: cuartoymita.net

Unveiling Covered Call Option Trading

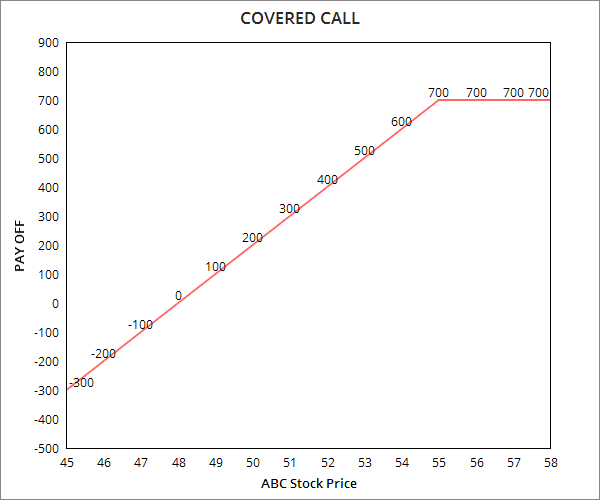

A covered call option is a strategy wherein an investor sells (writes) a call option against a stock they own. The call option grants the buyer the right, but not the obligation, to purchase the underlying stock at a specified price (the strike price) on or before a predetermined date (the expiration date). By selling the call option, the investor receives a premium payment from the buyer.

The inherent beauty of covered call option trading lies in its dual nature. On the one hand, it offers the potential for additional income generation through the premium received. On the other hand, it provides downside protection for the underlying stock position. If the stock price remains below the strike price, the call option expires worthless, and the investor retains ownership of their stock.

Essential Elements of Covered Call Option Trading

- Stock Selection: Choosing the right underlying stock is crucial. It should be a stock with moderate volatility, a clear uptrend, and a history of steady price appreciation.

- Option Selection: Understanding the strike price and expiration date is paramount. The strike price should be slightly above the current stock price, and the expiration date should be far enough in the future to give the stock time to appreciate.

- Premium Calculation: Determining the optimal premium is essential. Factors like stock price, strike price, time to expiration, interest rates, and volatility influence the premium.

- Risk Management: Covered call option trading involves calculated risk-taking. Investors should only invest what they can afford to lose and employ proper risk management techniques to minimize potential setbacks.

Navigating the Covered Call Option Trading Cycle

- Selling the Call Option: Once the parameters are set, the investor sells (writes) the call option against their existing stock position, pocketing the premium payment.

- Potential Scenarios: The stock price can fluctuate significantly during the life of the call option, leading to different outcomes.

- If the stock price rises above the strike price, the buyer may exercise their right to purchase the stock at the agreed-upon price. The investor will then sell the underlying shares to fulfill the obligation while profiting from both the stock appreciation and the premium received.

- If the stock price remains below the strike price, the call option expires worthless. The investor retains ownership of their shares, enjoying the premium received as additional income.

- Closing the Trade: The investor can close the covered call option trade before expiration by buying back the option they sold. This strategy allows for greater flexibility and risk management.

Image: tradebrains.in

Benefits of Covered Call Option Trading

- Enhanced Income Generation: The premium received from selling the call option supplements the potential gains from the underlying stock position.

- Downside Protection: The downside risk of the stock position is partially hedged, mitigating potential losses if the stock price declines.

- Time Decay: Call options lose value over time, especially if the stock price remains below the strike price. This time decay works in the investor’s favor, increasing the likelihood of a profitable trade.

Covered Call Option Trading Strategy

Image: www.chittorgarh.com

Conclusion

Covered call option trading is a robust strategy that combines income generation and risk management. By judiciously selecting stocks and options, investors can harness the power of this strategy to enhance their returns and navigate market fluctuations with greater confidence. While this article provides a comprehensive overview, it is essential to conduct thorough research and consult financial professionals before implementing covered call option trading to mitigate risks and maximize potential gains. Embrace the opportunities presented by covered call option trading and unlock the doors to a more rewarding and resilient investment strategy.