Ride the Upswing while Managing Risk

Remember the time I stumbled upon covered call option trading? It was like discovering a hidden treasure in the world of investing. Covered call writing allows me to generate passive income while protecting my stock positions in a rising market. Join me as I delve into the fascinating nuances of this strategy.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

Image: www.investopedia.com

Understanding Covered Call Writing

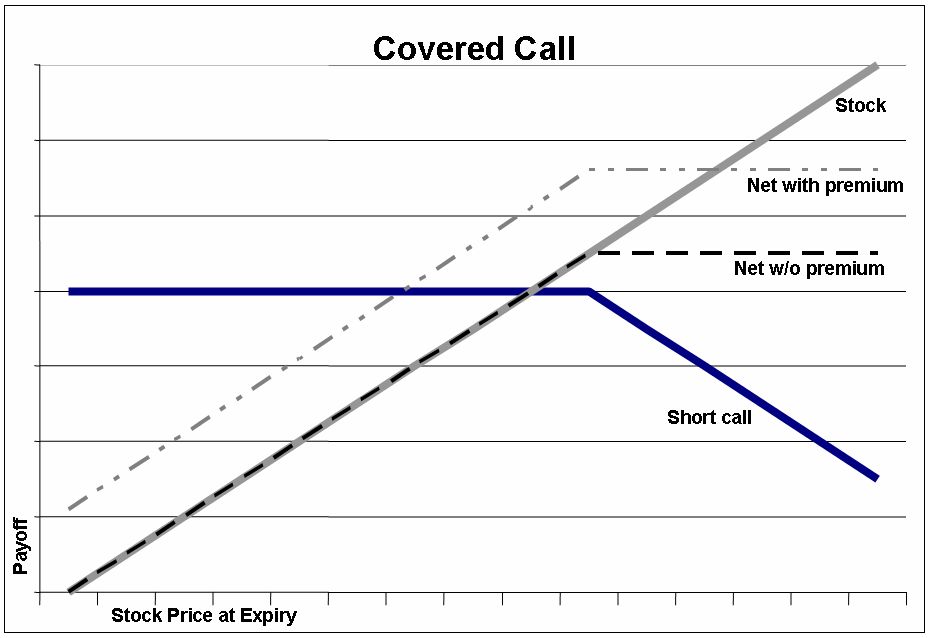

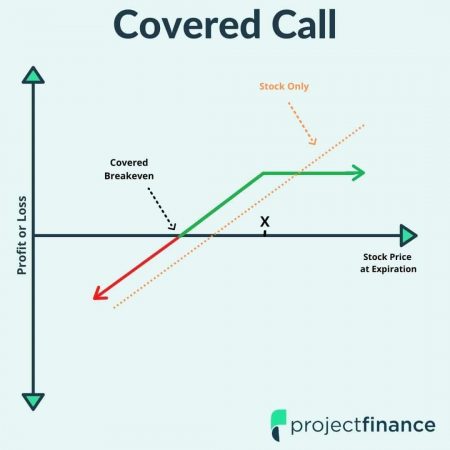

Covered call option trading involves selling a covered call option against a stock that you own. This strategy is designed to capitalize on the potential for the stock price to rise while limiting the risk of losing your shares.

Here’s how it works: When you sell a covered call, you are granting someone else the right, but not the obligation, to buy your shares at a specified price on or before a certain date. In return, you receive a premium, which is a payment upfront. If the stock price remains below the specified price, the buyer won’t exercise the option, and you keep both the premium and your shares.

Benefits of Covered Call Writing

- **Generate passive income:** The premium you receive for selling the option is yours to keep, regardless of whether the stock price goes up or down.

- **Limit downside risk:** If the stock price falls, your shares will offset the value of the call option, reducing your overall losses.

- **Enhance returns in rising markets:** As the stock price rises, the value of the call option will also increase, boosting your overall returns.

Tips and Expert Advice

- **Select the right stocks:** Choose stocks with a track record of steady growth potential and strong fundamentals.

- **Determine the optimal strike price:** Consider the stock’s price, implied volatility, and your risk tolerance.

- **Manage your risk:** Monitor the stock price and adjust your position as needed to maintain your desired risk level.

- **Consider selling multiple covered calls:** Spread your risk across different strike prices to enhance your chances of success.

- **Learn from the experts:** Read books and articles, attend webinars, and seek guidance from experienced traders to refine your strategy.

Image: www.newtraderu.com

FAQs

- Q: Can I sell covered calls on any stock I own?

A: It’s best to select stocks with ample liquidity, strong fundamentals, and a clear trend. - Q: What if the stock price drops below the strike price of the call?

A: You may face margin calls or have to sell your shares at a loss. - Q: How can I manage the risk associated with covered call writing?

A: By carefully selecting stocks, choosing the right strike price, and monitoring your positions.

Covered Call Option Trading

Image: www.projectfinance.com

Conclusion

Covered call option trading offers a compelling way to generate income, enhance returns, and manage risk in rising markets. By understanding the principles, following expert advice, and employing sound risk management practices, you can harness its power to achieve your financial goals. Are you eager to explore the potential of covered call option trading further?