In the realm of investing, stock options trading presents a unique opportunity to explore the intricacies of the stock market. Whether you’re an aspiring investor or a seasoned trader, the allure of mastering options strategies can propel your financial journey to new heights. Fortunately, with the advent of online resources and innovative learning platforms, you can delve into the world of stock options trading free of charge.

Image: www.youtube.com

Embarking on this educational adventure may seem daunting, but by following a structured learning path and harnessing the power of free resources, you can attain a comprehensive understanding of options strategies. From basic concepts to advanced techniques, this article will guide you through the journey of learning stock options trading for free, empowering you to navigate the market with confidence.

Understanding Stock Options: The Bedrock of Trading

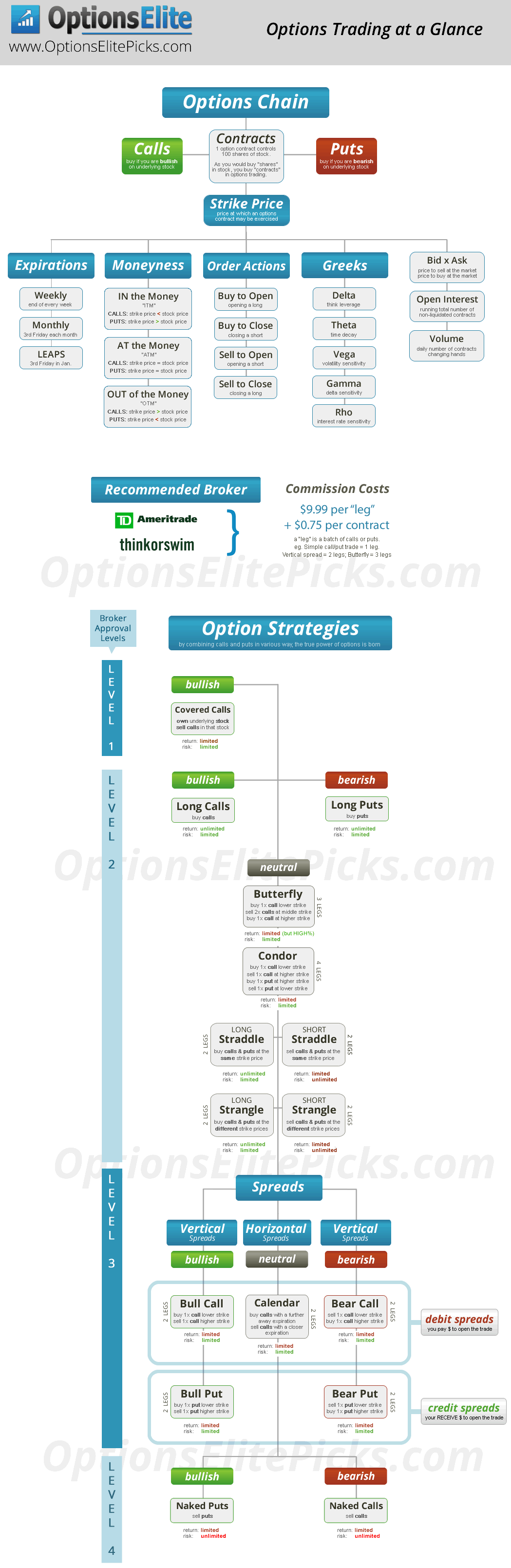

Stock options are financial contracts that grant you the right, but not the obligation, to buy (call options) or sell (put options) an underlying stock at a predetermined price (strike price) before a certain date (expiration date). They offer a powerful tool for investors to speculate on the price movements of the underlying stock, hedge against risk, or enhance returns through various strategies.

Mastering the nuances of stock options trading involves grasping the interplay between three crucial elements: option type (call or put), strike price, and expiration date. These components, when combined, determine the potential profit or loss you stand to gain or incur. With a firm understanding of these concepts, you can start exploring the diverse world of options strategies.

Discovering the Options Trading Landscape: Strategies and Beyond

The realm of stock options trading offers a wide spectrum of strategies, each tailored to specific investment goals and risk tolerance. Covered calls, cash-secured puts, and bull call spreads are but a taste of the diverse strategies commonly employed by traders.

Covered calls involve selling a call option on a stock you own to generate additional income and provide downside protection. Cash-secured puts offer a measured approach to generating income, giving you the option to purchase a stock at a discounted price if it falls below a specific level. Bull call spreads, on the other hand, allow you to capitalize on the potential upside of a stock while limiting your risk.

Navigating these strategies requires a clear understanding of their mechanics, risk-reward profiles, and suitability for different market conditions. Immerse yourself in educational resources, engage in virtual trading simulations, and seek guidance from experienced traders to refine your strategies and enhance your trading acumen.

The Art of Risk Management: Protecting Your Capital

In the exhilarating world of stock options trading, risk management lies at the cornerstone of every successful strategy. Mastering risk management techniques empowers you to safeguard your capital and preserve your hard-earned gains amidst the inherent volatility of the market.

Options trading is not without its risks, and embracing a disciplined approach to risk management is paramount for long-term success. Establishing clear risk parameters, setting stop-loss orders, and employing hedging strategies are all essential elements of a comprehensive risk management plan.

By integrating risk management principles into your trading ethos, you can mitigate exposure to potential losses, allowing you to venture forth with greater confidence and a buffer against market fluctuations.

Image: thestockmarketwatch.com

Freeing Your Trading Potential: Online Resources and Platforms

In this digital age, an abundance of free resources and platforms empowers individuals to learn stock options trading at no cost. Online courses, video tutorials, and interactive simulations provide a treasure trove of knowledge, enabling you to acquire the skills and strategies necessary for successful trading.

Platforms like Coursera, edX, and Udemy host a plethora of free online courses on stock options trading, encompassing beginner-friendly introductions to advanced trading strategies. Video tutorials on YouTube, webinars, and podcasts offer alternative avenues to delve into the intricacies of options trading.

Interactive simulations, available on platforms like Investopedia and thinkorswim, provide a risk-free environment to test your strategies and develop a deeper comprehension of options trading dynamics without putting your capital at stake. Embrace these free resources to expedite your learning curve and refine your trading skills.

Learn Stock Options Trading Free

/GettyImages-801479766-4fa7b4a1dd1d49b799565a733c9fb29d.jpg)

Image: www.investopedia.com

Conclusion: Unveiling the Power of Stock Options Trading

Stock options trading presents an exciting opportunity to enhance your investment portfolio and amplify your returns. By embracing the strategies outlined in this article and utilizing the wealth of free resources available online, you can embark on a journey of financial empowerment.

Becoming proficient in stock options trading requires dedication, continual learning, and a disciplined risk management approach. Embrace the challenge, immerse yourself in the learning process, and witness the transformative effects of unlocking the power of stock options trading. Let this article serve as your guide as you navigate the dynamic world of stock options trading, empowering yourself to make informed decisions and achieve your financial aspirations.