Market impact options trading, a sophisticated financial strategy, has revolutionized the trading landscape by bestowing savvy traders with the remarkable ability to influence market prices to their advantage. Unlike traditional options strategies, which solely speculate on price movements, market impact options seek to actively shape market dynamics by leveraging the trader’s trading volume.

Image: www.koerbler.com

Traditionally, options trading involved speculating on the direction of an underlying asset’s price, with profitability hinging on predicting correctly. However, market impact options traders deviate from this mold by not merely prognosticating price movements, but by orchestrating them through meticulous trading volume management. This novel strategy grants traders unprecedented control over the market, offering them the potential to profit from their own influence.

Understanding the Mechanisms of Market Impact Options Trading

The mechanics of market impact options trading are ingeniously intricate. Market impact options, also known as liquidity options, are tailored specifically for large-scale traders who possess substantial trading volume. When a trader exercises a market impact option, they’re purchasing or selling a sizeable amount of the underlying asset, thereby directly influencing its market price.

These options grant traders the power to move markets in a predetermined direction, with the magnitude of the price movement proportional to the size of the trade. Traders employing this strategy meticulously calculate the volume of assets they’ll trade, analyzing market liquidity and depth to estimate the impact of their trades. By doing so, they transform themselves from passive speculators into active market shapers.

Applications and Advantages of Market Impact Options Trading

Market impact options trading is a versatile strategy employed by a diverse range of market participants. Institutional investors, hedge funds, and proprietary trading firms commonly utilize this technique to enhance their trading returns. Its applications extend across various asset classes, including stocks, bonds, currencies, and commodities.

The advantages of market impact options trading are multifaceted and highly alluring. Primarily, the strategy offers superior risk management by enabling traders to counteract market volatility and mitigate losses. By carefully calibrating their trading volume, traders can control the extent of their market impact, reducing exposure to adverse price movements. Additionally, market impact options provide substantial liquidity for the underlying asset, facilitating seamless executions of large-scale trades without slippage.

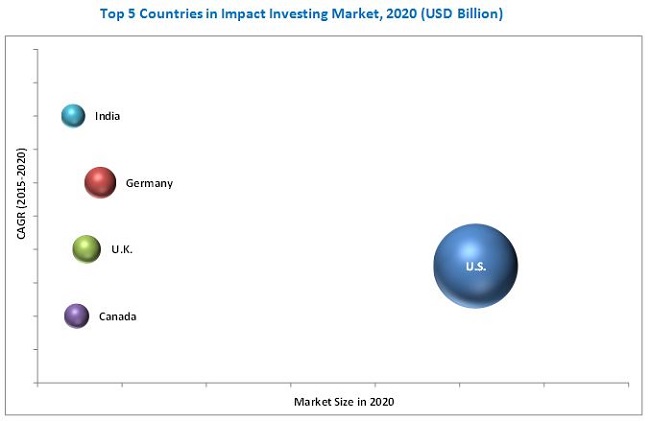

Image: perpetos.com

Market Impact Options Trading

Image: www.marketsandmarkets.com

Conclusion: Mastering the Art of Market Impact Trading

Market impact options trading empowers traders with exceptional agility and influence in financial markets. It’s a realm reserved for astute and experienced traders who possess a deep understanding of market dynamics and meticulous risk management acumen. While navigating this intricate terrain requires substantial skill and expertise, the potential rewards for mastering market impact trading can be profoundly lucrative.