In the ever-evolving world of finance, options trading has emerged as a powerful tool for investors seeking to enhance their returns. Among the various options strategies, covered call writing stands out as a low-risk yet potentially lucrative approach that deserves every investor’s attention. This article delves into the intricacies of covered call writing, empowering you with the knowledge and insights to navigate this exciting realm of options trading.

Image: www.chegg.com

Understanding the Fundamentals of Covered Call Writing

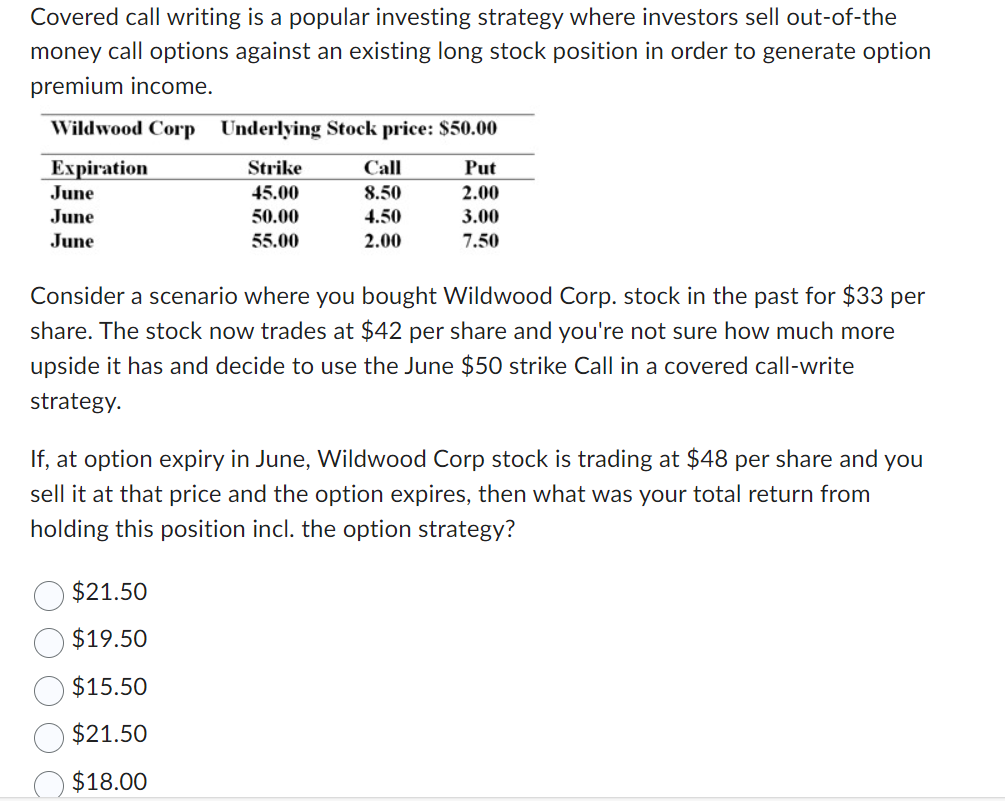

Covered call writing is a strategy where you own an underlying stock and sell (or “write”) a call option against it. The call option is a contract that gives the buyer the right, but not the obligation, to buy your shares at a specific price (“strike price”) on or before a certain date (“expiration date”). In return for selling the call option, you receive a premium, which represents the amount of money the option buyer pays you upfront.

By selling a call option, you effectively cap your potential gains on the underlying stock while capturing the premium as profit. However, you also limit your potential losses, as the buyer can only exercise the option if the stock price rises above the strike price. This trade-off between potential gain and protection from losses is what makes covered call writing an appealing strategy for conservative investors.

Benefits of Covered Call Writing

Covered call writing offers several advantages to investors:

- Income Generation: The premium received for selling the call option provides an additional income stream. This income can supplement returns or offset the cost of holding the underlying stock.

- Risk Mitigation: By limiting potential gains, covered call writing also reduces the risk associated with owning the underlying stock. This can be particularly beneficial during periods of market volatility or when the investor is uncertain about the stock’s direction.

- Flexibility: Covered call writing offers flexibility as investors can choose the strike price and expiration date of the call option based on their market outlook and risk tolerance.

- Capital Efficiency: Unlike other options strategies that require significant capital, covered call writing only requires the investor to own the underlying stock, which can often be a smaller investment.

Execution Strategies for Covered Call Writing

There are two primary execution strategies for covered call writing:

- Bullish Strategy: If the investor is bullish on the underlying stock and expects a modest price increase, they can sell a call option with a strike price slightly above the current market price. This allows them to capture some of the potential upside while limiting their losses.

- Neutral Strategy: If the investor expects the stock price to stay within a certain range, they can sell a call option with a strike price close to the current market price. This strategy focuses primarily on generating income through the premium while maintaining a neutral position on the stock’s direction.

Image: www.youtube.com

Options Trading Covered Call Writing

Image: anajevopule.web.fc2.com

Tips for Success in Covered Call Writing

To optimize your success in covered call writing, consider these tips:

- Choose Stocks with Good Trading Volume: Ensure the underlying stock has high liquidity, allowing you to enter and exit positions easily and minimize the impact of bid-ask spreads.

- Select Options with Moderate Volatility: Higher volatility options may generate larger premiums but also carry higher risks. Opt for options with moderate volatility to strike a balance between income generation and risk management.

- Manage Your Risk: Set stop-loss orders to limit your potential losses in case the stock price falls below a predetermined level.

- Consider Buy-Write Combinations: In a buy-write combination, you simultaneously purchase the underlying stock