Introduction: Mastering Market Opportunities with Covered Options

In the ever-evolving world of finance, investors seek innovative strategies to maximize returns while mitigating risks. Among the myriad of trading approaches, covered option writing has emerged as a time-tested technique that offers attractive opportunities for experienced investors. In this comprehensive guide, we delve into the best Tier 1 covered option trading strategies, empowering traders with the knowledge and insights to unlock the potential of this powerful technique.

Image: forexrobotnation.com

Defining Covered Option Trading and Its Significance

Covered option trading involves selling (or “writing”) an option contract while simultaneously holding an underlying asset that matches or exceeds the option’s underlying value. This strategy mitigates downside risk by pairing the option sale with the underlying asset’s ownership. Tier 1 covered option strategies refer to those that are least speculative and involve selling options with the lowest level of risk. Understanding the nuances of these strategies is crucial for investors seeking stable returns with manageable risk exposure.

Strategies for Tier 1 Covered Options: Navigating Market Dynamics

-

Buy-Write Strategy: Generating Premium Income without Asset Sale

The buy-write strategy involves purchasing an underlying asset and simultaneously writing a covered call option against it. The objective is to generate premium income from the option sale while maintaining the underlying asset’s value. This strategy is ideal for investors bullish on the underlying asset and seek additional income.

-

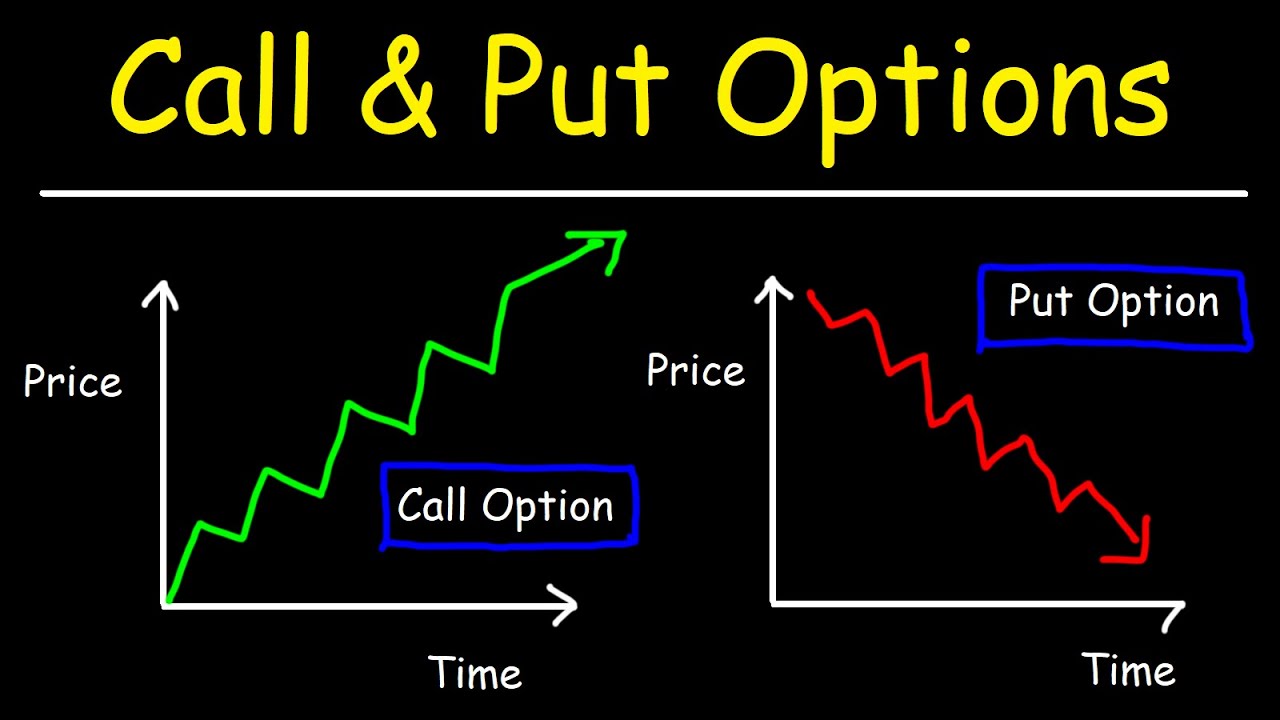

Image: www.youtube.comCash-Secured Put Strategy: Securing Downside Protection

In contrast to the buy-write strategy, the cash-secured put strategy entails selling a covered put option without owning the underlying asset yet. The investor sets aside cash in their account to cover the potential obligation to buy the asset at the strike price if the option is exercised. This strategy is suitable for investors anticipating a decline or sideways movement in the underlying asset’s price.

-

Covered Calls: Profiting from Limited Upside

Covered call writing involves selling a covered call option against an underlying asset already owned by the investor. This strategy is designed to generate premium income while capping potential gains from a further increase in the underlying asset’s value. Covered calls are ideal for investors seeking income and are comfortable with a limited upward profit potential.

-

Collar Strategy: Striking a Balance between Upside and Downside

The collar strategy combines a covered call with a protective put option. By selling a covered call to generate premium income and purchasing a protective put to hedge downside risks, this strategy aims to enhance income generation while preserving the potential for limited capital appreciation. The collar strategy is suitable for investors seeking a balanced approach to covered option trading.

Cautions and Considerations: Mitigating Risks

-

Expiration Risk: Managing Option Duration

Covered options have a finite lifespan, and investors must consider the expiration date carefully. Options that expire “in the money” may result in the obligation to sell or buy the underlying asset, potentially leading to an undesirable outcome. Proper timing and risk management are crucial in this regard.

-

Margin Requirements: Ensuring Adequate Account Balance

Cash-secured puts and covered calls may require margin accounts, which entail maintaining sufficient cash or marginable securities to cover potential trading losses. Investors should be aware of these margin requirements and ensure they have adequate account balances to trade effectively.

-

Stock Price Volatility: Navigating Market Swings

Covered option strategies are sensitive to stock price movements. Investors should thoroughly understand the underlying asset’s price history and volatility profile before engaging in covered option writing. Market swings can significantly impact option premiums and potential profit or loss.

Best Tier 1 Covered Option Trading Strategies

Image: kurskpu.ru

Conclusion: Empowering Investors through Covered Option Trading

Covered option trading strategies offer a valuable tool for investors seeking to enhance portfolio returns and mitigate risks. By carefully selecting Tier 1 strategies such as buy-write, cash-secured put, covered calls, and collar strategies, investors can tailor their approach to their risk tolerance and market outlook. However, it’s imperative to approach these strategies with proper knowledge, risk management techniques, and an understanding of market dynamics. Embracing the insights presented in this guide empowers investors to navigate market uncertainties and unlock the potential of covered option trading.