Introduction

Image: thehindsightinvestor.com

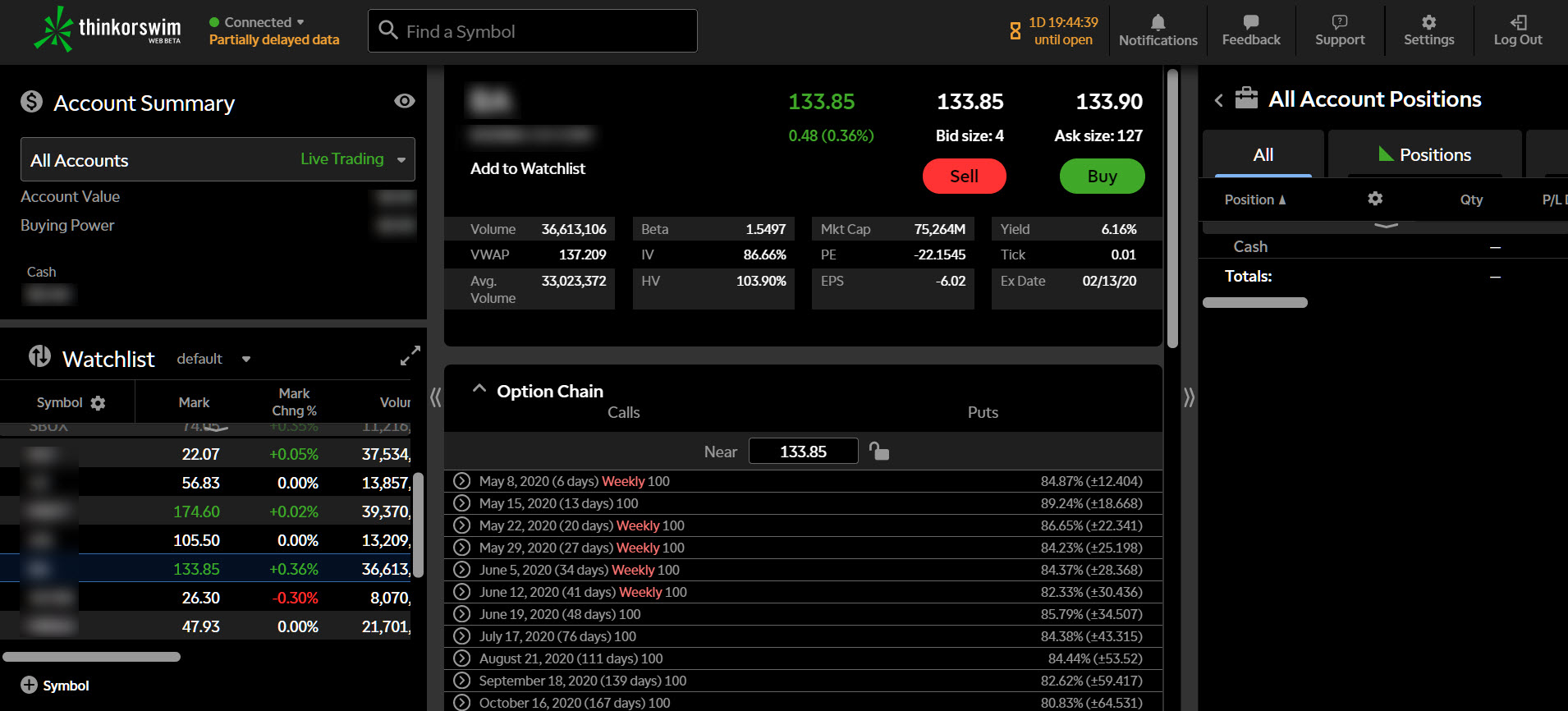

Options trading can be a compelling tool for enhancing your investment portfolio. Tier 1 covered options trading, specifically offered by TD Ameritrade, enables you to earn potential income while mitigating risk and maximizing returns. This detailed guide will unravel the intricacies of Tier 1 covered options trading and empower you to leverate this strategy effectively through TD Ameritrade’s platform.

Understanding Tier 1 Covered Options Trading

Tier 1 covered options trading involves selling (or writing) a call option while simultaneously holding an underlying security (the stock) in your account. The call option gives the buyer the right but not the obligation to purchase your shares at a specified price (strike price) on or before a certain date (expiration date). By selling the call option, you receive a premium from the buyer upfront, which represents the payment for giving them the option to buy your shares.

Tier 1 Covered Options Trading with TD Ameritrade

TD Ameritrade offers Tier 1 covered options trading, providing investors with a user-friendly platform and comprehensive tools to facilitate successful trading. To initiate a covered options trade with TD Ameritrade, follow these steps:

-

Selection of Underlying Security: Choosing the right underlying security is crucial. Consider factors such as the stock’s price, volatility, and dividend yield.

-

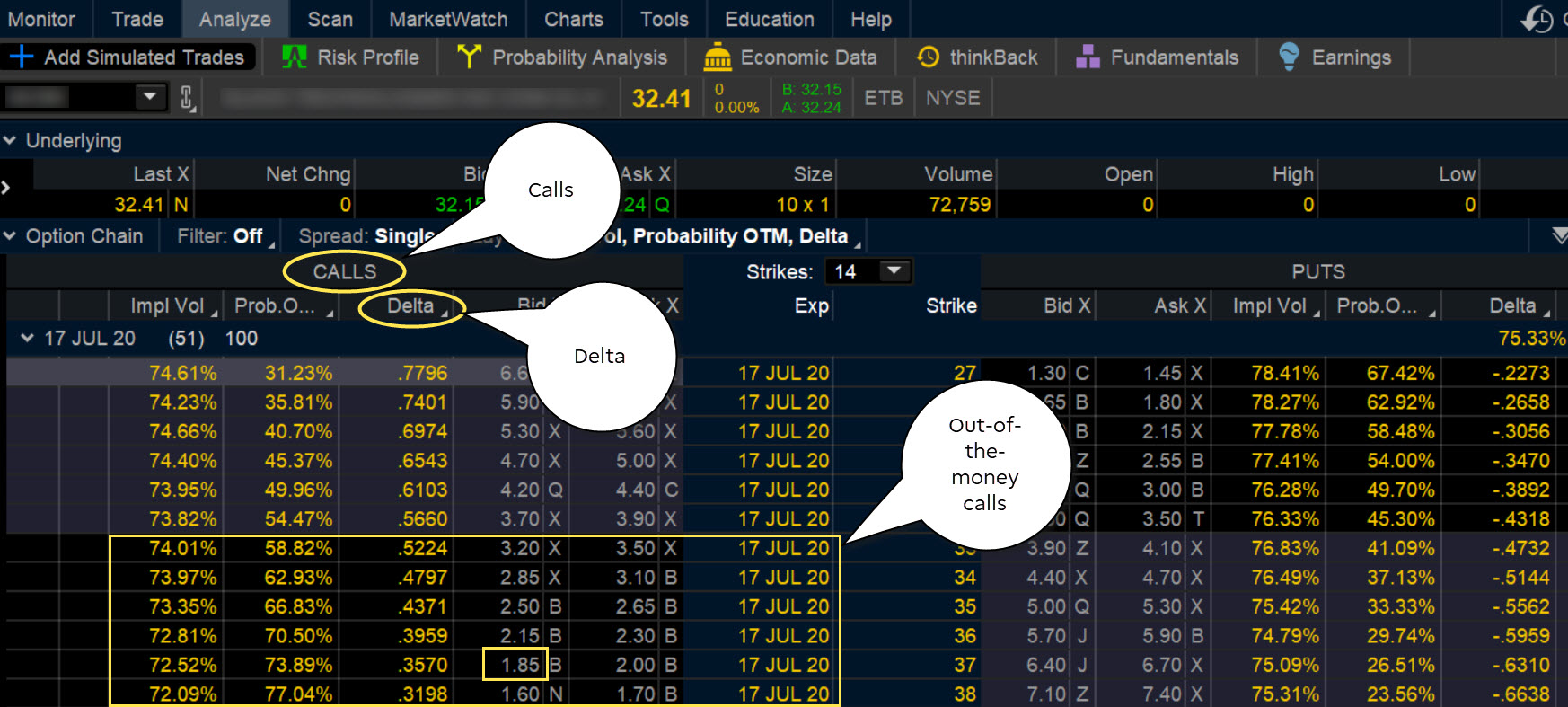

Option Selection: Determine the strike price and expiration date for the call option you want to sell. The strike price should be above the current stock price, and the expiration date should align with your investment timeline.

-

Trade Execution: Once you have selected the underlying security and options, place a sell order for the call option in TD Ameritrade’s trading platform.

-

Stock Holding Requirement: Remember that Tier 1 coverd options trading requires you to hold the underlying security in your account for the duration of the option’s life.

Benefits of Tier 1 Covered Options Trading

-

Potential Premium Income: Selling the call option earns you an immediate premium payment, which you can use to supplement your returns or cover trading costs.

-

Reduced Risk: By holding the underlying security, you limit your potential losses in case the stock price falls below the strike price of the option you sold.

-

Flexibility: Covered options trading offers flexibility in terms of holding period. You can hold the option until its expiration, exercise it yourself to purchase the stock, or buy it back to close out the trade prematurely.

-

Tax Advantages: In certain situations, covered options trading can provide tax advantages compared to selling short stock, thanks to the treatment of premium payments as either short-term or long-term capital gain.

Risks and Considerations

-

Market Volatility: Stock prices can fluctuate, which can impact the value of the call option and the potential profitability of your trade.

-

Interest Rate Risk: Interest rate changes can affect stock prices, and subsequently, the value of the covered options.

-

Stock Ownership: Tier 1 covered options trading requires you to own the underlying stock, which carries its own risks associated with stock ownership.

-

Time Decay: As the expiration date approaches, the time value of the call option decays, potentially reducing or eliminating the premium you received initially.

Conclusion

Tier 1 covered options trading, offered through TD Ameritrade, offers investors a viable strategy to generate income, reduce risk, and potentially maximize returns. By understanding the concept, carefully selecting the underlying stock and option parameters, and managing the risks involved, you can leverage the power of tier 1 covered options trading to enhance your investment portfolio and achieve your financial goals.

Image: binary.mxzim.com

Tier 1 Covered Options Trading Td Ameritrade

Image: zwemclubstz.be