Introduction

The allure of financial growth enticed me into the realm of stock market investing many years ago. Initially, I was intrigued by the concept of covered call options trading. However, I soon realized the complexities it entailed, requiring a deeper understanding of the underlying mechanisms. Determined to unravel this enigmatic strategy, I embarked on a journey of study and research, eager to master the nuances of Tier 1 covered call options trading.

Image: www3.technologyevaluation.com

Delving into Tier 1 Covered Call Options Trading

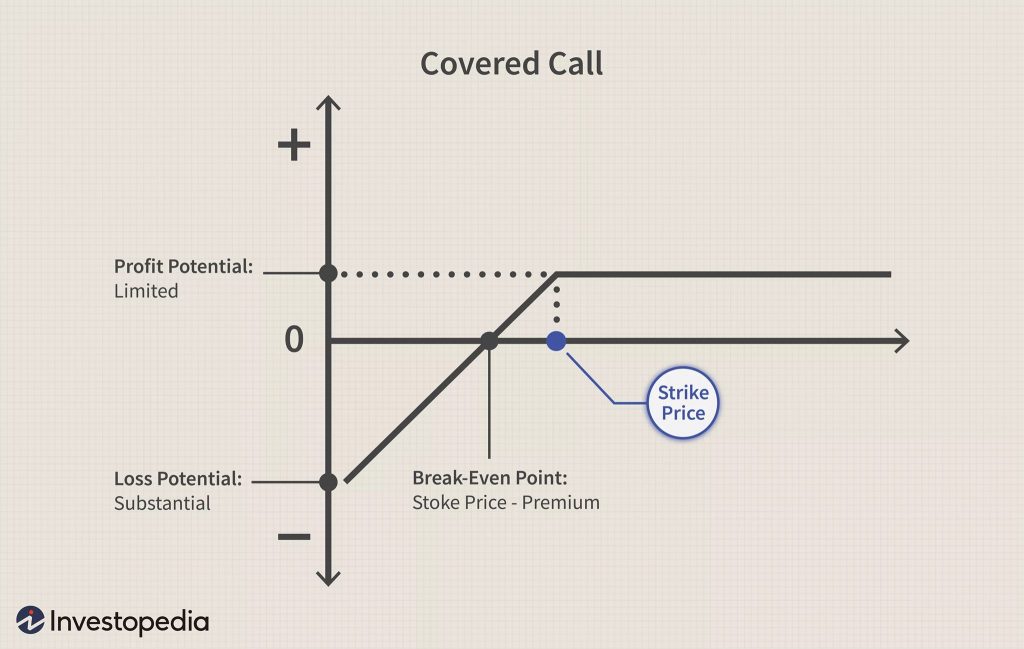

Tier 1 covered call options involve selling (writing) a call option while simultaneously holding (owning) the underlying stock. This strategy aims to generate income from the premium received from selling the call option while limiting potential losses by owning the underlying asset. As the call option buyer holds the right but not the obligation to buy the stock at a specified strike price, the downside risk is mitigated.

Understanding the Mechanics

When a trader sells a call option, they grant the buyer the right to buy the underlying stock at a predetermined strike price before a specific expiration date. In return, the seller receives a premium payment. If the stock price rises above the strike price before expiration, the buyer may exercise the option and purchase the stock from the seller at the strike price. Conversely, if the stock price remains below the strike price, the option expires worthless, and the premium received by the seller represents the sole profit.

Navigating Different Markets

Tier 1 covered call options trading can be employed in various market scenarios. In a bullish market, where stock prices are rising, traders can benefit from the potential appreciation of the underlying stock while generating additional income from option premiums. In a sideways market, where stock prices fluctuate within a narrow range, the premium income can provide a steady source of revenue. In a bear market, where stock prices are declining, the option premiums can offset potential losses, effectively reducing the overall downside risk.

Image: www.myespresso.com

Tips and Expert Advice for Success

- Choose the right stocks: Select stocks with good fundamentals and a history of steady growth.

- Determine appropriate strike prices: Consider the current stock price and market trends to set strike prices that optimize income generation without limiting potential stock appreciation.

- Manage risk: Limit the number of contracts traded and avoid selling options on stocks that you are unwilling to sell at the strike price.

- Monitor market conditions: Stay informed about market movements and adjust your trading strategy accordingly.

FAQs on Tier 1 Covered Call Options Trading

Q: What are the potential risks associated with covered call options trading?

A: The main risks include the loss of potential stock appreciation if the stock price rises significantly above the strike price and the obligation to sell the stock at the strike price even if the stock price declines below the strike price.

Q: How does covered call options trading compare to selling naked call options?

A: Covered call options trading carries less risk than selling naked call options as the trader owns the underlying stock, limiting the potential loss to the difference between the stock price and the strike price.

Tier 1 Covered Call Options Trading

Image: www.vietish.com

Conclusion

Tier 1 covered call options trading can be a lucrative strategy for generating income while managing risk. By understanding the mechanics, navigating different markets, following expert tips, and addressing potential risks, traders can harness the power of this options trading strategy. Are you interested in learning more about Tier 1 covered call options trading?