In the fast-paced realm of finance, where every decision can have far-reaching consequences, emotional intelligence (EQ) reigns supreme. EQ empowers traders to harness their emotions, navigate market volatility, and make rational decisions that lead to consistent profitability. This comprehensive guide will delve into the world of EQ options trading, exploring the profound impact it can have on your financial journey.

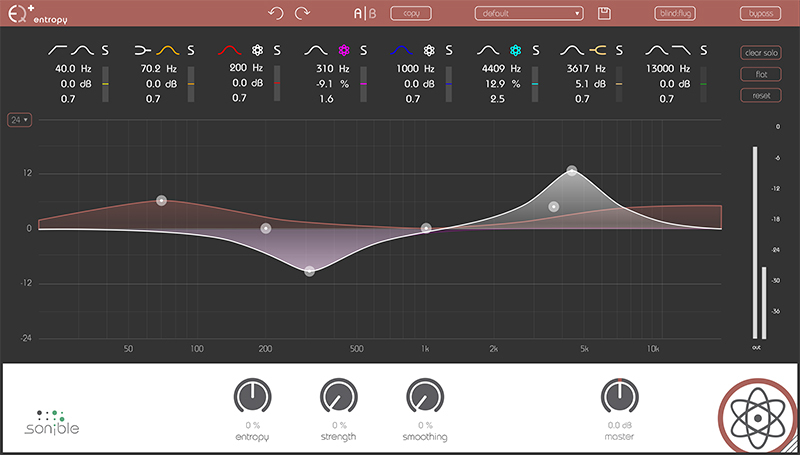

Image: mindfulcodingsolutions.com

EQ, the ability to perceive, understand, and manage one’s emotions and those of others, is essential for successful trading. Amidst the market’s relentless fluctuations, the ability to stay composed and make sound judgments is paramount. Traders with high EQ are better equipped to recognize their own emotional triggers and curb impulses that can lead to costly mistakes.

Understanding the Concepts of EQ Options Trading:

EQ options trading involves applying emotional intelligence principles to the buying and selling of options, financial instruments that allow investors to speculate on the future direction of an asset’s price. By recognizing their emotions and understanding the emotions of the market, traders can make more informed decisions and improve their trading performance.

A key component of EQ options trading is emotional detachment. When emotions run high, it becomes challenging to make objective decisions. Traders must learn to separate their personal feelings from their trading strategies and rely on analytical thinking to guide their actions. By practicing emotional detachment, traders can avoid falling prey to fear and greed, two emotions that can lead to impulsive trading and poor outcomes.

Another essential aspect of EQ options trading is self-awareness. Traders need to be acutely aware of their own emotional state and how it affects their trading decisions. By recognizing the emotions that drive their actions, traders can identify potential biases and make adjustments to their strategies accordingly. Self-awareness empowers traders to cultivate an objective and rational mindset, which is vital for making sound trading decisions.

The Benefits of EQ Options Trading:

EQ options trading offers a multitude of benefits that can elevate the trading experience and enhance profitability. Some of the notable benefits include:

- Improved risk management: Traders with high EQ are better able to assess risk tolerance and manage their emotions during periods of volatility. They are also less likely to engage in excessive risk-taking, which can lead to substantial losses.

- Enhanced decision-making: Emotions can cloud judgment and lead to poor trading decisions. By leveraging EQ, traders can minimize the impact of emotions and make rational decisions based on sound analysis.

- Increased resilience: The emotional ups and downs of trading can take a toll on traders. However, traders with high EQ are more resilient and better able to cope with setbacks and market fluctuations.

Expert Insights on EQ Options Trading:

Seasoned experts in the financial industry emphasize the crucial role of EQ in trading. “Emotions are an inevitable part of trading, but it’s how traders handle those emotions that truly matters,” says Dr. Richard Peterson, a renowned psychologist and author in the field of financial trading. “Traders with high EQ possess the self-control and emotional intelligence to navigate the market’s complexities and make informed decisions.”

Echoing these sentiments, veteran trader Mark Douglas stresses the importance of self-awareness. “The first step to successful trading is understanding yourself,” he advises. “By identifying your strengths and weaknesses, you can develop strategies that align with your emotional profile and minimize the impact of negative emotions.”

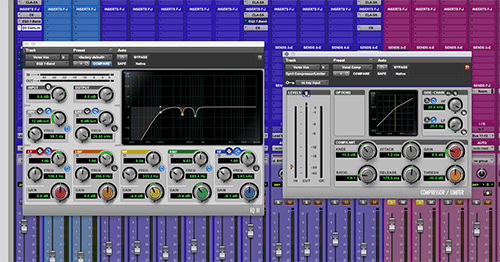

Image: www.pluginboutique.com

Practical Tips for Implementing EQ Options Trading:

Incorporating EQ principles into your options trading strategy can significantly enhance your performance. Here are some actionable tips:

- Practice emotional detachment: Recognize that emotions are fleeting and should not drive your trading decisions. Instead, rely on objective analysis and logical thinking.

- Cultivate self-awareness: Monitor your emotional state and identify any biases that may influence your trading. Take steps to mitigate the negative impact of these emotions.

- Seek support: Surround yourself with other traders, mentors, or therapists who can provide emotional support and help you navigate challenging times.

Eq Options Trading

Image: mastering.com

Conclusion: Unleashing Your EQ Potential for Trading Success:

By embracing the principles of EQ, options traders can unlock a new level of trading success. Emotional intelligence empowers traders to navigate the market’s complexities, make rational decisions, and minimize the impact of negative emotions. As emphasized by experts in the field, self-awareness, emotional detachment, and support are key ingredients for cultivating EQ in trading. By implementing the tips outlined above, traders can elevate their emotional intelligence and harness the power of emotions to achieve lasting profitability in the financial markets.

Remember, trading is an ongoing journey of learning and self-discovery. The development of EQ is a lifelong pursuit, but the rewards it offers are immeasurable. By embracing emotional intelligence and incorporating its principles into your options trading strategy, you can unlock your full potential and achieve sustainable success in the financial arena.