<!DOCTYPE html>

Image: www.youtube.com

Imagine being able to predict the direction of a stock’s price and potentially capitalize on that knowledge. That’s precisely what option trading offers. In today’s financial landscape, India has emerged as a bustling hub for option trading, and traders of all levels are eager to delve into its intricacies.

**Navigating the World of Option Trading**

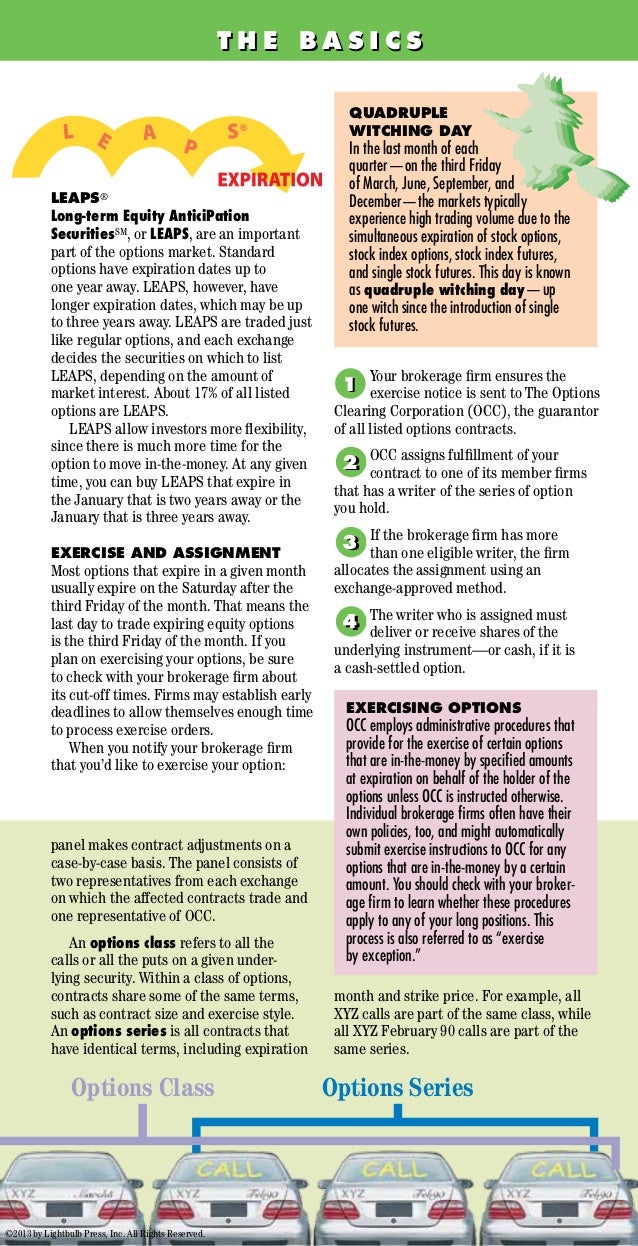

Options are financial instruments that provide traders with the right (but not the obligation) to buy (call option) or sell (put option) an underlying asset, such as a stock or index, at a specified price (strike price) on or before a specified date (expiration date). These contracts offer traders the potential for substantial returns, but they also come with inherent risks.

**Types of Option Trading Strategies**

- **Bullish Strategies:** These strategies anticipate a rise in the underlying asset’s price. Common examples include buying call options and covered calls.

- **Bearish Strategies:** As the name suggests, these strategies profit from a decline in the underlying asset’s price. Short selling and cash-secured puts are typical bearish strategies.

- **Neutral Strategies:** These strategies are designed to generate income without a directional bias on the underlying asset’s price. Examples include selling covered calls and selling cash-secured puts.

**Understanding Fundamental Concepts**

**Call Options:** Gives the buyer the right to buy the underlying asset at the strike price on or before the expiration date. The buyer pays a premium to the seller to acquire this right.

**Put Options:** Provides the buyer the right to sell the underlying asset at the strike price on or before the expiration date. Again, the buyer pays a premium to the seller.

**Strike Price:** The price at which the buyer can buy (call option) or sell (put option) the underlying asset.

**Expiration Date:** The last day on which the option can be exercised.

**Option Premium:** The price paid by the buyer to the seller to acquire the right to buy or sell the underlying asset.

Image: www.tradethetechnicals.com

**Stay Abreast of Market Dynamics**

The option trading landscape is ever-evolving, influenced by global economic events, company news, and regulatory changes. To stay ahead of the curve, traders must stay informed. Regularly monitoring financial news sources, joining industry forums, and engaging in social media discussions can provide valuable insights into market trends.

Additionally, subscribing to reputable newsletters and seeking guidance from experienced traders can help individuals stay abreast of the latest developments in the field.

**Expert Tips for Successful Option Trading**

1. Know Your Risk Tolerance:

Before venturing into option trading, determine your tolerance for risk and invest accordingly. Understand that options trading involves inherent risks, and losses are possible.

2. Choose the Right Strategies:

Not all option trading strategies are suitable for every individual. Select strategies that align with your risk appetite and market outlook.

3. Monitor Positions Regularly:

Options have limited lifespans, and their value can fluctuate significantly. Monitor your positions closely and adjust them as needed based on market conditions.

4. Manage Your Portfolio Risk:

Diversify your option portfolio across different underlying assets and expiries. This helps spread risk and reduce the impact of any single position.

**Frequently Asked Questions**

Q: Is option trading legal in India?

A: Yes, option trading is legal in India and regulated by the Securities and Exchange Board of India (SEBI).

Q: What are the benefits of option trading?

A: Option trading offers the potential for high returns and provides flexibility in tailoring strategies to individual risk profiles.

Q: What are the risks involved in option trading?

A: Option trading involves inherent risks, including the possibility of losses, time decay, and the need for constant monitoring.

Option Trading In India Pdf

Image: ujejocykixova.web.fc2.com

**Conclusion**

Option trading in India presents a compelling opportunity for traders to profit from market fluctuations. By equipping themselves with knowledge, understanding risks, and applying expert advice, individuals can navigate the complexities of this dynamic field and maximize their chances of success.

Would you like to learn more about option trading in India? Share your thoughts and questions in the comments section, and let’s delve deeper into this exciting realm together.