Unleash the Power of Options Trading in India

In the realm of financial markets, options trading has emerged as a potent tool for investors seeking strategic wealth creation. Options, contracts that grant the holder the right but not the obligation to buy or sell an underlying asset, provide immense flexibility in tailoring trading strategies. India, with its burgeoning economy and vibrant stock market, offers an enticing arena for options trading. This comprehensive guide delves into the intricacies of options trading in India, equipping investors with practical strategies and expert insights to navigate this complex yet rewarding landscape.

Image: listwithsage.com

Understanding the Options Arena

Options are derivative instruments that derive their value from the price of an underlying asset, such as stocks, indices, or currencies. They grant the holder two fundamental rights:

- Call option: The right to buy the underlying asset at a specified price (strike price) on or before a specific date (expiry date).

- Put option: The right to sell the underlying asset at a strike price on or before the expiry date.

By leveraging options, investors can hedge against market risks, enhance their returns, and exploit market inefficiencies.

Crafting Options Trading Strategies

The Indian options market offers a plethora of trading strategies, each tailored to specific market conditions and investor goals. Some popular strategies include:

- Covered call: Selling a call option against an existing holding of the underlying stock to generate income and reduce risk.

- Protective put: Buying a put option to shield an existing stock position against potential price declines.

- Bull call spread: Combining a long call option with a short call option at a higher strike price to benefit from expected price increases.

- Iron condor: Combining a buy of a put option at a lower strike price, a sell of a put option at a higher strike price, a sell of a call option at an even higher strike price, and a buy of a call option at the highest strike price to capitalize on low volatility.

Expert Insights and Proven Tactics

Seasoned options traders in India share valuable insights that can empower investors:

- Deepak Shenoy (Founder of Capital Mind): “Options allow investors to control risk and participate in market movements even with limited capital.”

- Nithin Kamath (Founder of Zerodha): “Focus on strategies that align with your risk tolerance and financial goals.”

- Ankur Parekh (Managing Director of Parag Parikh Financial Advisory Services): “Options trading requires a thorough understanding of the underlying asset and options pricing.”

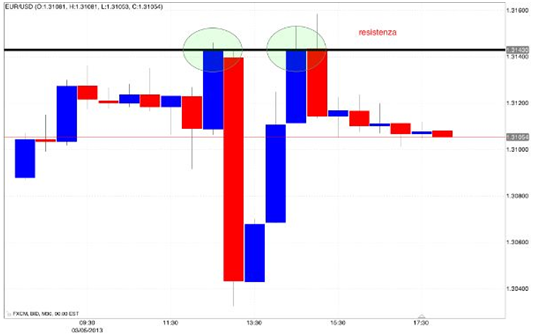

Image: www.cashoverflow.in

Options Trading Strategies In India

Image: ifmcinstitute.medium.com

Mastering the Indian Market: A Call to Action

Options trading in India presents investors with immense opportunities for strategic wealth creation. By comprehending fundamental concepts, crafting tailored strategies, and heeding expert advice, investors can harness the power of options to navigate market complexities. With careful planning and prudent risk management, options trading can elevate your investment portfolio to new heights in the thriving Indian financial landscape.