As an avid investor, I’ve delved into the intricate world of options trading, and TD Ameritrade’s robust platform has been an indispensable tool in my journey. In this comprehensive guide, I will unveil the nuances of options trading covered by TD Ameritrade, empowering you with the knowledge and strategies to harness this powerful financial instrument.

Image: toughnickel.com

Options trading involves the buying and selling of contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a set date. TD Ameritrade provides an unparalleled platform for options trading, offering a wide range of account types, advanced tools, and educational resources tailored to meet the needs of both novice and seasoned traders.

TD Ameritrade’s Comprehensive Options Trading Features

TD Ameritrade’s options trading platform boasts a plethora of features that streamline the trading process and enhance your investment experience:

- Multiple Account Types: From basic brokerage accounts to sophisticated managed accounts, TD Ameritrade caters to all levels of traders with customized offerings.

- Advanced Trading Tools: TD Ameritrade’s thinkorswim platform provides real-time market data, technical analysis tools, and advanced order types for precise execution.

- Educational Resources: TD Ameritrade hosts an extensive library of webinars, tutorials, and articles to empower traders with the knowledge and skills to navigate the options market.

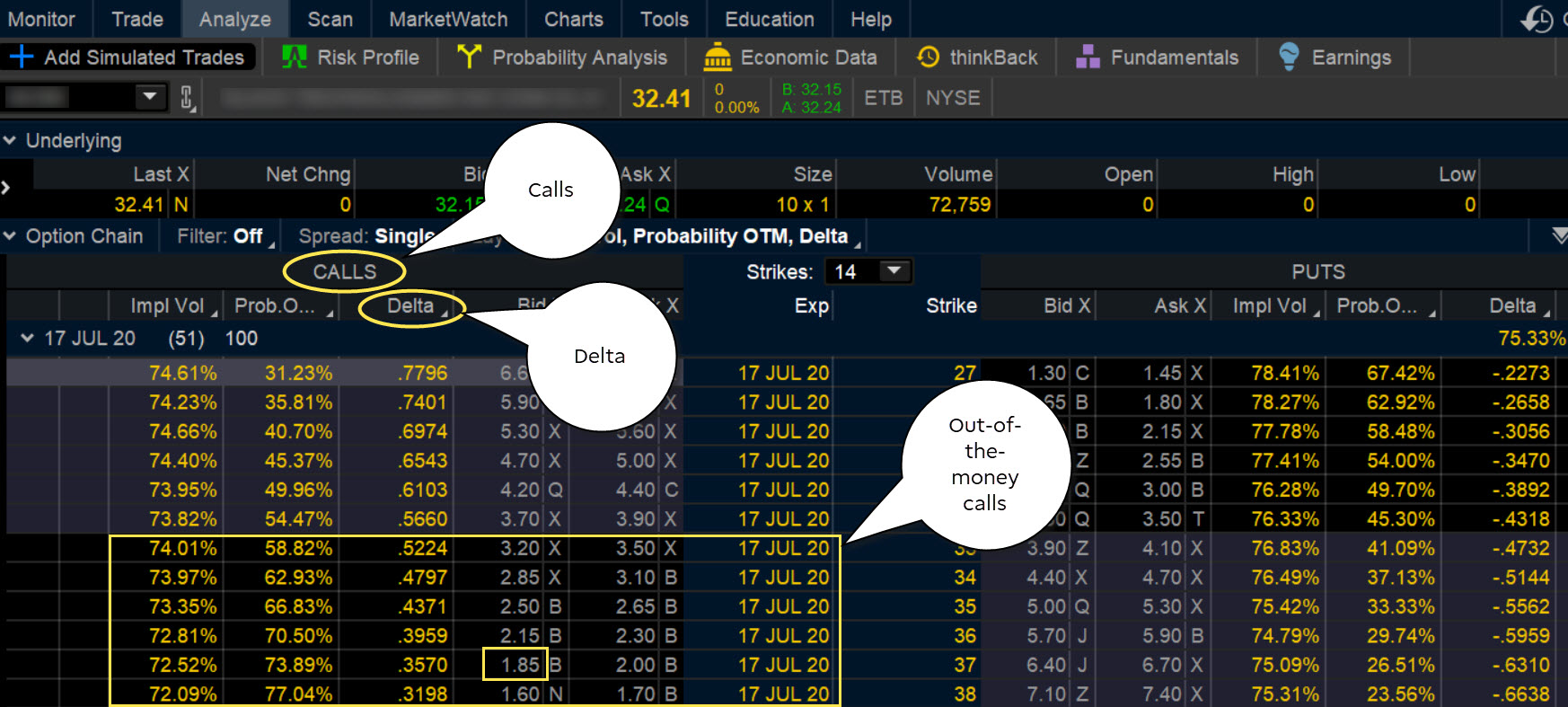

Understanding Options Trading Basics

Options contracts represent a unique way to participate in the stock market without owning the underlying asset directly. When you buy an option, you are purchasing the right to buy or sell an asset at a predetermined price on a specified date. The premium paid for the option contract is the cost of acquiring this right.

There are two main types of options: call options and put options. Call options give you the right to buy an asset at a specific price, while put options give you the right to sell an asset at a specific price. The strike price is the price at which you can exercise the option, and the expiration date is the last day on which you can exercise it.

Covered Options Trading Strategies

Covered options trading is a strategy where you sell an option contract while simultaneously owning the underlying asset. This strategy can enhance your potential returns by generating additional income from the sale of the option.

There are two primary covered options trading strategies:

- Covered Call: Selling a call option against stock that you own. This strategy generates income but caps your potential upside if the stock price rises too quickly.

- Covered Put: Selling a put option against stock that you own. This strategy provides a cushion against downside potential but limits your profit gains from a rising stock price.

Image: tickertape.tdameritrade.com

Expert Advice and Tips

To maximize your success in options trading, it’s essential to heed expert advice and implement proven strategies:

- Research Thoroughly: Before trading options, thoroughly research the underlying asset, market conditions, and potential risks.

- Manage Risk Effectively: Implement risk management strategies such as setting stop-loss orders and position sizing to limit potential losses.

- Trade with Discipline: Adhere to a clearly defined trading plan and avoid impulsive trades that can lead to costly mistakes.

Frequently Asked Questions

- What are the benefits of options trading? Options trading offers potential for income generation, enhanced returns on investments, and risk mitigation.

- What are the risks of options trading? Options trading involves significant risk of losses, and traders should carefully consider their financial situation before participating.

- How do I get started with options trading? Open an options trading account with a reputable brokerage like TD Ameritrade and educate yourself thoroughly before making any trades.

Options Trading Covered Td Ameritrade

Image: www.ainfosolutions.com

Conclusion

Options trading covered by TD Ameritrade empowers investors with a versatile tool to navigate the financial markets. By leveraging TD Ameritrade’s comprehensive platform, traders can access advanced tools, educational resources, and expert support to enhance their trading strategies. Whether you’re a seasoned professional or an aspiring trader, options trading opens up a world of possibilities for generating income, increasing portfolio returns, and managing risk.

Are you intrigued by the lucrative opportunities and dynamic challenges of options trading? Join TD Ameritrade today and uncover the next level of investing.