Have you ever witnessed the thrilling surge of adrenaline when witnessing a well-executed options trade? The meticulous planning, the precise timing, the calculated risk-taking—it’s a symphony of financial acumen and market mastery. And now, I’m delighted to introduce you to the ultimate options trading package, your gateway to unlocking the boundless possibilities of this financial arena.

Image: www.goodreads.com

Get ready to embark on an extraordinary journey where we’ll delve into the depths of options trading, unravel its complexities, and equip you with the knowledge and tools to navigate the market with confidence. From the basics of options contracts to advanced trading strategies and real-time market insights, our comprehensive package has everything you need to become a master of this financial domain.

Understanding Options Trading: A Foundation of Knowledge

Options trading, a captivating field of finance, involves contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price on or before a specified date. These contracts offer a unique way to speculate on price movements, hedge against potential losses, and generate additional income through option premiums.

At the heart of options trading lies the concept of risk and reward. Options contracts provide a measure of leverage, allowing traders to control significant positions with a smaller capital outlay compared to outright ownership of the underlying asset. However, this leverage also magnifies potential gains and losses, making risk management a paramount consideration.

Navigating the Options Market Landscape

The options market is a vibrant and dynamic arena where traders from all walks of life converge, each with varying objectives and strategies. To thrive in this competitive environment, a thorough understanding of the market’s intricacies is essential. Our ultimate options trading package will equip you with:

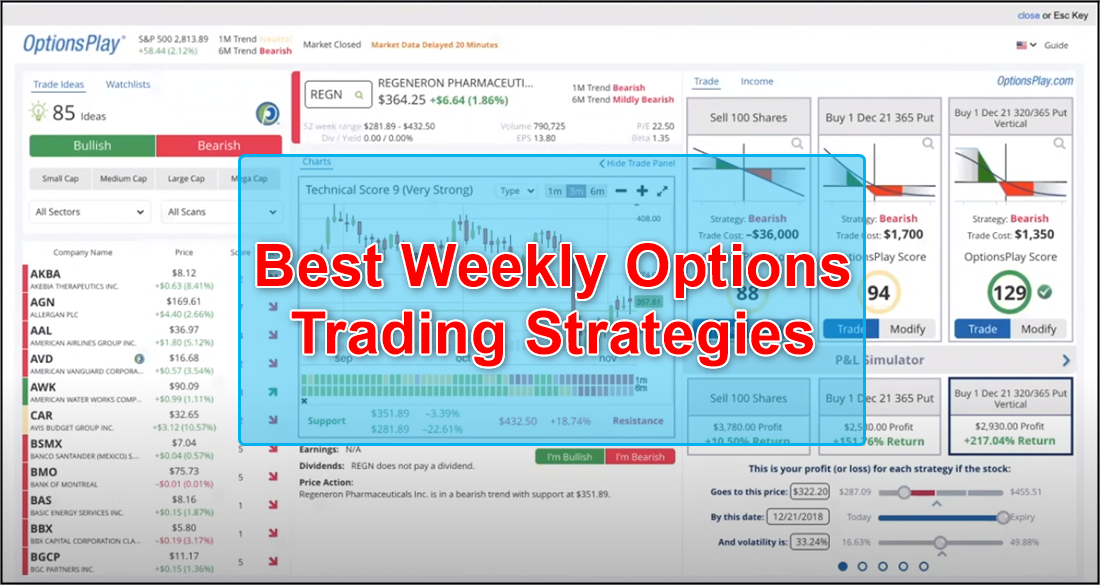

- In-depth analysis of different options strategies: Discover the nuances of call spreads, put spreads, straddles, and strangles as we delve into their mechanics, risk-reward profiles, and practical applications.

- Expert guidance on technical indicators: Unleash the power of technical analysis by mastering the art of identifying trends, support and resistance levels, and momentum indicators. Become adept at interpreting market signals and making informed trading decisions.

- Real-time market updates and insights: Stay ahead of the curve with our exclusive access to real-time market data, news, and analysis from industry experts. Track market movements, identify potential opportunities, and react swiftly to changing conditions.

Expert Tips for Options Trading Success

To elevate your options trading prowess, consider the following tips from seasoned professionals:

- Thoroughly research and understand the underlying asset: Don’t venture into options trading without a comprehensive understanding of the asset you’re targeting. Conduct thorough research on its fundamentals, market trends, and historical volatility.

- Define clear trading goals and risk tolerance: Establish realistic trading objectives and assess your personal risk tolerance before placing any trades. Determine how much capital you’re willing to risk and stick to your predefined limits.

- Practice with paper trading before risking real capital: Hone your trading skills and strategies in a risk-free environment. Paper trading platforms simulate real-world trading conditions, allowing you to test your mettle without any financial consequences.

Image: stockscreenertips.com

Frequently Asked Questions About Options Trading

Here are answers to some of the most common questions about options trading:

- Q: What is the difference between a call and a put option?

A: Call options give the buyer the right to buy the underlying asset at a specified price, while put options provide the right to sell the underlying asset.

- Q: How do I calculate the profit or loss from an options trade?

A: Options profit or loss is determined by the difference between the option premium paid and the difference between the strike price and the underlying asset’s price at expiration.

- Q: What are the risks involved in options trading?

A: Options trading carries inherent risks, including the possibility of losing the entire premium paid for the contract if the option expires worthless.

Ultimate Options Trading Package

Image: www.barnesandnoble.com

Conclusion: Embark on Your Options Trading Journey

The ultimate options trading package is an invaluable resource for anyone seeking to unlock the potential of this captivating financial arena. With our comprehensive suite of educational materials, expert guidance, and real-time market insights, you’ll acquire the knowledge, skills, and confidence to navigate the options market like a seasoned professional.

We invite you to join us on this exciting journey and elevate your financial prowess to new heights. Are you ready to embrace the possibilities and unlock the ultimate options trading experience?