**Ally Options Trading: Mastering the Art of Stock Buybacks**

The world of stock buybacks has long been shrouded in mystery for many investors. However, Ally Options Trading provides a unique opportunity to unravel the complexities of this financial maneuver. By leveraging Ally’s user-friendly platform and comprehensive trading tools, investors can gain access to the intricacies of stock buybacks with ease.

Image: www.optionsbro.com

**Understanding Stock Buybacks**

Stock buybacks occur when a company repurchases its own outstanding shares from the market. This transaction reduces the number of shares in circulation, increasing the ownership stake of existing shareholders and potentially boosting the stock price. It’s a strategic move that can influence the value of the company and yield significant returns for investors.

**Types of Stock Buybacks**

**Open Market Buyback:**

The purchase of shares directly from the open market, allowing companies to strategically acquire shares when prices are favorable.

Image: wallethacks.com

**Fixed-Price Buyback:**

A predetermined number of shares are acquired at a specific price, providing stability in the stock buyback process.

**Dutch Auction Buyback:**

Shares are acquired from shareholders who tender their shares within a specified price range, offering a flexible approach.

**Why Execute Stock Buybacks?**

1. Enhance Shareholder Value: Buybacks can increase earnings per share and boost share prices, benefiting existing shareholders.

2. Signal Financial Strength: Companies with strong financial positions often engage in buybacks, indicating confidence in their future prospects.

3. Mitigate Dilution: If a company issues new shares to fund growth, buybacks can counterbalance the potential dilution of existing shareholder ownership.

**Tips for Navigating Stock Buyback Options Trading**

1. Research the Company:** Thoroughly analyze the company’s financial health, industry trends, and management team before executing a buyback.

2. Monitor Market Conditions:** Timing is crucial in buyback trading. Stay informed about market movements, interest rates, and economic indicators.

3. Diversify Your Portfolio:** While buybacks can yield rewards, it’s essential to diversify investments and not rely solely on a single buyback strategy.

**Frequently Asked Questions about Ally Options Trading Buyback**

**What are the tax implications of a stock buyback?**

Buybacks can have tax implications, depending on whether the transaction is classified as a taxable dividend or a stock redemption. It’s crucial to consult a tax advisor for specific guidance.

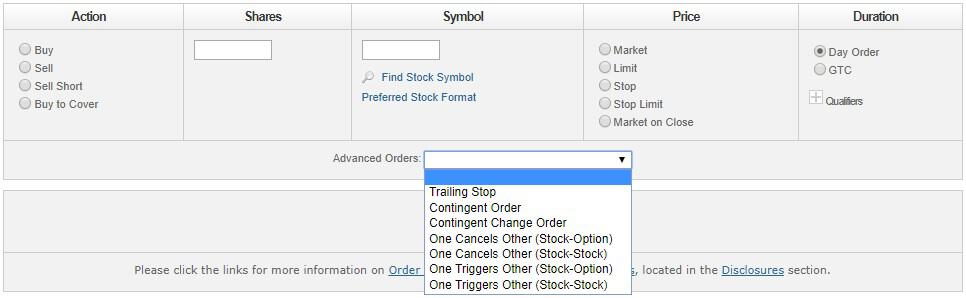

**Can I use Ally Options Trading to short stocks involved in buybacks?**

Yes, Ally Options Trading allows users to engage in both long and short positions, enabling investors to speculate on the potential price movements of stocks involved in buybacks.

Ally Options Trading Buyback

**Conclusion**

Ally Options Trading Buyback empowers investors with the tools and knowledge to navigate the intricacies of stock buybacks. By delving into the different types of buybacks, understanding their rationale, and utilizing expert tips, investors can leverage the Ally platform to maximize their returns and optimize their trading strategies. As always, it’s vital to approach investing with an informed mindset, seeking professional advice when necessary.

Are you ready to embark on the journey of stock buyback trading? Ally Options Trading awaits, ready to guide you along the path to profitable opportunities.