Introduction:

Image: www.cboe.com

The stock market has witnessed a transformative shift in recent years as companies have shied away from traditional stock splits. This phenomenon, combined with rising share prices, has significantly impacted the dynamics of option trading, leaving traders perplexed about its implications. In this article, we delve into the intricate relationship between stock splits and option trading, unraveling the complexities and exploring the impact on traders’ strategies.

Stock Splits and Their Significance:

A stock split is a corporate action where a company increases the number of outstanding shares by dividing each existing share into multiple shares. This adjustment typically results in a proportional reduction in the stock’s price. Historically, stock splits have been used to make companies more accessible to retail investors and increase liquidity.

Option Trading in the Era of Declining Stock Splits:

Options are derivative contracts that provide the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset (usually a stock) at a specific price (strike price) on or before a certain date (expiration date). The pricing of options is heavily influenced by factors such as the underlying stock price, volatility, and time to expiration.

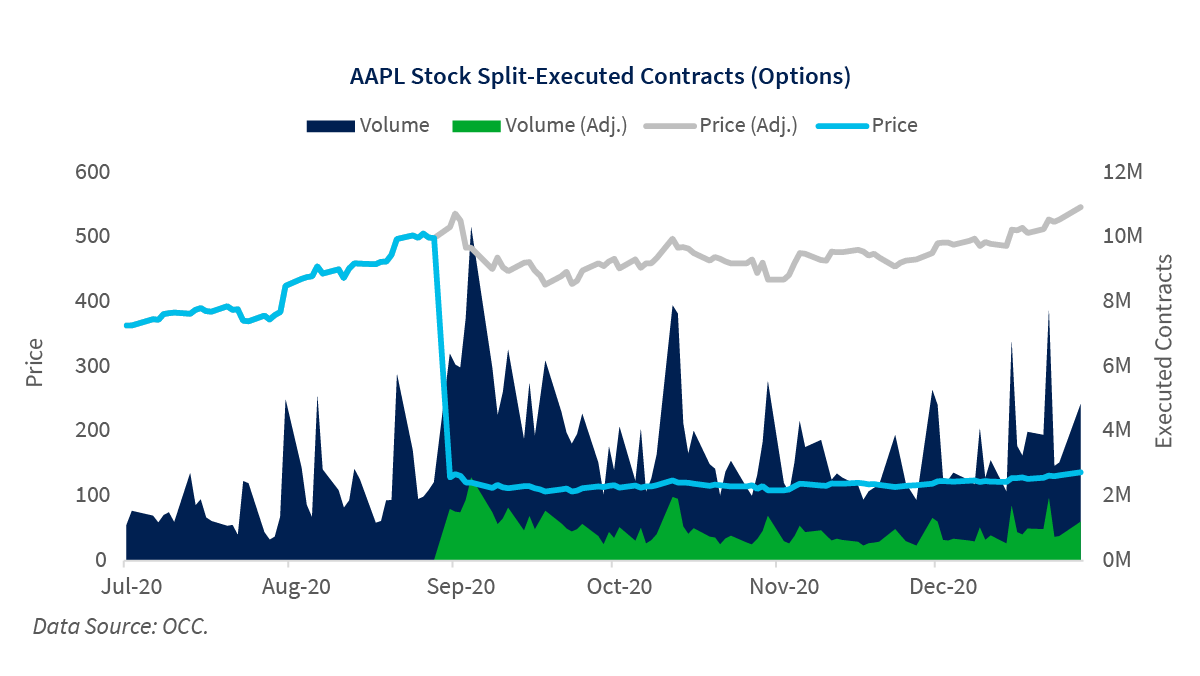

In the past, frequent stock splits kept share prices within a range that was attractive to option traders. However, as stock splits have become less common, share prices have surged, making options more expensive. This has created a situation where many companies are priced too high for retail investors to affordably trade options.

Impact on Option Trading Strategies:

The decline in stock splits has forced option traders to adapt their strategies. Some have shifted towards trading options on lower-priced stocks or ETFs. Others have adopted spreads, which involve buying and selling options with different strike prices, to offset the higher cost of premiums.

However, these strategies come with their own set of challenges. Lower-priced stocks generally have lower liquidity, making it difficult to enter and exit trades. Spreads can also be more complex and require a higher level of trading expertise.

Expert Insights:

“The decline in stock splits is a significant shift for option traders,” says Dr. James Chen, a renowned expert in financial derivatives. “Traders need to be aware of the implications and adjust their strategies accordingly.”

“Consider selling out-of-the-money options or using spreads to reduce the risk and increase the probability of profit,” advises Mark Fisher, a veteran option trader. “Also, look for alternative investment opportunities, such as warrants or equity-linked notes, that offer similar leverage to options but may have different characteristics.”

Conclusion:

The impact of decreased stock splits on option trading is still unfolding. As companies continue to favor share buybacks over splits, traders must navigate the changing landscape by adapting their strategies and exploring alternative investment vehicles. By understanding the intricacies of this dynamic, traders can position themselves to succeed in the evolving market environment.

Image: wealthdesk.in

Has Decreased Stock Splits Impacted Option Trading

Image: www.scirp.org