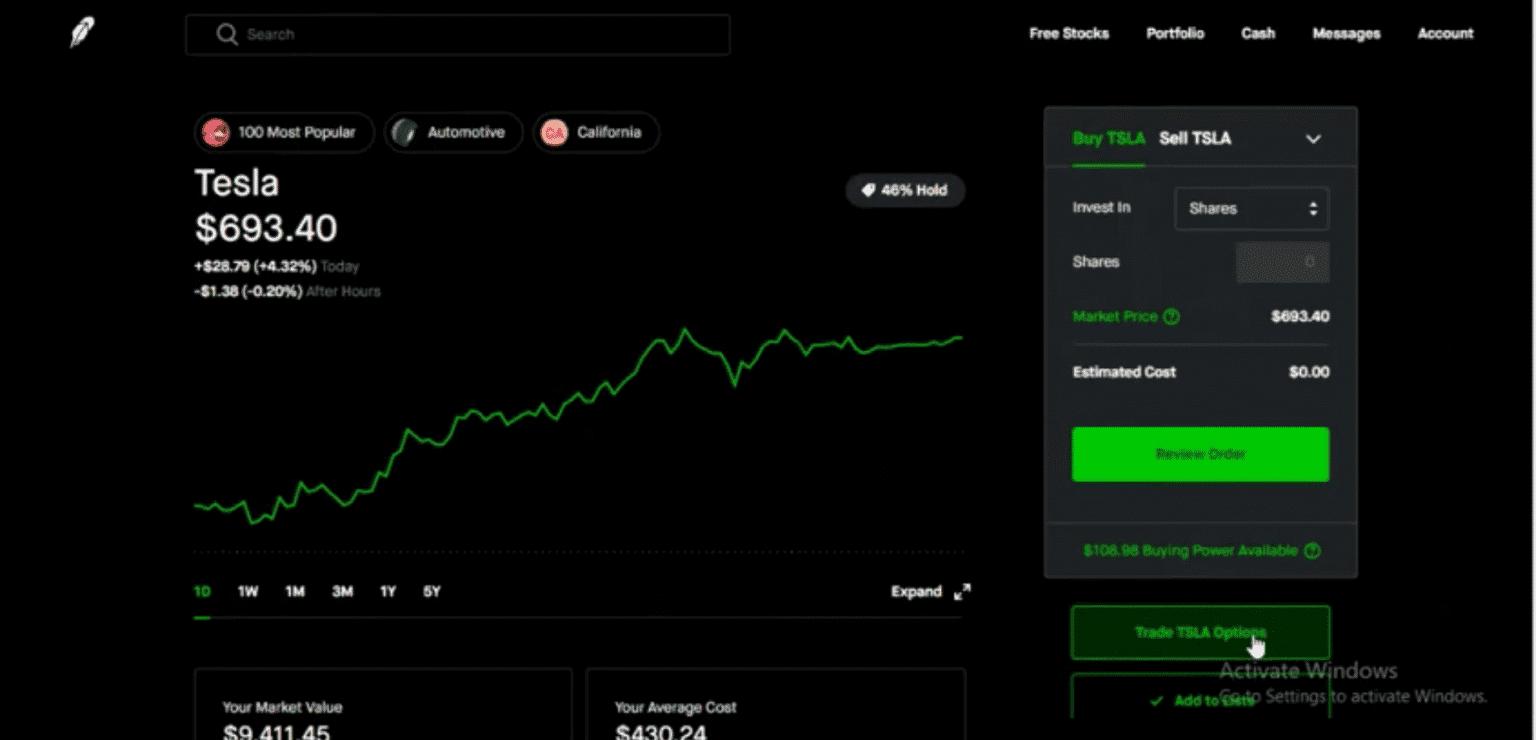

In the realm of investing, options trading offers a world of possibilities and potential rewards. Robinhood, a popular online broker, makes this complex financial instrument accessible to individual investors. With Robinhood, the right opportunity can be seized at the perfect moment. However, understanding the options trading hours on Robinhood is critical to executing successful trades.

Image: 4xpip.com

The Dynamics of Options Trading Hours

Options trading on Robinhood follows a precise schedule, ensuring fairness and transparency in the market. The regular trading session runs from 9:30 AM to 4:00 PM Eastern Time (ET). During this period, traders have ample time to evaluate market conditions, analyze underlying securities, and place their trades.

Pre-Market Session:

Before the regular trading session, an optional pre-market session takes place from 9:00 AM to 9:30 AM ET. This session allows traders to get an early glimpse of market movements and place limit orders, which are executed once the market opens.

After-Hours Session:

After the regular trading session concludes, an after-hours session runs from 4:00 PM to 8:00 PM ET. During this session, trading volumes typically decrease, but it provides an additional opportunity for investors to adjust positions or execute orders.

Important Considerations for Options Trading Hours

-

Expiration Dates: Options contracts have a finite lifespan. It’s crucial to monitor the expiration date of the options you’re trading, as most options expire on the third Friday of each month.

-

Trading Volume: Volume plays a significant role in options trading. Higher trading volume indicates a more active market, offering greater liquidity and potentially tighter spreads.

-

Market Volatility: Options trading thrives on volatility. The more volatile the underlying security, the higher the potential rewards but also the risks involved.

-

Risk Management: Options trading can be a double-edged sword. Understanding and implementing sound risk management strategies, such as diversification and proper position sizing, is essential to mitigate potential losses.

Expert Insight and Actionable Tips

“Options trading can be a powerful tool, but only when used appropriately,” advises financial expert Mark Douglas. “Adhere to your trading plan, manage your risk, and continually educate yourself to navigate the complexities of the market.”

To enhance your options trading experience on Robinhood:

-

Familiarize yourself with the platform’s options features and functionality.

-

Research and select underlying securities that align with your investment goals and risk tolerance.

-

Set realistic profit targets and stop-loss levels to protect your capital.

-

Monitor market news and economic events that may impact the underlying securities.

-

Consider seeking guidance from a qualified financial advisor to optimize your trading strategies.

Image: marketxls.com

Options Trading Hours Robinhood

Image: www.warriortrading.com

Conclusion

Mastering options trading hours on Robinhood provides traders with a solid foundation for success. By understanding the market schedule, considering relevant factors, and leveraging expert insights, investors can navigate the complexities of options trading with confidence. Remember, trading involves both risks and rewards, and prudent risk management is the cornerstone of any successful trading strategy. Embrace the challenge, learn from your experiences, and optimize your trading journey on Robinhood.