Are you an aspiring forex trader looking to expand your trading horizons? Dive into the exciting world of forex options, where you can enhance your profit potential while mitigating risk. This comprehensive guide will empower you with the knowledge and strategies needed to trade forex options like a seasoned pro.

Image: www.publicfinanceinternational.org

In the realm of forex trading, an option gives you the right, but not the obligation, to buy or sell a specified currency pair at a predetermined price on a specific date. Unlike spot forex, where you buy or sell currencies outright, options trading allows you to speculate on currency movements without taking on the full exposure of owning or selling the underlying asset. This flexibility makes forex options a versatile instrument suitable for various trading styles and risk appetites.

Decoding Forex Options: Types and Terminology

Understanding the different types of forex options is crucial. The two main types are:

**Call options:** Grant you the right to buy a currency pair at a specified price (strike price) on a specified date (expiry date). You profit if the market price of the currency pair rises above the strike price at expiry.

**Put options:** Grant you the right to sell a currency pair at a specified price (strike price) on a specified date (expiry date). You profit if the market price of the currency pair falls below the strike price at expiry.

Key Terms:

- Option premium: The price you pay to buy an option

- Strike price: The predetermined price at which you can buy or sell the currency pair

- Expiry date: The date on which the option contract expires

Trading Forex Options: A Comprehensive Overview

To trade forex options successfully, a thorough understanding of the market dynamics is essential:

**Execution:** When buying an option, you gain the right to execute the contract at the specified strike price on or before the expiry date. You can choose to exercise the option (i.e., buy or sell the currency pair) if it’s profitable or let it expire worthless.

**Option pricing:** The premium of an option is influenced by several factors, including the current market price of the underlying currency, the strike price, the time to expiry, and the implied volatility. Understanding these factors is essential for making informed pricing decisions.

**Risk management:** Forex options offer the potential to leverage your position and enhance your profit potential. However, it’s crucial to manage your risk prudently. Implement stop-loss orders to limit potential losses and consider your risk appetite before initiating any trades.

Image: forexautotradingaccounts.blogspot.com

The Intricacies of Forex Option Strategies

Beyond the basics, exploring advanced forex option strategies can elevate your trading prowess. Here are a few popular approaches:

**Covered call strategy:** Involves selling (writing) call options against the underlying asset that you own. This strategy allows you to generate income while maintaining exposure to potential upside in the market.

**Collar strategy:** Combines a long call option with a short put option at a higher strike price to create a trading range. This strategy provides protection against significant losses in either direction while offering the potential for limited profit.

Tips for Success in Forex Options Trading

Seasoned traders have honed their expertise through years of experience. Here are some invaluable tips they offer:

**Research extensively:** Delve into the nuances of forex option trading before placing any trades. Stay updated with market news, economic data, and technical analysis.

**Start small:** Don’t jump into the deep end right away. Begin with small trades to minimize risk and enhance your confidence in trading forex options.

Embracing a Continual Learning Mindset

Embrace a perpetual learning mindset. The forex options market is constantly evolving; traders must adapt their strategies accordingly. Attend industry events, consult with experienced mentors, and seek knowledge from reputable resources to refine your expertise.

FAQs on Forex Options Trading

To clarify common queries, here are some frequently asked questions:

Q1. Are forex options only for experienced traders?

A1. No, forex options can be suitable for both beginner and experienced traders. However, a solid understanding of the fundamentals and risks involved is imperative before trading.

Q2. How can I choose the right expiry date for an option?

A2. Consider the market conditions, your trading strategy, and the implied volatility. Longer-dated options offer more flexibility but typically have a higher premium.

Q3. What is the difference between buying and selling options?

A3. Buying an option gives you the right to execute the contract at a specified price on or before the expiry date. Selling (writing) an option involves creating a contract that gives others the right to buy or sell the underlying asset from you.

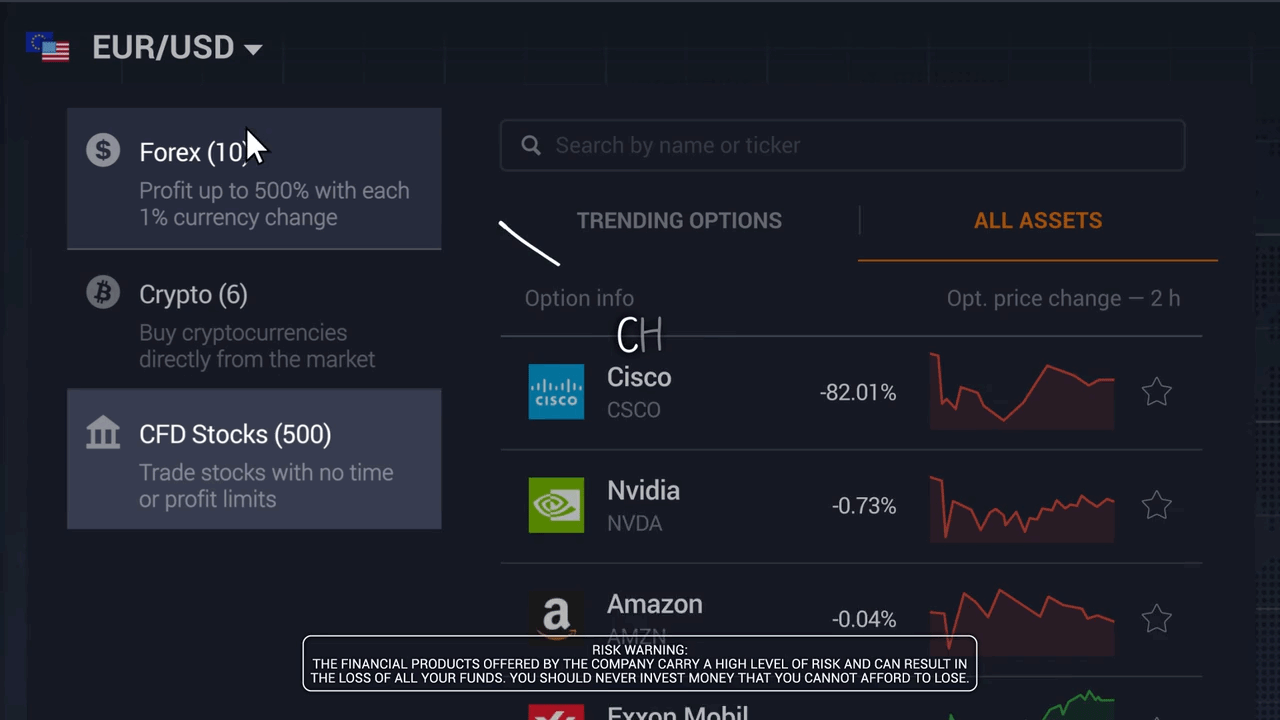

Trading Forex Option

Image: www.youtube.com

Conclusion

Forex options trading presents a captivating opportunity for traders to enhance their profit potential and mitigate risk. By mastering the concepts, strategies, and risk management principles outlined in this guide, you can navigate the complexities of forex options like an expert. Remember, education is an ongoing journey, embrace the learning process, and strive for continuous improvement.

Are you ready to delve into the realm of forex options and tap into its vast possibilities? Dive in today, and unleash the trader within!