Unlock the Power of Flexible Currency Trading

In the dynamic world of financial markets, forex options emerge as a powerful tool for sophisticated currency traders. By delving into the depths of this trading strategy, you’ll discover a gateway to tailored risk management and potentially boundless opportunities in the currency markets.

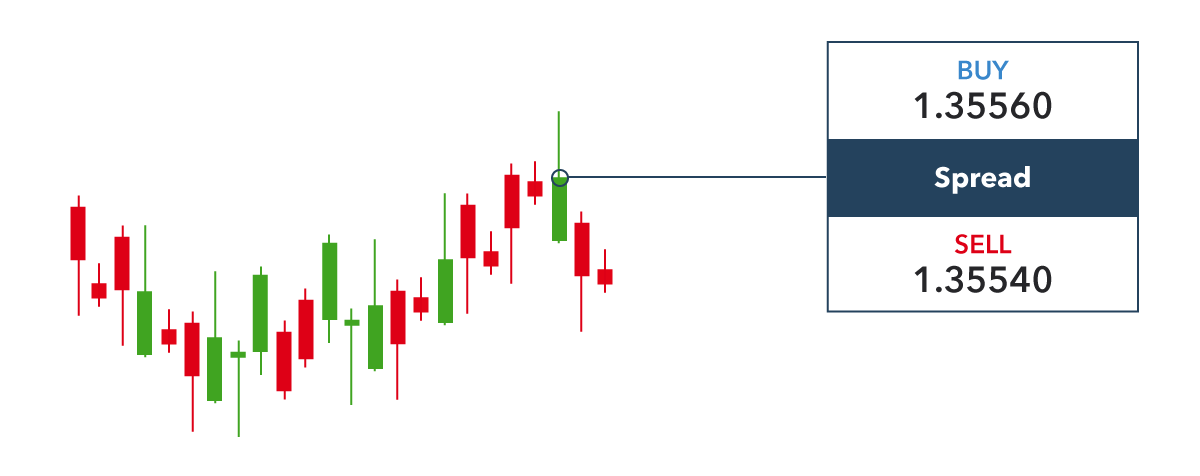

Image: www.forexbrokers.com

Forex Options: A Closer Examination

Forex options are financial contracts that grant the buyer the right, but not the obligation, to buy or sell a specific currency at a predetermined price on or before a certain date. Unlike traditional forex trading, which involves buying or selling currencies outright, options provide traders with an additional layer of flexibility and adaptability.

Benefits of Trading Forex Options

Forex options offer a wealth of advantages to traders, including:

-

Risk Management: Options allow traders to hedge against potential losses by setting limits on both their potential gains and liabilities.

-

Flexibility: Traders can tailor their options contracts to suit their specific market outlook and risk tolerance.

-

Income Generation: Selling options can generate income even when currency prices remain stable or fluctuate within a narrow range.

Types of Forex Options

The two primary types of forex options are:

-

Call Options: These options give the buyer the right to buy a currency at a specified price before a certain date.

-

Put Options: These options give the buyer the right to sell a currency at a specified price before a certain date.

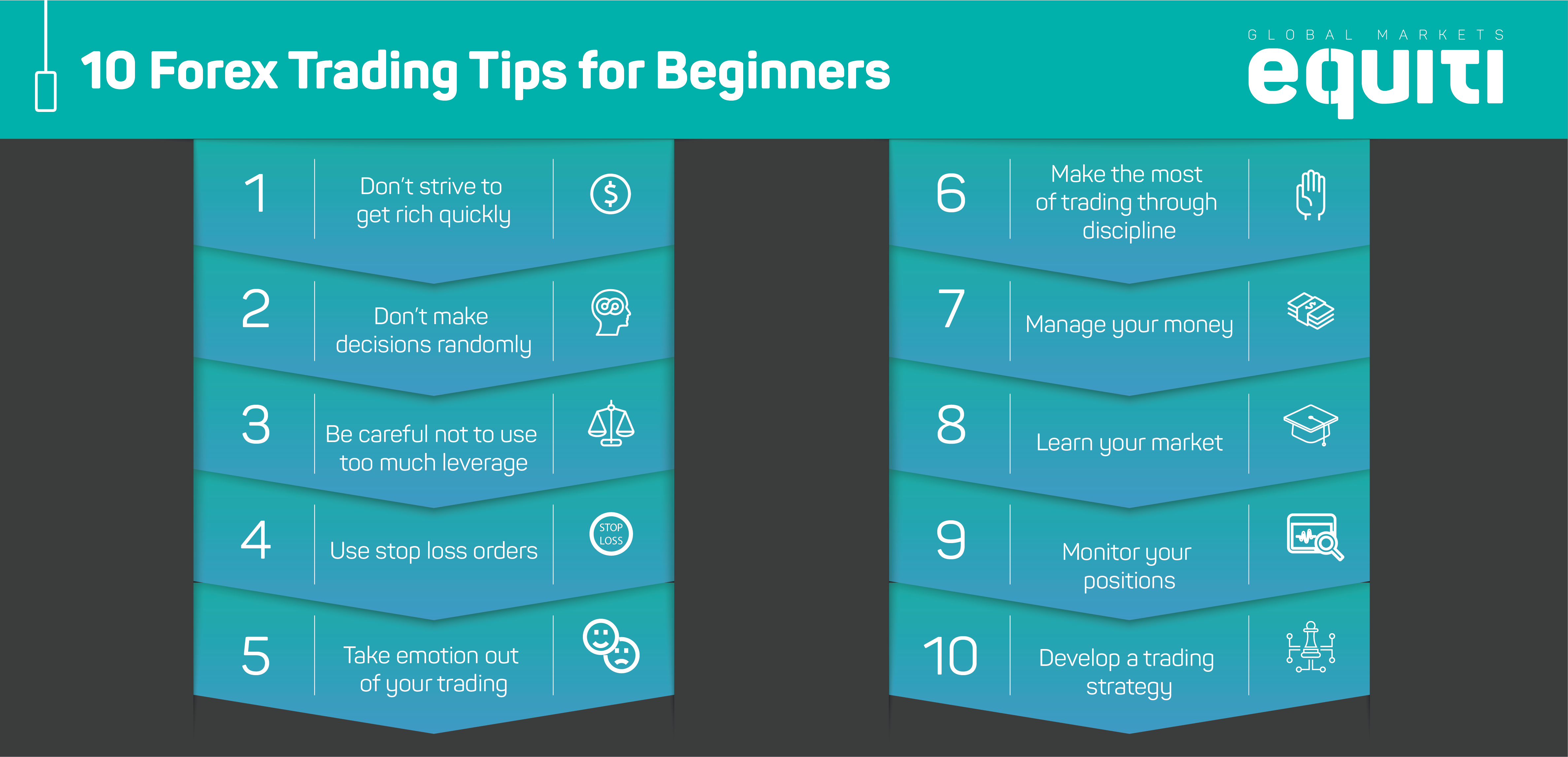

Image: flholoser.weebly.com

How to Trade Forex Options

Trading forex options involves a simple process:

-

Choose an underlying currency: Determine the currency pair you wish to trade.

-

Select an option type: Decide whether to buy a call or put option.

-

Set a strike price: This is the predefined price at which you can buy or sell the currency.

-

Select an expiration date: Determine the date at which your option contract expires.

-

Quote: Obtain a quote from a broker or trading platform.

-

Execute the trade: Complete the transaction with your broker.

Expert Insights on Trading Forex Options

-

“Forex options are not suitable for all traders. They require a high level of knowledge and an understanding of risk management techniques.” – John Carter, Trading Coach

-

“Options can be used to reduce drawdowns and create defined risk parameters in forex trading.” – Toni Turner, Certified Financial Analyst

-

“Traders should thoroughly research and understand option spreads and Greeks before utilizing them in their trading strategies.” – Adam Clarke, Market Analyst

Trading Forex Options Example

Image: www.equiti.com

Conclusion

Forex options empower traders with an expanded toolkit for navigating the currency markets. By understanding the ins and outs of this advanced trading strategy, you can enhance your risk management, tailor your positions to market conditions, and unlock new income-generating opportunities. Remember, successful forex options trading requires thorough research, a solid understanding of risk management, and ongoing market analysis. Embrace the power of options and embark on a journey toward informed and profitable currency trading.