Introduction

In the ever-evolving realm of global finance, currency futures trading has emerged as a sophisticated and lucrative avenue for investors and traders seeking to navigate the fluctuating currency markets. Currency futures are financial contracts that allow traders to buy or sell a specific currency at a predetermined price on a future date. By tapping into the currency futures market, traders can speculate on exchange rate movements, hedge against currency risks, or simply enhance their portfolio diversification.

Image: www.pinterest.com

Understanding Currency Futures Trading

A currency futures contract is an agreement to buy or sell a certain amount of a currency at a specified price on a specific future date. The buyer of the contract agrees to purchase the currency at the agreed-upon price, while the seller agrees to deliver the currency on the specified date. Currency futures contracts are traded on standardized exchanges, ensuring transparency and liquidity.

The value of a currency futures contract fluctuates based on the underlying spot price of the currency. When the spot price of a currency rises, the value of the corresponding currency futures contract also increases. Conversely, when the spot price falls, the value of the futures contract decreases.

Types of Currency Futures Contracts

There are various types of currency futures contracts available in the market, each representing a specific underlying currency. Some of the most commonly traded currency futures include:

• EUR/USD (Euro-US Dollar)

• USD/JPY (US Dollar-Japanese Yen)

• GBP/USD (British Pound-US Dollar)

• CHF/USD (Swiss Franc-US Dollar)

Benefits of Currency Futures Trading

Participating in currency futures trading offers numerous advantages for investors and traders:

• Leverage: Currency futures contracts provide leverage, allowing traders to control a larger position with a smaller amount of capital.

• Flexibility: Futures contracts provide flexibility in terms of contract size and expiration dates, giving traders the freedom to customize their positions.

• Risk Management: Currency futures can be used for hedging purposes, allowing traders to reduce their exposure to currency risks.

• Diversification: Adding currency futures to an investment portfolio can enhance diversification and spread risk across different asset classes.

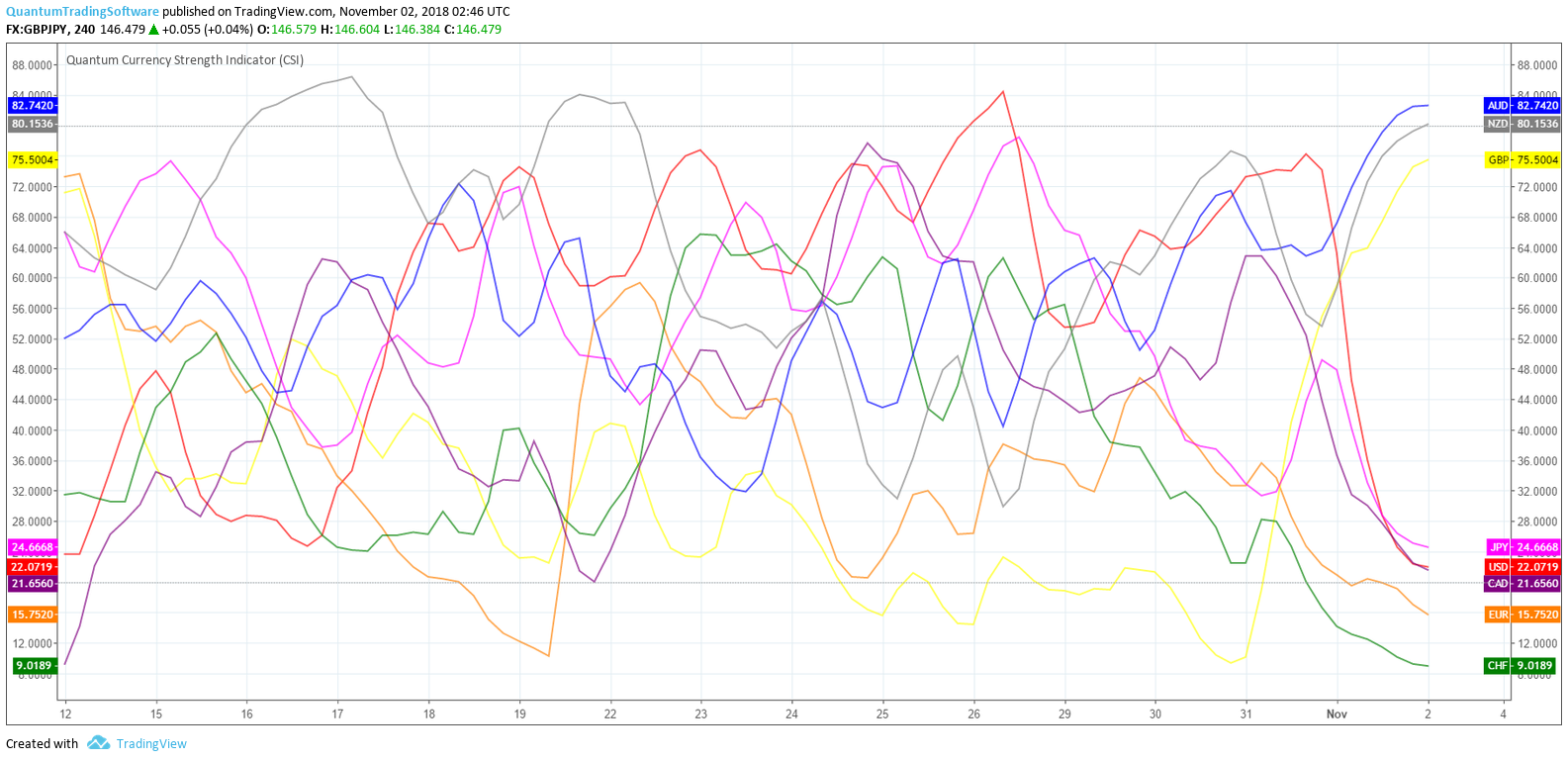

Image: tradingviewindicators.quantumtrading.com

Key Considerations for Currency Futures Trading

While currency futures trading offers significant opportunities, it is crucial to consider certain key factors before engaging in this market:

• Volatility: Currency markets can be highly volatile, leading to sudden and unpredictable price swings.

• Margin Requirements: Futures contracts require margin payments, which can tie up a portion of a trader’s capital.

• Counterparty Risk: When entering into a futures contract, it is important to consider the creditworthiness of the counterparty.

• Transaction Costs: Fees and commissions associated with currency futures trading should be accounted for to optimize profitability.

Latest Trends in Currency Futures Trading

The currency futures market is constantly evolving, with new trends and innovations emerging. Some of the current trends include:

• Technology Advancements: Automated trading platforms and algorithmic strategies are becoming increasingly prevalent in the currency futures market.

• Increased Global Interconnectivity: The globalization of economies and financial markets has led to heightened interdependence among currencies, creating more opportunities for currency futures trading.

• Volatility Driven Strategies: In recent years, strategies that exploit currency volatility have gained popularity.

• Convergence with Other Markets: Currency futures markets are increasingly interconnected with other financial markets, such as stock and bond markets.

Currency Futures Trading Options

Image: www.pinterest.com

Conclusion

Currency futures trading options offer a lucrative and sophisticated way to participate in the global financial markets. By understanding the fundamentals, navigating market dynamics, and managing risks effectively, investors and traders can unlock the potential of this dynamic market. Whether it is for portfolio diversification, hedging strategies, or speculative trading, currency futures provide a gateway to capitalize on the ever-fluctuating world of currencies. Embracing this intriguing arena can empower investors to enhance their financial prowess and navigate the complex global economy with greater confidence and success.