Imagine a world where you could potentially profit from the fluctuations of global currencies without having to own the actual currencies themselves. That’s the power of currency options trading. In this comprehensive guide, we will delve into the strategies that can empower you to navigate the dynamic currency markets effectively.

Image: hauntedeaston.com

Currency options trading involves the buying or selling of options contracts that give the holder the right, but not the obligation, to buy or sell a specified amount of a currency at a predetermined price on a future date. This flexibility allows traders to speculate on potential currency movements or hedge against foreign exchange risk.

To embark on this journey, let’s explore the foundational concepts. Currency options are typically traded in pairs, such as EUR/USD or GBP/JPY. The first currency in the pair is known as the base currency, while the second is the counter currency. The strike price is the exchange rate at which the option contract can be exercised.

There are two main types of currency options: calls and puts. Call options grant the holder the right to buy the base currency at the strike price, while put options give the holder the right to sell the base currency at the strike price. The expiration date determines the period during which the option contract is valid.

Numerous strategies can be employed in currency options trading. A common strategy is the Covered Call, where the trader owns the underlying currency and sells a call option at a higher strike price. This strategy aims to generate income by selling the option premium while capping the potential upside.

Another strategy is the Protective Put, which involves buying a put option against an owned currency position. This strategy provides a safety net against potential currency declines at the cost of the option premium.

For traders seeking higher potential returns, the Straddle involves buying both a call and a put option with the same strike price and expiration date. This strategy benefits from large currency movements in either direction.

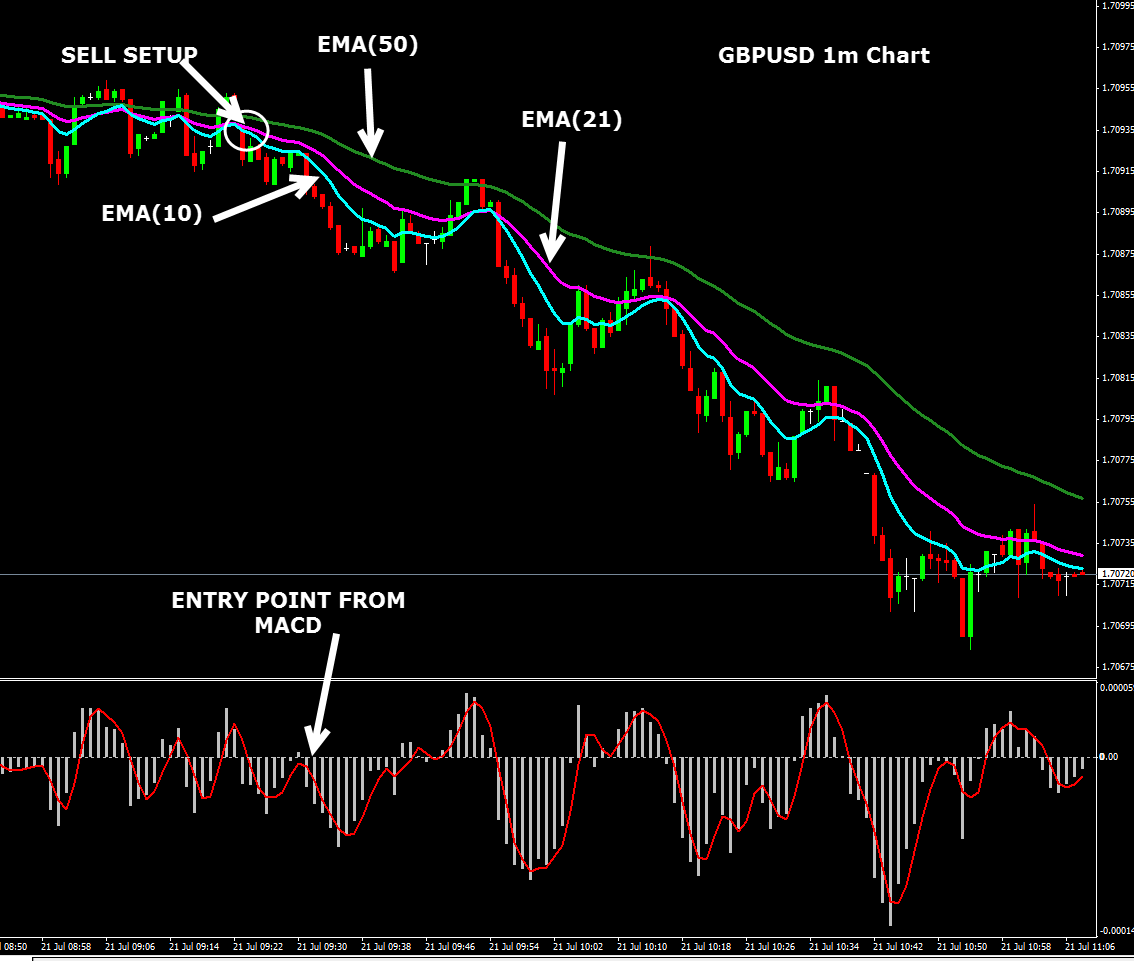

Technical analysis plays a crucial role in identifying trading opportunities in currency options. Indicators like moving averages, trendlines, and support and resistance levels can provide valuable insights into potential price movements.

To enhance your trading skills, consider seeking guidance from experienced traders or reputable online resources. Risk management is paramount in currency options trading. Always define your entry and exit points and manage your position size prudently.

In conclusion, currency options trading strategies offer a powerful tool for navigating the currency markets potentially profitably. By understanding the fundamentals, employing effective strategies, and managing risk appropriately, you can unlock the potential of this dynamic and rewarding financial instrument.

Image: marketinvestopedia.com

Currency Options Trading Strategies