I’ve always been fascinated by the world of finance, and specifically by the currency markets. There’s something about the ebb and flow of the markets that I find incredibly alluring, and I love trying to predict which way the currencies will move next.

Image: lorafincham.blogspot.com

Currency Option Trading

One of my favorite ways to trade currencies is through options. Options give me the right, but not the obligation, to buy or sell a currency at a specific price on a specific date. This gives me a lot of flexibility and allows me to profit from both rising and falling markets.

Currency option trading is a popular way to speculate on the foreign exchange market. It allows traders to take advantage of price fluctuations in currency pairs without having to take on the full risk of owning the underlying currency. Currency option trading is also a relatively low-cost way to trade the foreign exchange market, making it accessible to a wide range of traders.

Where is Most Currency Option Trading On?

Currency option trading is most commonly traded on over-the-counter (OTC) markets. OTC markets are decentralized marketplaces where buyers and sellers can trade directly with each other without the use of a central exchange. This allows for greater flexibility and customization of trades, but it also means that there is less regulation and transparency than on exchange-traded markets.

There are a number of different OTC markets for currency option trading. Some of the most popular include:

- The Chicago Mercantile Exchange (CME)

- The Intercontinental Exchange (ICE)

- The London International Financial Futures and Options Exchange (LIFFE)

- The Eurex

These exchanges offer a wide range of currency option contracts, and they provide a safe and reliable platform for trading.

Pros and Cons of Currency Option Trading

There are a number of advantages to trading currency options. Some of the most notable include:

- Flexibility: Currency option trading gives traders a lot of flexibility in how they trade. Traders can choose to buy or sell options, and they can choose the strike price and expiration date that best suits their trading strategy.

- Leverage: Currency option trading allows traders to use leverage, which means they can control a larger position with less capital. This can magnify profits, but it can also increase losses.

- Limited Risk: Currency option trading limits the risk of loss to the premium paid for the option.

There are also some disadvantages to trading currency options. Some of the most notable include:

- Complexity: Currency option trading can be complex, and it is important to understand the risks involved before trading.

- Time Decay: The value of currency options decays over time, which means that traders need to be careful about the expiration date of their options.

- Liquidity: Currency option trading can be less liquid than other types of trading, which can make it difficult to get in and out of positions quickly.

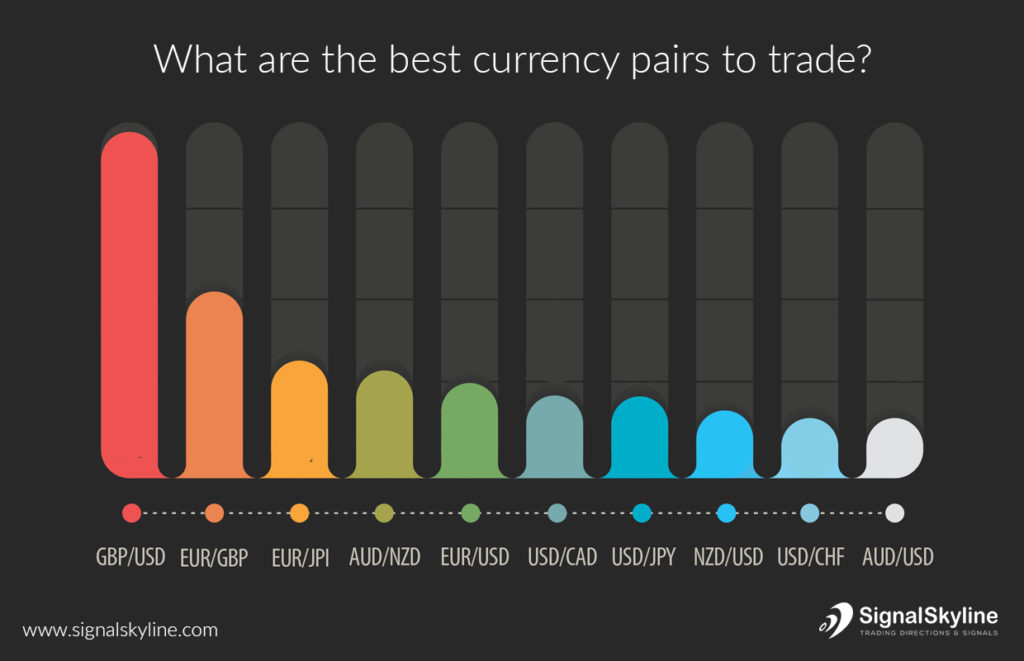

Image: www.signalskyline.com

Tips for Trading Currency Options

If you are considering trading currency options, there are a few things you should keep in mind:

- Do your research: It is important to understand the risks and rewards of currency option trading before you start trading.

- Start small: When you first start trading currency options, it is a good idea to start with a small position size.

- Use a stop-loss order: A stop-loss order can help to protect you from losses if the market moves against you.

- Manage your risk: It is important to manage your risk when trading currency options. This means setting a budget for your trading and sticking to it.

FAQ on Currency Option Trading

What are the different types of currency option contracts?

There are two main types of currency option contracts: calls and puts.

- Calls: A call option gives the holder the right to buy a currency at a specified price on or before a specified date.

- Puts: A put option gives the holder the right to sell a currency at a specified price on or before a specified date.

What is the strike price of a currency option?

The strike price of a currency option is the price at which the holder can buy or sell the currency.

What is the expiration date of a currency option?

The expiration date of a currency option is the date on which the option expires. If the option is not exercised before the expiration date, it will expire worthless.

Most Currency Option Trading Is On

Image: www.youtube.com

Are you interested in trading currency options?

If you are interested in trading currency options, there are a number of resources available to help you get started.

- The CME offers a number of educational resources on currency option trading, including webinars, videos, and articles.

- The ICE also offers a number of educational resources on currency option trading, including courses, tutorials, and webinars.

- There are a number of books and websites that can also help you learn about currency option trading.