The Essence of Wolfe Waves

Imagine a journey through a treacherous forest, where every step is fraught with uncertainty. But with a skilled guide like the Wolfe Wave Theory, you can navigate the complexities of the financial markets with confidence. Based on the pioneering work of Larry Pesavento, this elegant technique identifies recurring patterns in market behavior, revealing hidden opportunities and predicting price action with remarkable precision.

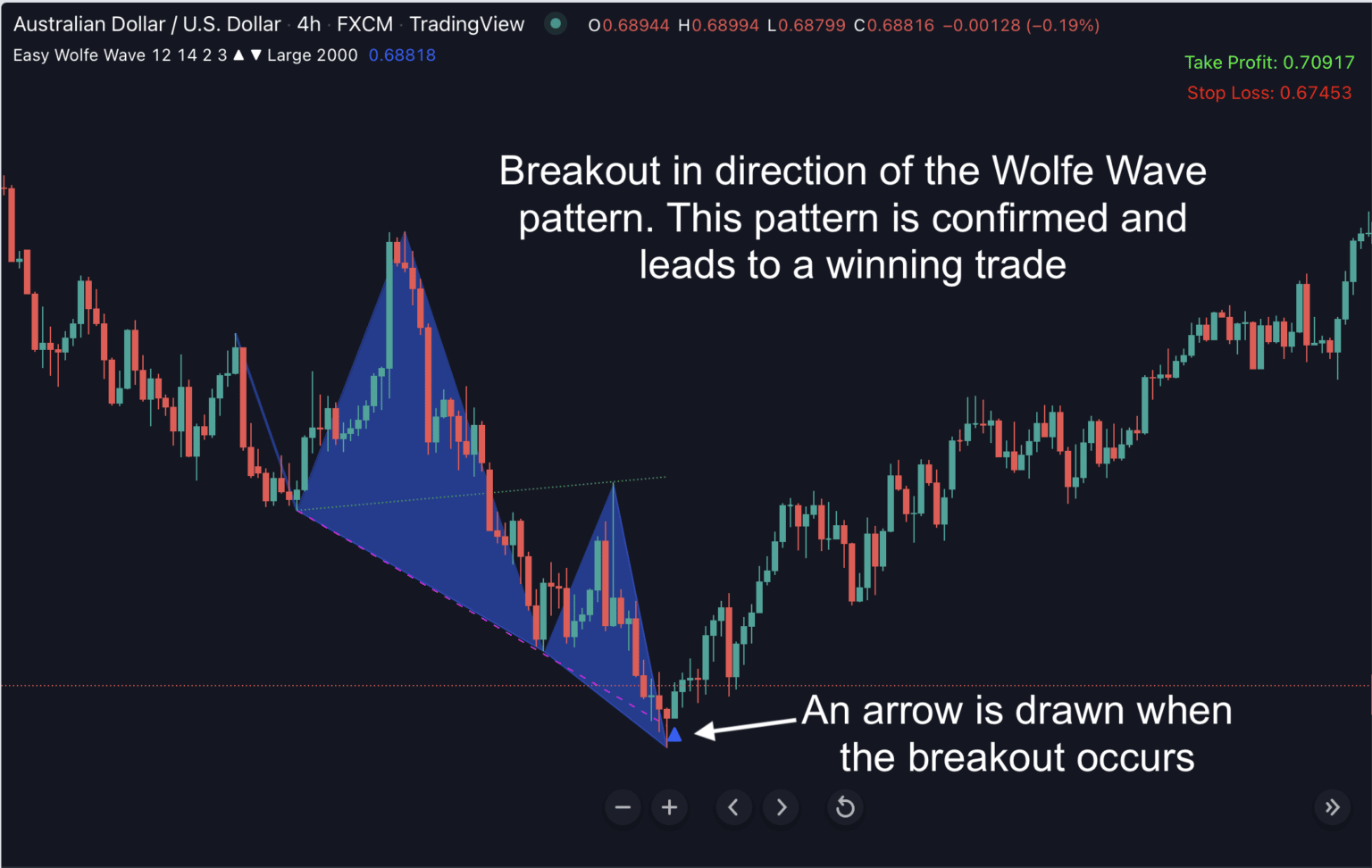

Image: indicatorvault.com

Unveiling the Wolfe Wave Patterns

The Wolfe Wave Theory recognizes five distinct wave patterns that form the building blocks of market movements. These waves are intertwined in specific ratios, forming a harmonious dance that signals imminent trend reversals or extensions.

• Wave 1: This wave marks the beginning of a new trend and serves as the foundation for the subsequent waves.

• Wave 2: A corrective wave that partially retraces Wave 1, creating a platform for the next move.

• Wave 3: The strongest and most impulsive wave, propelling the trend forward with significant momentum.

• Wave 4: A corrective wave that provides a second period of consolidation before the final push.

• Wave 5: The completion of the pattern, mirroring Wave 1 and extending the trend.

Trading with Wolfe Waves

Mastering the Wolfe Wave Theory empowers traders with a powerful arsenal of trading strategies. By identifying these patterns on price charts, traders can anticipate price movements, set precise entry and exit points, and maximize their profits. Key trading strategies include:

• Trend Following: Identifying Wolfe Wave trends and riding them for extended gains.

• Contrarian Trading: Spotting Wolfe Wave reversal patterns and capitalizing on impending trend shifts.

• Range Trading: Using Wolfe Wave patterns to define trading ranges and target breakout plays.

The Power of Wolfe Waves in Options Trading

Options traders, in particular, benefit from the precise timing and directionality provided by Wolfe Waves. By applying this technique to options chains, traders can:

• Maximize Premiums: Trade options contracts expiring close to Wolfe Wave turning points, capturing substantial premiums.

• Define Risk-Reward: Use the Wolfe Wave patterns to establish well-defined risk-reward ratios for options trades.

• Enhance Probability: Combine Wolfe Waves with other technical indicators to increase the probability of successful options trades.

Image: forexkingea1.blogspot.com

Expert Tips and Advice

• Study with Discipline: Dedicate time to understanding the Wolfe Wave Theory thoroughly, studying the principles and practicing pattern identification.

• Use Multiple Time Frames: Analyze charts over different time frames to capture Wolfe Wave patterns at various scales.

• Confirm with Other Indicators: Combine Wolfe Waves with other technical analysis tools, such as moving averages or oscillators, to validate trading signals.

FAQs

1. What is the significance of the 1.618 ratio in Wolfe Waves?

Answer: The 1.618 ratio (the Golden Ratio) plays a crucial role in Wolfe Wave patterns, appearing in the proportions between waves and wave lengths.

2. How do I identify the “Point of Control” in a Wolfe Wave pattern?

Answer: The “Point of Control” refers to the highest point in an uptrend or the lowest point in a downtrend. It signifies potential trend termination or reversal.

Wolfe Wave Trading Options

Image: www.insidefutures.com

Conclusion

Wolfe Wave trading options is a transformative technique that unleashes the power of pattern recognition in the financial markets. By mastering the art of Wolfe Waves, traders gain a profound understanding of market behavior, enabling them to navigate the treacherous waters of trading with confidence and profitability.

Are you ready to embark on this captivating journey?