When it comes to navigating the turbulent waters of financial markets, every trader seeks an edge, a guiding light to illuminate their path towards profitability. Among the many trading strategies, Elliott Wave Options Trading stands out as a beacon of hope, providing traders with a time-tested framework for understanding market movements and profiting from price fluctuations.

Image: danericselliottwaves.blogspot.com

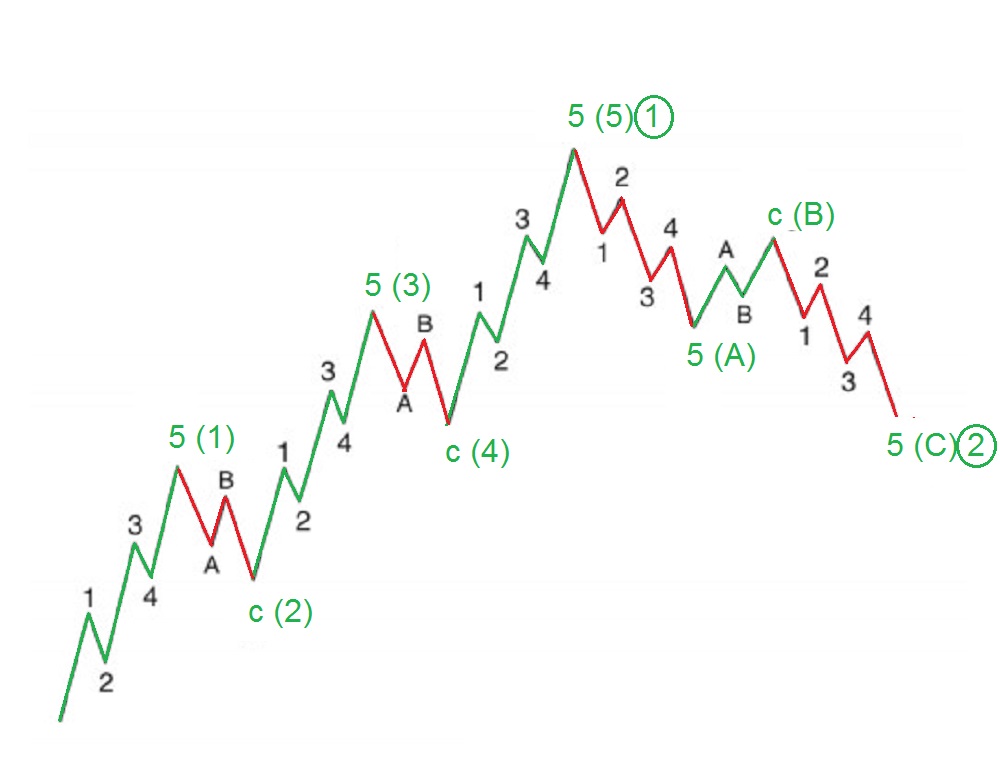

Elliott Wave Theory, developed by Ralph Nelson Elliott in the 1930s, is founded on the premise that financial markets move in predictable patterns known as waves. These waves occur in a specific sequence and can be classified into two main categories: motive and corrective waves. Motive waves propel the market higher, while corrective waves retrace a portion of the preceding gain.

Embracing Elliott Wave Options Trading

Options, derivative instruments that grant traders the right but not the obligation to buy or sell an underlying asset at a predetermined price, offer traders a powerful tool for implementing Elliott Wave strategies. Options trading allows traders to take positions aligned with their Elliott Wave analysis, capitalizing on the potential for substantial returns.

Identifying Market Opportunities

The key to successful Elliott Wave Options Trading lies in accurately identifying wave sequences and anticipating the direction of the market. Traders can utilize a range of technical indicators, such as moving averages, Bollinger Bands, and Fibonacci retracements, to confirm wave patterns and support their trading decisions.

Unlocking the Power of Wave Extensions

Understanding wave extensions is crucial for navigating the complexities of market cycles. When a motive wave extends beyond its typical length, it often indicates the presence of strong market momentum. Traders can capitalize on this by extending their positions in the direction of the trend, maximizing their profit potential.

Hedging Risks with Corrective Waves

Corrective waves provide traders with opportunities to protect their gains and manage risk. By identifying corrective wave sequences, traders can hedge their positions using options strategies such as straddles or strangles. This shields them from potential market reversals while allowing them to maintain exposure to future market movements.

Case Study: The USD/JPY Trade

Consider a hypothetical example of trading the USD/JPY currency pair. A trader, utilizing Elliott Wave analysis, identifies a wave 5 extension in progress, indicating a potential rally. They enter a long call option with a strike price above the current market value, betting on the continuation of the uptrend.

Guiding Principles of Success

As with any trading strategy, managing risk and maintaining discipline are paramount in Elliott Wave Options Trading. Traders should always use stop-loss orders to protect their capital and adhere to a sound money management plan. Additionally, ongoing education and a deep understanding of market dynamics are essential for long-term success.

Conclusion: Charting a Course to Trading Success

Elliott Wave Options Trading empowers traders with a proven framework for market analysis and trade execution. By embracing the principles of Elliott Wave Theory and the power of options, traders can make informed decisions, hedge risks, and unlock the full potential of financial markets. While mastering this strategy requires a blend of technical proficiency and unwavering discipline, the rewards for those who persevere can be substantial.

As you venture into the realm of Elliott Wave Options Trading, remember this mantra: “Discipline is the bridge between goals and accomplishment.” By adhering to these principles and refining your trading skills, you can transform financial trading from a daunting enigma into a rewarding and empowering experience.

Image: www.money.it

Elliott Wave Options Trading

Image: mungfali.com