Options trading can be a lucrative endeavor if you have the right strategies and knowledge. Among the most crucial skills you need to master is the ability to calculate probability effectively. In this article, we’ll take a deep dive into the world of probability in options trading, equipping you with the knowledge and tools you need to make informed decisions and maximize your chances of success.

Image: www.jpcashflow.com

Understanding Probability in Options Trading

In its essence, probability in options trading refers to the likelihood of an event occurring. Options traders use probability to assess the chances of an underlying asset, such as a stock or currency, moving in a favorable direction within a given time frame. By understanding the probability of certain scenarios, traders can make calculated decisions about which options to buy or sell.

Methods for Calculating Probability

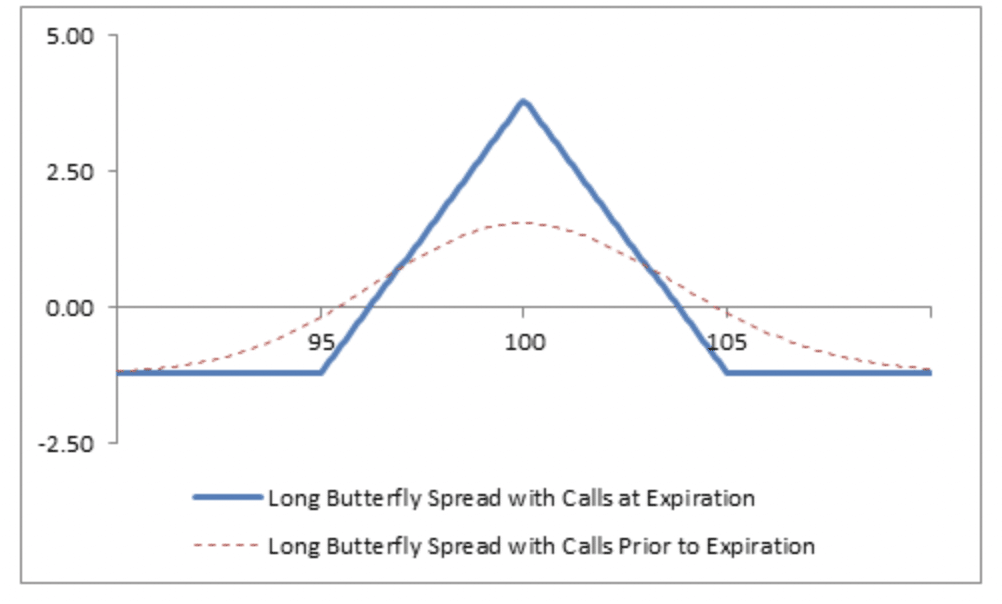

There are various methods for calculating probability in options trading, each with its own advantages and disadvantages. Here are some common techniques:

- Historical Volatility: This method uses past price data to determine the likelihood of an asset’s future price movements. Higher historical volatility indicates a greater probability of large price fluctuations.

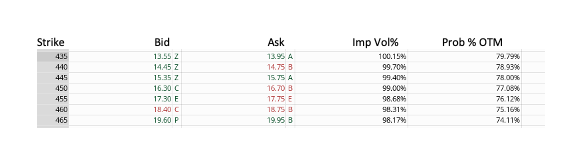

- Implied Volatility: Implied volatility, derived from options prices, reflects market expectations about the future volatility of an underlying asset. The higher the implied volatility, the greater the perceived likelihood of significant price changes.

- Monte Carlo Simulations: Using advanced computer models, this method randomly generates scenarios based on historical data to simulate possible future asset prices and their corresponding probabilities.

Factors Affecting Probability

In addition to the methods mentioned above, several factors can impact the probability of an asset’s price movement:

- News and Events: Significant news or events can have a dramatic impact on the price of an underlying asset.

- Technical Analysis: Analyzing past price patterns and trends can provide insights into the likelihood of future movements.

- Market Sentiment: The overall sentiment of market participants, whether optimistic or pessimistic, can influence the direction of an asset’s price.

Image: www.wikihow.com

Expert Insights and Tips

Seasoned options traders emphasize the importance of understanding probability and managing risk effectively. Here are some tips from the experts:

- Quantify Your Expectations: Use probability calculations to determine the range of potential outcomes and set realistic targets for your trades.

- Use Stop-Loss Orders: Protect your capital by placing stop-loss orders that automatically close positions if the asset’s price moves against you.

- Diversify Your Portfolio: Spread your risk by trading multiple options with varying maturities and strike prices.

How To Calculate Probability In Options Trading

Image: investcrown.com

Conclusion

Mastering the art of calculating probability is essential for success in options trading. By employing the methods and tips outlined in this article, you can develop a solid understanding of the factors that influence asset price movements and make informed decisions to maximize your chances of achieving your financial goals. Remember, the ultimate key to success in options trading is proper risk management and a disciplined approach to trading.