Chapter 1: Introduction and Overview

The world of financial markets can be alluring and daunting in equal measure. As an avid trader, I’ve had my fair share of ups and downs, but one strategy that has consistently yielded me impressive gains is options buying. Remember that memorable trade where I turned a modest investment into a sizeable profit? That’s the beauty of options buying – the potential for exponential returns.

Image: www.pinterest.com

In this comprehensive guide, we’ll embark on a journey into the realm of options buying trading strategies. We’ll delve into the fundamentals, explore the latest trends, and uncover expert advice to empower you with the knowledge and skills to navigate the options market confidently.

Chapter 2: The Basics of Options Buying

Options, simply put, are financial instruments that grant you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price, known as the strike price, on or before a specified date. When you buy an option, you’re essentially wagering on the future price movement of the underlying asset.

Options trading offers a diverse range of strategies, each tailored to specific market conditions and risk appetites. Whether you’re aiming to hedge against potential losses, enhance portfolio returns, or speculate on market volatility, options buying presents a myriad of opportunities.

Chapter 3: Types of Option Buying Strategies

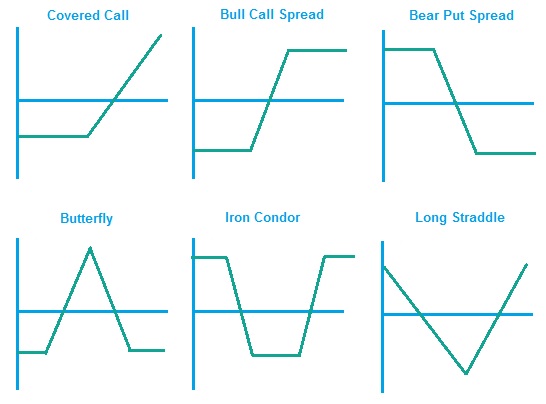

The options market is a vibrant tapestry of strategies, each with its own distinct characteristics and risk-reward profile. Let’s explore three widely employed option buying strategies:

- Bull Call Options: A bullish bet that the underlying asset will rise in price, allowing you to profit from upward market movements.

- Bear Put Options: A bearish wager that the underlying asset will decline in value, enabling you to capitalize on downward market trends.

- Covered Calls: A strategy that involves selling a call option while simultaneously owning the underlying asset. This approach generates income from premiums while potentially limiting potential profits.

Chapter 4: Risk Management in Options Buying

While options buying offers immense potential rewards, it’s imperative to tread carefully and manage risk effectively. Here are some crucial risk management guidelines:

- Thorough Research: Before venturing into options trading, conduct thorough research on the underlying asset, market conditions, and the specific option strategy you intend to employ.

- Understand Greeks: The Greeks – a set of metrics that quantify option risk and sensitivity to underlying asset price movements, volatility, and time decay – are invaluable tools for risk assessment.

- Position Sizing: Allocate only a portion of your portfolio to options trading and carefully determine the appropriate position size for each trade.

Image: content.stocktrak.com

Chapter 5: Expert Advice for Options Buying Success

Drawing upon the wisdom of seasoned traders, here are some invaluable pieces of expert advice to enhance your options buying strategy:

- Trade the Trend: Align your options trades with the prevailing market trend. Don’t attempt to fight the trend as it increases the risk of losses.

- Control Emotions: Discipline and emotional control are paramount in options trading. Avoid making impulsive or fear-based decisions that could derail your strategy.

Chapter 6: Frequently Asked Questions about Option Buying

- What is the difference between call and put options?

Call options give you the right to buy an asset, while put options grant you the right to sell. - How much capital is required to trade options?

The capital required varies depending on the option strategy, underlying asset, and position size. - Can I lose more than my initial investment in options buying?

Yes, you can lose more than your initial investment in some options strategies, such as naked options.

Option Buying Trading Strategies

https://youtube.com/watch?v=Cq0WzdTxQlc

Conclusion: The Path to Profitability in Options Buying

Mastering options buying trading strategies is an ongoing endeavor that requires patience, discipline, and a commitment to continuous learning. This guide has laid the foundation for your options trading journey. Remember, success in this demanding yet rewarding market stems from a combination of knowledge, experience, and unwavering risk management. Embrace the challenges, trade wisely, and unlock the potential of options buying to elevate your financial prowess.

Are you ready to delve deeper into the captivating world of options buying? Explore our comprehensive knowledge base, engage with our vibrant community of traders, and embark on the path to options trading success. The journey begins now.