Introduction: Embracing the Thrill of Options Trading

In the captivating world of finance, options trading stands out as an exciting and potentially lucrative endeavor. As the stock market continues to captivate investors, platforms like Webull have emerged as accessible gateways into this enthralling realm. In this comprehensive guide, we delve into the intricacies of option trading on Webull, empowering you with the knowledge and tools to navigate these dynamic markets.

Image: millennialmoneyman.com

Embarking on this journey, we mustn’t overlook the inherent risks associated with options trading. It’s imperative to approach this arena with caution, armed with a solid understanding of the underlying concepts and potential pitfalls. With a clear grasp of the fundamentals, we can unlock the doors to this thrilling investment frontier.

Understanding the Basics of Webull Option Trading

Webull, an established fintech platform, offers a user-friendly interface for options trading, catering to both experienced traders and those just starting their adventure. To delve into this realm, it’s crucial to comprehend the basics of options:

- Options: Contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a set date.

- Call Options: Bestow upon the buyer the right to purchase an underlying asset at the specified “strike price.” When the asset’s market value exceeds this strike price, the call option gains value.

- Put Options: Grant the buyer the right to sell an underlying asset at the specified “strike price.” These options become valuable when the market value of the asset falls below the strike price.

Navigating the Webull Option Trading Platform

Once you have a grasp of the underlying concepts, it’s time to navigate the Webull platform. Its intuitive design makes it simple to place trades:

- Identify the underlying asset: Enter the ticker symbol of the stock, ETF, or index you wish to trade options on.

- Choose the expiration date: Select the date on which the option contract expires.

- Determine the strike price: Specify the price at which you have the right to buy (call) or sell (put) the underlying asset.

- Review the premium: The price you pay to purchase the option contract is known as the premium.

- Execute the trade: Once satisfied with the details, confirm your order, and the platform will execute the trade.

Tips and Expert Advice for Webull Option Trading Success

To enhance your chances of success in Webull option trading, seasoned traders recommend the following:

- Start small: Begin with modest trades to minimize potential losses and gain experience.

- Educate yourself: Continuously expand your knowledge through books, online courses, and forums.

- Manage risk: Utilize stop-loss orders to mitigate potential losses.

- Monitor the markets: Stay abreast of economic events and market trends.

- Use technical analysis: Study price charts and patterns to identify trading opportunities.

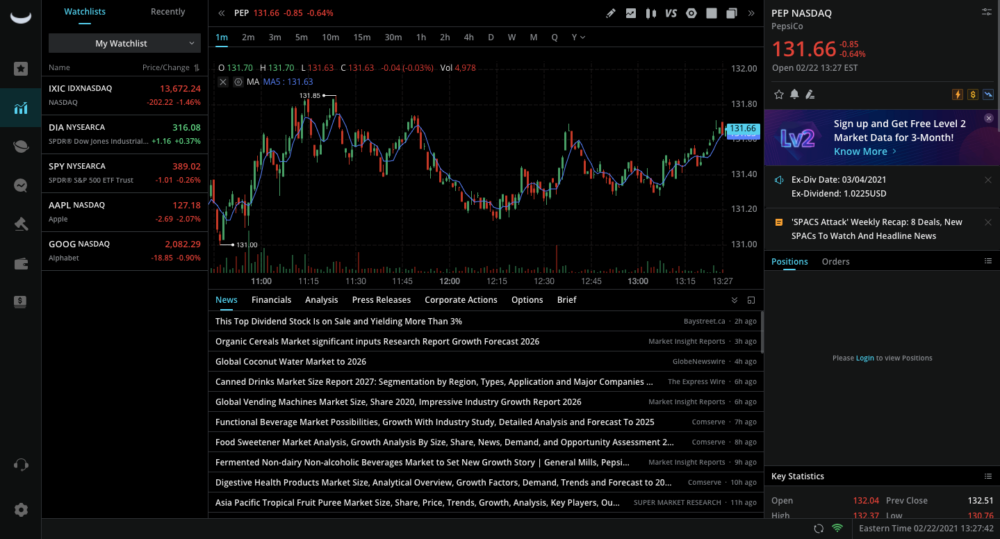

Image: www.webull.com

Elaborating on the Key Tips for Option Trading

Embracing the above tips will significantly enhance your odds of success. Starting small safeguards against overextending oneself financially, allowing you to learn from experience. Continuous education empowers you to make informed decisions. Employing stop-loss orders acts as a protective measure, limiting potential losses. Monitoring the markets keeps you attuned to external factors that may influence option prices. Incorporating technical analysis sharpens your ability to identify and capitalize on trading opportunities.

Frequently Asked Questions (FAQs) on Webull Option Trading

For those just starting their Webull options trading journey, the following FAQs provide clear and concise answers to common questions:

Q: What is the minimum balance required to trade options on Webull?

A: The minimum balance may vary depending on your account type and trading activity. It’s advisable to contact Webull for the most up-to-date information.Q: Are there any fees associated with option trading on Webull?

A: Yes, there are fees involved in option trading, including the premium you pay to purchase the contract and commissions for executing the trade. Webull’s fee schedule provides detailed information on these costs.Q: Can I sell options that I have purchased?

A: Yes, you can sell options that you have bought back to the market before their expiration date. This strategy is commonly employed to close out a position or adjust your risk exposure.Q: How are option prices determined?

A: Option prices are influenced by various factors, including the underlying asset’s price, time to expiration, volatility, and market sentiment.

Option Trading On Webull

Conclusion: Unlock the Potential of Webull Option Trading

Venturing into the world of option trading on Webull opens a gateway to potential profits and the exhilaration of navigating financial markets. By embracing the knowledge, tips, and advice outlined in this comprehensive guide, you can confidently embark on this thrilling journey. As you delve deeper into the intricacies of options trading, remember to proceed with caution, manage your risk judiciously, and continuously expand your understanding. The world of options awaits your exploration – are you ready to seize the opportunity?