Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has gained immense popularity among traders and investors alike. ETH options trading has emerged as a compelling strategy for capitalizing on the price fluctuations of Ethereum, offering potential advantages beyond traditional spot trading.

Image: bitcoinexchangeguide.com

Introducing ETH Options Trading

Options contracts provide traders with the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) on or before a predetermined date (expiration date). In the context of ETH options trading, the underlying asset is Ethereum (ETH).

By purchasing an ETH call option, a trader is essentially betting that the price of Ethereum will rise above the strike price before the expiration date. On the other hand, purchasing an ETH put option implies a belief that the price of Ethereum will fall below the strike price. The premium paid for the option represents the cost of acquiring this right.

Advantages of ETH Options Trading

ETH options trading offers several benefits compared to spot trading, including:

- Leverage: Options provide traders with the potential to leverage their capital by controlling a larger amount of ETH than they could afford to purchase outright.

- Hedging: Options can be used to hedge against market risk by allowing traders to lock in a favorable price.

- Income generation: Selling (writing) options premiums can generate income if the underlying asset’s price does not move significantly.

Types of ETH Options

ETH options are classified into two main types:

- Call options: Give the buyer the right to purchase ETH at a predetermined price.

- Put options: Give the buyer the right to sell ETH at a predetermined price.

Image: bitcoinexchangeguide.com

Understanding Option Greeks

Option Greeks are mathematical measures that quantify the risk and sensitivity of options contracts:

- Delta: Measures the change in option price relative to a change in the underlying asset’s price.

- Gamma: Measures the sensitivity of delta to changes in the underlying asset’s price.

- Theta: Measures the decay in option value as the expiration date approaches.

- Vega: Measures the sensitivity of option value to changes in implied volatility.

ETH Options Trading Platforms

Numerous cryptocurrency exchanges in the US market offer ETH options trading platforms, including:

- Coinbase

- Binance

- Kraken

Strategies for ETH Options Trading

Successful ETH options trading involves implementing effective strategies that align with market conditions and risk tolerance:

- Covered call: Sell a call option against ETH that you own to generate income.

- Protective put: Buy a put option to protect against a potential decline in ETH’s price.

- Iron condor: A combination strategy that simultaneously sells out-of-the-money call and put options and buys even further out-of-the-money options of the opposite type.

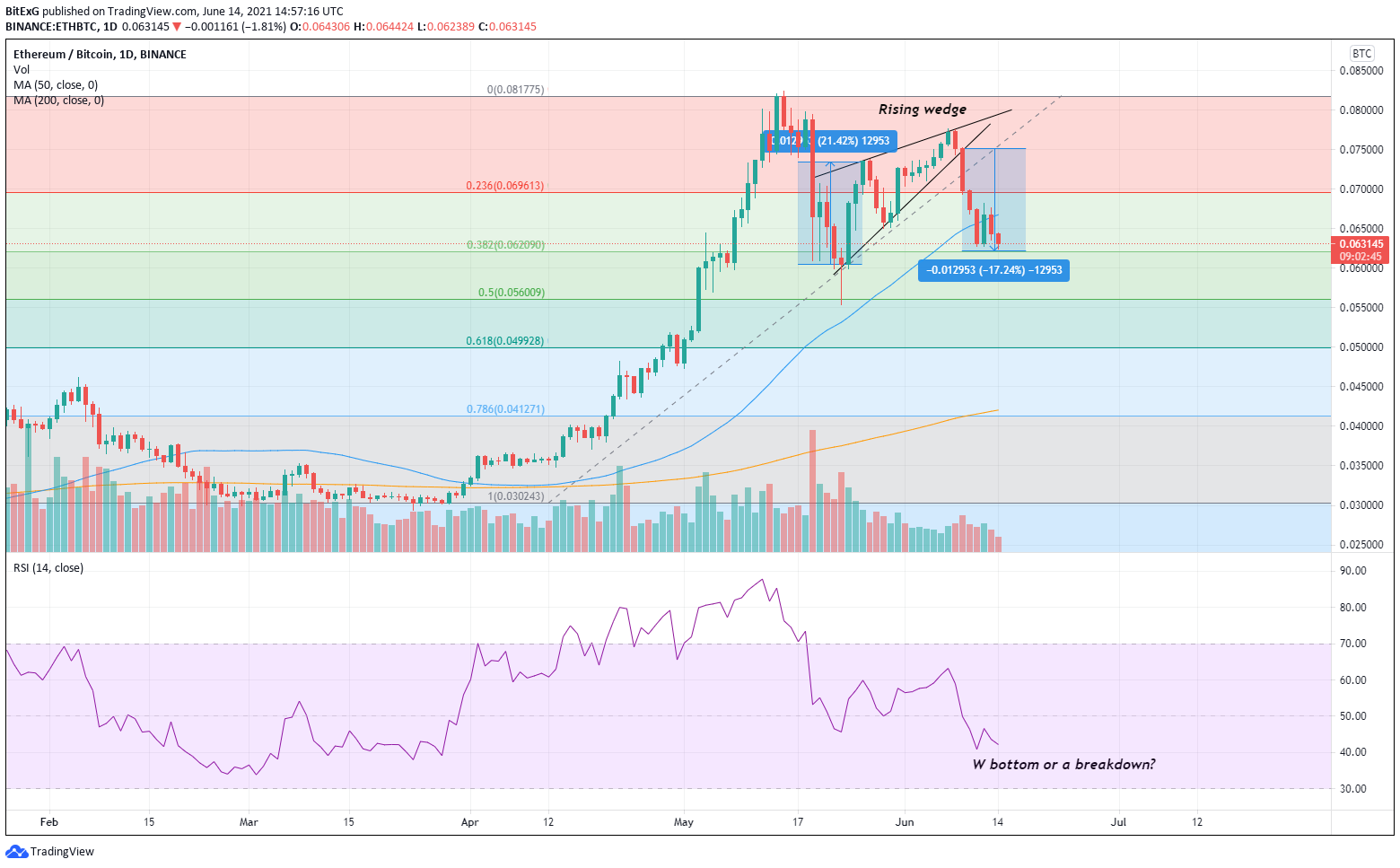

Eth Options Trading Usa

Image: www.tradingview.com

Conclusion

ETH options trading has become an indispensable tool for traders seeking to enhance returns and manage risk in the Ethereum market. By understanding the fundamentals of options trading, including the different types, option Greeks, and trading strategies, traders can harness the potential of ETH options to unlock new opportunities. As the Ethereum ecosystem continues to evolve, ETH options trading is expected to remain a dynamic and rewarding avenue for savvy investors.