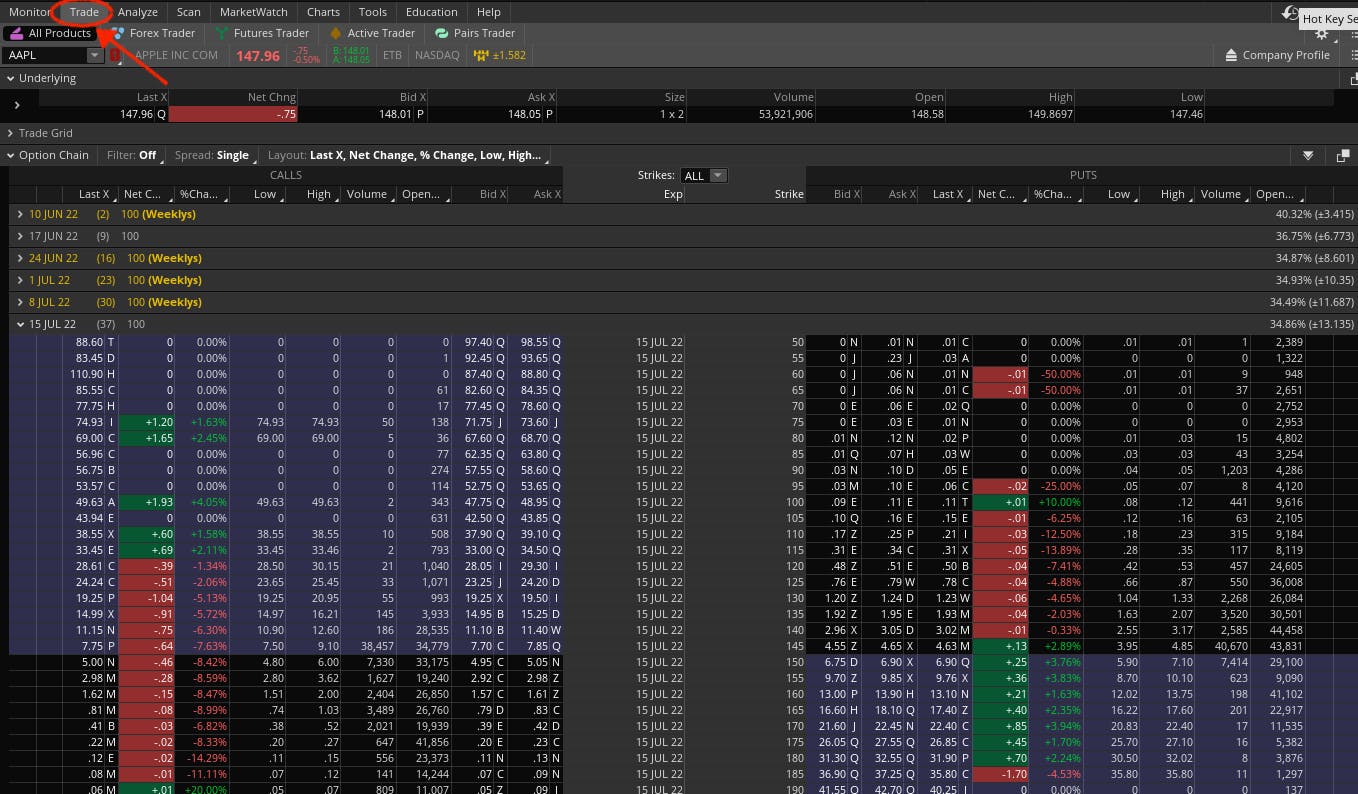

Thinkorswim, a popular trading platform, provides various tools and resources to enhance options trading strategies for savvy investors. However, navigating the complexities of options trading can be daunting, and understanding the fee structure plays a crucial role in maximizing profitability. This thorough guide delves into the intricate details of Thinkorswim options trading fees, empowering you with the knowledge to optimize your trading efficiency and avoid costly surprises.

Image: www.ivtrades.com

Deciphering the Fee Structure: Breaking Down Every Layer

Thinkorswim’s fee structure is meticulously designed to accommodate a wide range of trading activities. Understanding the different fee components and their impact on your trades is paramount. Here’s a breakdown of the essential elements:

Base Commissions: The Core Expense

Base commissions form the primary fee charged by Thinkorswim. Traders incur this fee with each options contract they execute, regardless of the contract’s size or underlying asset. The base commission varies based on the contract type (options on stocks, indices, futures, etc.) and the number of contracts traded.

Regulatory Fees and Exchange Fees: Ensuring Compliance and Market Access

Regulatory fees are imposed by regulatory bodies to ensure market stability and adherence to industry standards. Exchange fees are charged by the exchanges where options contracts are traded. Both these fees are typically passed on to the trader and vary depending on the contract specifications and the exchange used.

Image: bullishbears.com

Exercise and Assignment Fees: Managing Contract Execution

Exercise and assignment fees come into play when options contracts are exercised (purchasing the underlying asset for options to buy) or assigned (selling the underlying asset for options to sell). Thinkorswim charges a nominal fee for these actions, which compensates the platform for facilitating the contract execution process.

Account Maintenance Fees: Preserving Trading Capabilities

Thinkorswim offers a tiered account structure, with different account types incurring varying maintenance fees. These fees cover the costs associated with maintaining account operations, providing access to trading tools, and ensuring customer support.

Fees in Practice: Real-World Scenarios and Considerations

The impact of Thinkorswim options trading fees can vary significantly depending on the frequency and size of your trades. Here are some scenarios that illustrate the fee implications:

Low-Volume Trader: Minimizing Fees for Occasional Trades

For occasional traders with a low volume of options contracts, base commissions and regulatory fees can be relatively modest. However, it’s crucial to consider the overall fee structure, including potential exercise and assignment fees, to estimate the total cost of trading.

High-Volume Trader: Exploring Fee Discounts and Negotiating Options

High-volume traders can potentially qualify for discounted commission rates through Thinkorswim’s volume-based pricing program. Additionally, negotiating directly with Thinkorswim may yield further fee reductions, particularly for substantial trading volumes.

Complex Options Strategies: Navigating Tiered Fee Structures

Complex options strategies often involve multiple legs and contract types. Understanding the tiered commission structure for these strategies is crucial to avoid unexpected costs. Carefully assessing the fee implications before executing such strategies is highly recommended.

Optimizing Fee Management: Strategies for Savvy Traders

Minimizing fees is a key consideration for maximizing profitability in options trading. Here are some strategies to streamline costs:

Consolidating Trades: Reducing Base Commissions

When executing multiple options trades simultaneously, consider consolidating them into a single order. This approach can significantly reduce base commissions compared to placing multiple individual orders.

Selecting Efficient Contract Types: Exploring Reduced-Fee Options

Certain contract types, such as multi-leg options or index options, may offer reduced commission rates. Exploring these options can lead to substantial savings over time.

Negotiating with Thinkorswim: Leveraging Volume and Loyalty

High-volume traders can negotiate with Thinkorswim to secure discounted commission rates. Additionally, long-standing customers may be eligible for loyalty discounts or personalized fee structures.

Exploring Alternative Platforms: Comparing Fee Structures

Comparing fee structures across different trading platforms can reveal more cost-effective options. While Thinkorswim offers comprehensive trading capabilities, other platforms may specialize in specific market segments or provide more competitive fee structures for certain types of trades.

Think Or Swim Options Trading Fees

Image: tickertape.tdameritrade.com

Conclusion: Empowering Options Traders with Fee Knowledge

Understanding Thinkorswim options trading fees is a crucial step towards successful trading. By carefully navigating the fee structure, traders can minimize costs, optimize profitability, and make informed trading decisions. Whether you are a low-volume trader or a seasoned high-volume strategist, a comprehensive understanding of these fees empowers you to maximize your trading potential while reducing unnecessary expenses. Remember, the time invested in studying fees is an investment in the long-term success of your options trading endeavors.