As I meticulously scanned the price charts, my heart pounding with anticipation, I realized the exhilarating potential of options day trading. Armed with the insights gleaned from countless hours on Thinkorswim, I was ready to navigate the choppy waters of the market.

Image: www.youtube.com

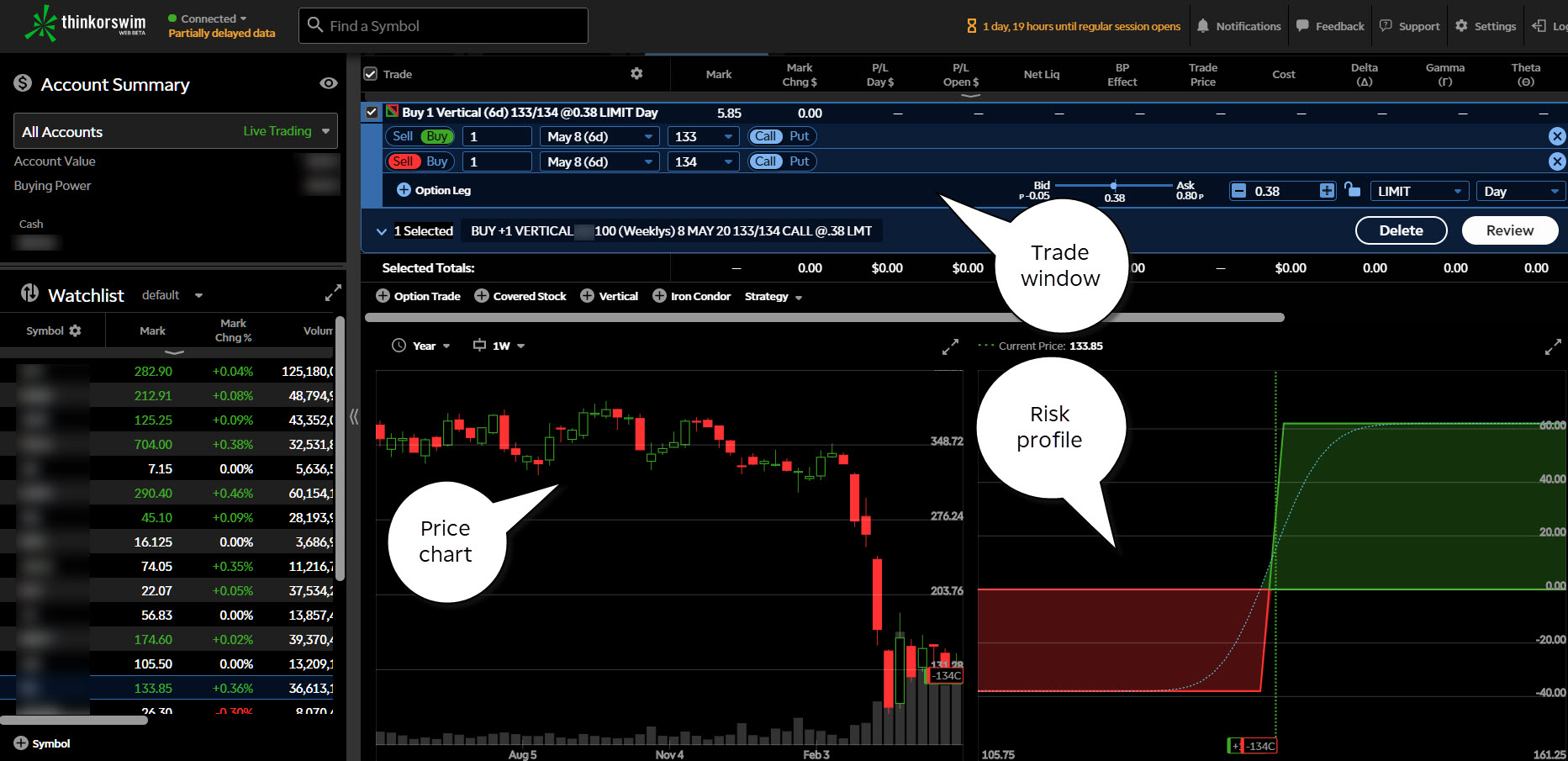

Navigating Thinkorswim’s Intuitive Platform

Thinkorswim, a sophisticated trading platform renowned for its power and flexibility, has become an indispensable tool for options day traders. Its user-friendly interface and advanced features offer a seamless trading experience. With intuitive charting tools, lightning-fast trade execution, and sophisticated risk management capabilities, Thinkorswim empowers traders to maximize their potential.

Understanding Options and Their Role in Day Trading

Options are versatile financial instruments that grant traders the right, but not the obligation, to buy or sell an underlying asset at a specified price. Day traders utilize options to capitalize on short-term price fluctuations in the underlying asset without taking on ownership. This unique characteristic makes options an attractive vehicle for strategic trading strategies.

Day trading options involves making multiple trades throughout the day, aiming to profit from small price movements. By leveraging the leverage provided by options, traders can amplify gains while carefully managing their risk.

Day Trading Strategies with Thinkorswim

Thinkorswim offers an array of options day trading strategies to suit diverse trading styles. From simple direction trading to advanced spread trading, the platform provides tools and strategies tailored to capture market opportunities. Popular strategies include:

- Scalping: Exploiting minute price movements within a trading day.

- Range Trading: Capitalizing on price fluctuations within a defined range.

- Iron Condor: Neutral strategy to profit from low volatility.

Image: www.kingdavidsuite.com

Tips and Expert Advice for Options Day Trading Success

Mastering options day trading with Thinkorswim requires a combination of knowledge, strategy, and disciplined execution. Here are some invaluable tips:

- Know Your Options: Gain a thorough understanding of option contracts, including their structure, pricing, and risks.

- Develop a Trading Strategy: Define specific rules and parameters for entering, exiting, and managing trades.

- Use Technical Analysis: Employ charting tools and indicators to identify potential trading opportunities.

- Manage Your Risk: Implement risk management techniques such as proper position sizing and stop orders.

Frequently Asked Questions

Q: Is day trading options profitable?

A: While it offers the potential for high returns, day trading options is also a high-risk endeavor. Profitability depends on a combination of factors, including knowledge, skill, and disciplined execution.

Q: What are the advantages of using Thinkorswim for options day trading?

A: Thinkorswim offers advanced charting capabilities, real-time data, sophisticated risk management tools, and a wide range of educational resources.

Day Trading Options On Thinkorswim

Conclusion

Day trading options on Thinkorswim can be a rewarding yet challenging endeavor. By harnessing the power of Thinkorswim’s platform, understanding the nuances of options, employing effective strategies, and adhering to sound risk management principles, traders can increase their chances of success. Remember, education, discipline, and unwavering dedication are the keys to unlocking the full potential of options day trading.

Are you ready to embark on the transformative journey of options day trading with Thinkorswim?