In the ever-evolving landscape of financial markets, spread option trading stands out as a sophisticated strategy that empowers investors to navigate complex market dynamics, manage risk, and unlock substantial returns. This comprehensive guide will delve into the fundamentals, intricacies, and practical applications of spread option trading, equipping you with the knowledge and strategies to succeed in this dynamic and rewarding arena.

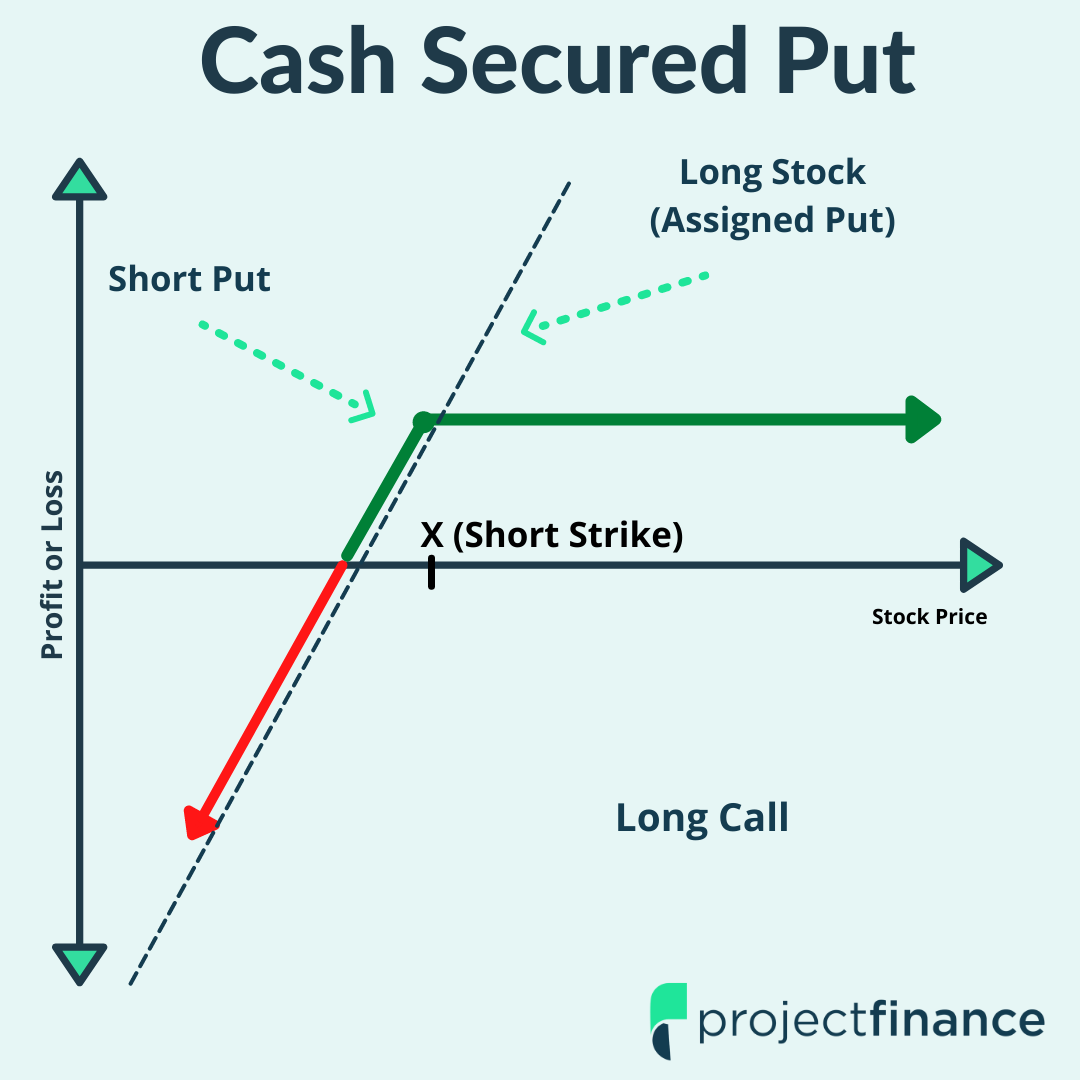

Image: www.projectfinance.com

Understanding the Basics of Spread Option Trading

An option is a contract that grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and date. Spread option trading involves simultaneously buying and selling options with different strike prices and expiration dates, creating a synthetic position that balances risk and reward. By understanding the mechanics of options and the concept of spreads, you can unlock the doors to a wider universe of trading possibilities.

Types of Spread Option Strategies

There are a myriad of spread option strategies, each tailored to specific market conditions and risk-return profiles. Some of the most commonly employed strategies include:

- Bull Call Spread: This strategy involves buying one call option at a higher strike price and simultaneously selling one call option at a lower strike price. It is typically employed when the trader anticipates a moderate rise in the underlying asset’s price.

- Bear Put Spread: Similar to the bull call spread, this strategy entails buying one put option at a lower strike price and selling one put option at a higher strike price. It is usually adopted when the trader expects a moderate decline in the price of the underlying asset.

- Vertical Spreads: Vertical spreads involve options of the same type (either call or put) with differing strike prices. They offer a flexible blend of defined risk and return parameters.

- Horizontal Spreads: These spreads consist of options with the same expiration date but differing strike prices. They are typically implemented in anticipation of a limited price fluctuation in the underlying asset.

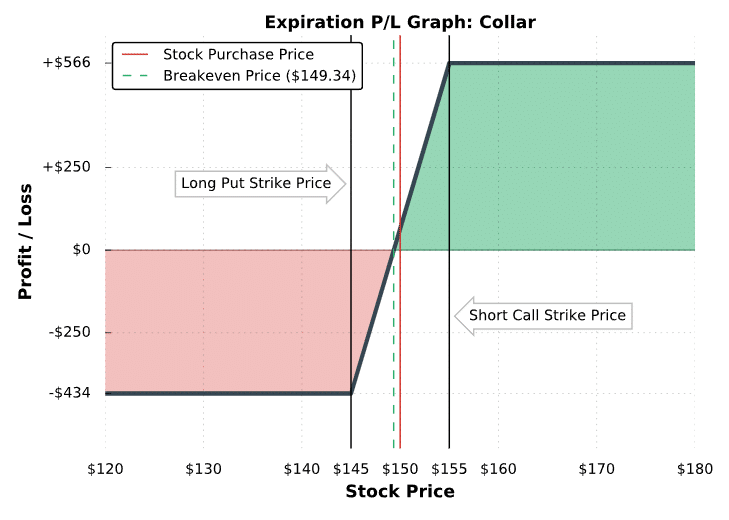

Determining Risk and Reward

One of the critical aspects of spread option trading is understanding the inherent risks and rewards associated with each strategy. Vertical spreads offer limited profit potential and defined risk, making them suitable for conservative traders. Horizontal spreads, on the other hand, offer greater profit potential but also carry higher risk.

Image: www.projectfinance.com

Managing Risk and Maximizing Returns

Managing risk is paramount in spread option trading. By adhering to sound risk management principles, traders can mitigate potential losses and preserve capital. These principles include:

- Defining Exit Strategies: Establishing clear entry and exit points before executing a trade is crucial to managing risk effectively.

- Monitoring Market Conditions: Continuously monitoring market conditions and the performance of the underlying asset helps traders identify opportunities for maximizing returns and adjusting strategies as needed.

- Managing Leverage: Spread option trading involves the use of leverage, which can amplify both profits and losses. Traders should be conservative in their use of leverage to avoid overexposure and financial ruin.

Spread Option Trading

Conclusion: Empowering Investors in the World of Options

Spread option trading presents a world of opportunities for astute investors willing to navigate the complexities of options markets. By understanding the fundamentals, embracing sound risk management practices, and utilizing proven strategies, you can unlock the potential of spread option trading to achieve your financial goals. Remember, knowledge is power, and with the insights contained in this comprehensive guide, you can confidently embark on this rewarding journey and emerge as a proficient spread option trader.