Introduction

In the ever-expanding realm of cryptocurrency, options trading has emerged as a sophisticated and potentially lucrative avenue for savvy investors. Bitcoin, the pioneering cryptocurrency that has sparked a global financial revolution, now presents unparalleled opportunities for options trades, enabling investors to navigate market volatility and profit from the dynamic price fluctuations of this digital asset. This article delves into the intricate world of options trading for Bitcoin, exploring its history, fundamentals, and practical applications, equipping readers with the knowledge and insights to navigate this exciting market landscape.

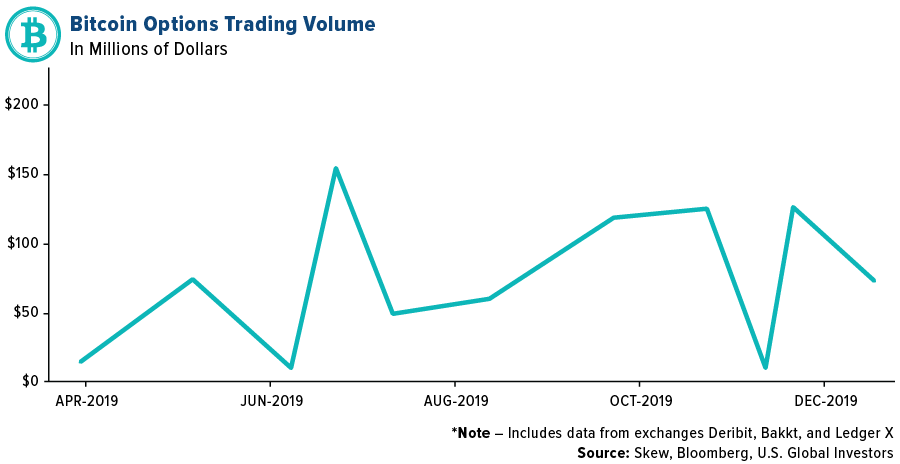

Image: www.usfunds.com

Unveiling the Basics of Options Trading

Options are financial instruments that grant the holder the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price within a specified timeframe. In the context of Bitcoin options trading, the underlying asset is, unsurprisingly, Bitcoin itself. By purchasing an options contract, investors gain the flexibility to capitalize on price movements in the underlying asset without the need to own it directly. This flexibility allows for various trading strategies, catering to different risk appetites and investment goals.

Understanding Call and Put Options

Call options confer upon the holder the right to buy a certain amount of Bitcoin at a specified price (known as the strike price) on or before a set date (known as the expiration date). If the market price of Bitcoin exceeds the strike price at or before expiration, the holder can exercise their option and purchase the Bitcoin at the advantageous strike price, potentially profiting from the price difference. Conversely, put options grant the holder the right to sell a certain amount of Bitcoin at the strike price on or before the expiration date. If the market price of Bitcoin falls below the strike price, the holder can exercise their put option and sell their Bitcoin at the higher strike price, mitigating potential losses from the price decline.

Strategic Deployment of Options Trading

Options trading in the Bitcoin market offers a diverse range of strategies, enabling investors to tailor their trades to their individual investment goals and risk tolerance. Some common strategies include:

-

Bullish strategies: These strategies are employed when investors anticipate a price increase in Bitcoin. Call options are typically used in bullish setups, allowing investors to profit from upward price movements while limiting downside risk.

-

Bearish strategies: These strategies are implemented when investors expect a price decrease in Bitcoin. Put options are commonly used in bearish setups, offering investors the potential to profit from downward price trends while managing their exposure to potential losses.

-

Neutral strategies: These strategies are utilized when investors anticipate the price of Bitcoin to remain relatively stable within a specific range. Neutral strategies involve combinations of call and put options, aiming to generate income from option premiums while neutralizing market fluctuations.

Image: www.drwealth.com

Navigating the Challenges of Options Trading

While options trading presents immense opportunities, it also comes with inherent risks that investors must be cognizant of. Options have a finite lifespan, and their value can decay over time, especially if the underlying asset’s price does not move in the anticipated direction. Furthermore, options trading involves the payment of premiums, which can reduce potential profits if the underlying asset’s price does not reach the desired strike price.

Options Trading For Bitcoin

Image: cryptopotato.com

Conclusion

Options trading for Bitcoin offers a myriad of possibilities, empowering investors to harness the potential of this dynamic cryptocurrency market. By embracing a comprehensive understanding of options basics, strategic trading techniques, and the associated challenges, investors can navigate this complex landscape with greater confidence and potentially reap substantial rewards. As the Bitcoin market continues to evolve, the sophistication and versatility of options trading will undoubtedly continue to attract the attention of discerning investors seeking to maximize their returns and mitigate risks in the ever-changing world of cryptocurrency.