Unleashing the Power of Credit Spread Option Trading

Imagine holding the keys to a strategy that empowers you to navigate the dynamic realm of financial markets with precision and potential profit. Credit spread option trading unlocks a world of opportunities, allowing you to venture beyond traditional investment approaches. It’s like wielding a financial scalpel, meticulously shaping the risk and reward profile of your investments to align with your unique objectives. Join us on this educational journey as we delve into the captivating world of credit spread option trading strategies, equipping you with the knowledge and tools to maximize your financial potential.

Image: www.projectoption.com

Navigating the Dynamics of Credit Spread Option Trading

A credit spread option trade involves the simultaneous buying and selling of options with different strike prices and the same expiration date. By constructing a credit spread, you effectively define a narrow trading range within which you anticipate the underlying asset to move. If your prediction holds true, you harness the potential for substantial returns while limiting your potential losses.

Unlimited Upside, Defined Downside

The beauty of credit spread option trading lies in its inherent asymmetry. You enjoy unlimited upside potential if the underlying asset’s price moves favorably within your predicted range. Conversely, your downside risk is clearly defined, providing a sense of comfort and control.

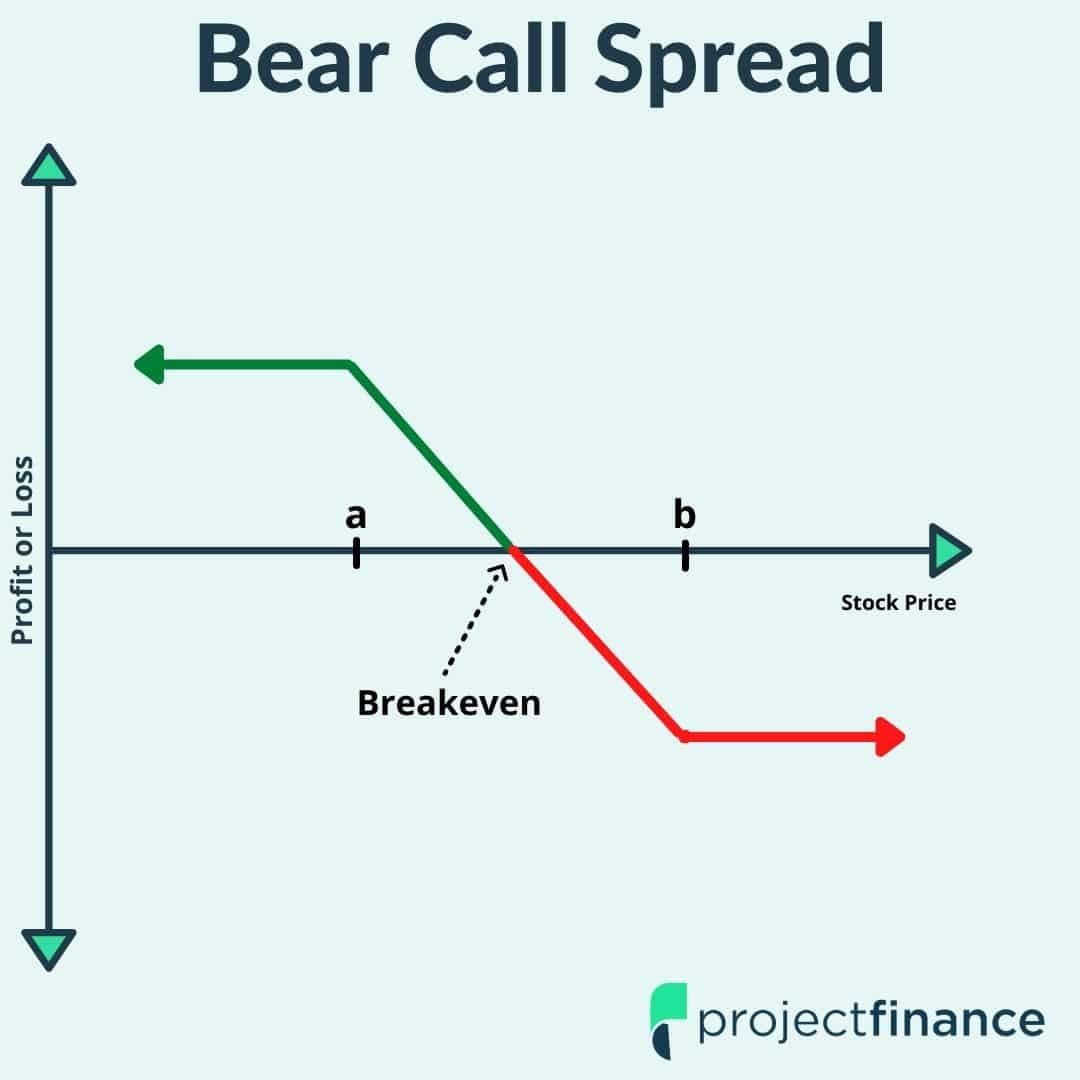

Bull Call Credit Spreads

When you anticipate an upward price movement in the underlying asset, a bull call credit spread is your weapon of choice. This strategy involves selling a call option with a higher strike price and simultaneously buying a call option with a lower strike price, both having the same expiration date. By doing so, you generate immediate cash flow and position yourself to profit from a bullish trend within the defined range.

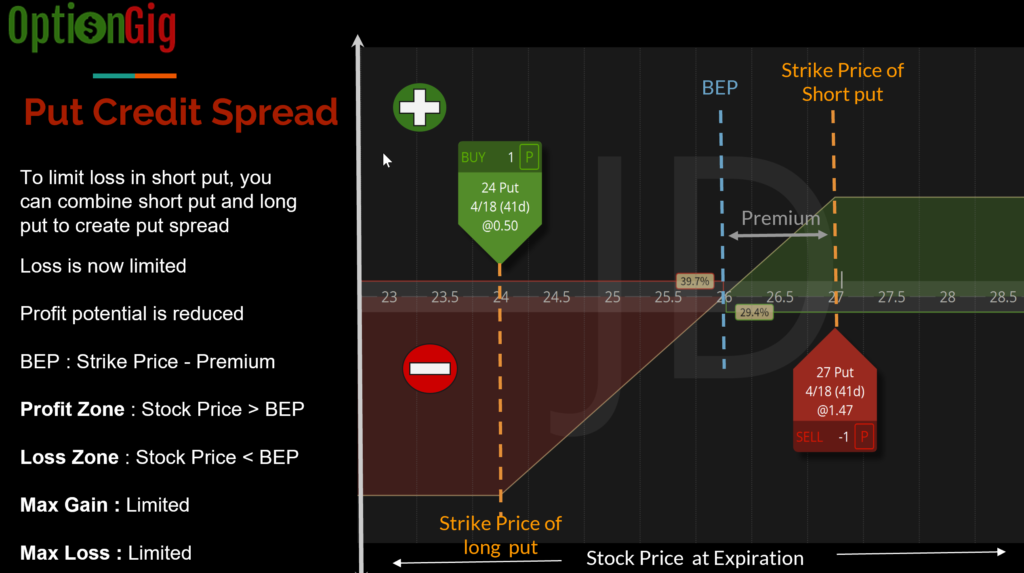

Image: optiongig.com

Bear Put Credit Spreads

If your market analysis anticipates a decline in the underlying asset’s price, a bear put credit spread is the strategy you’ll want to employ. Here, you sell a put option with a lower strike price and buy a put option with a higher strike price, again with the same expiration date. This strategy enables you to benefit from a bearish outlook while capturing immediate cash flow.

Expert Insights and Strategies

As you embark on your credit spread option trading journey, seek guidance from seasoned experts in the field. Consult with experienced financial professionals who can provide personalized advice tailored to your unique financial goals and risk tolerance.

Here’s a pro tip: when constructing a credit spread, always maintain a bullish or bearish stance regarding the underlying asset’s price movement. Never straddle or strangle (buying and selling both call and put options simultaneously) unless you’re comfortable with unlimited losses.

Credit Spread Option Trading Strategies Part 1

Image: www.projectfinance.com

Conclusion

Credit spread option trading empowers you to explore new horizons in financial investing, offering opportunities for strategic decision-making and potentially profitable returns. By understanding the foundational concepts and employing a disciplined approach, you gain the confidence to navigate the complexities of the financial markets. Don’t hesitate to venture further into this fascinating realm, seeking knowledge, embracing expert advice, and honing your skills. The world of credit spread option trading awaits you, brimming with possibilities and the potential to elevate your financial prowess.