In the realm of financial markets, where precision and strategy reign supreme, option credit spreads emerge as an invaluable tool for investors seeking to harness the transformative power of risk management. These intricate contracts, meticulously crafted to orchestrate an equilibrium of profit potential and risk tolerance, have captivated the interest of astute traders for decades. In this comprehensive guide, we embark on an enlightening journey to unravel the intricate tapestry of option credit spread trading, empowering you with the knowledge and insights to confidently navigate the ever-evolving landscape of financial markets.

Image: www.pinterest.com

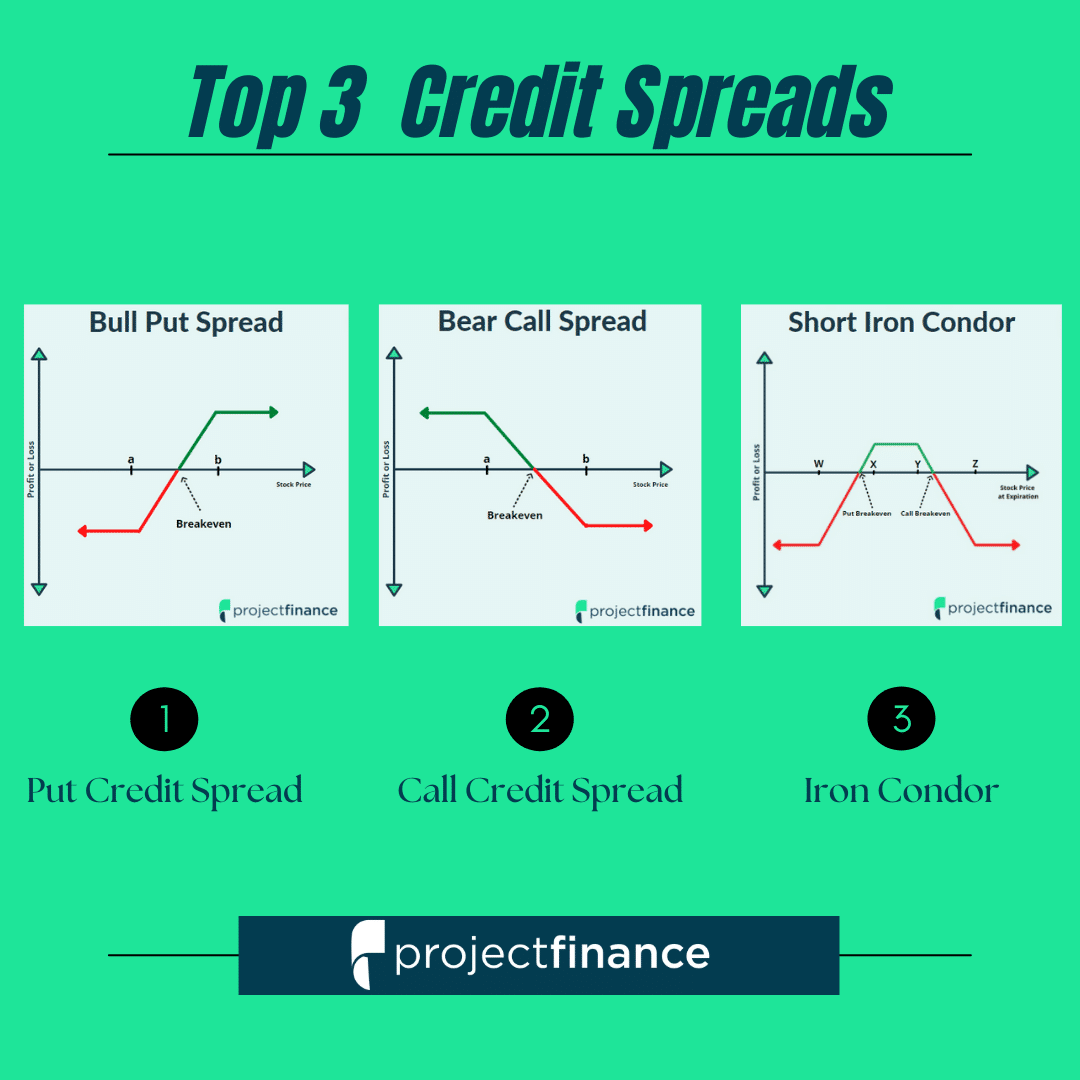

Unveiling the Essence of Option Credit Spreads:

At their core, option credit spreads represent a class of trading strategies meticulously designed to capitalize on specific market movements while simultaneously mitigating the inherent risks associated with traditional option trading. Through a synergistic combination of premium collection and measured risk exposure, credit spreads provide traders with a unique avenue to generate income and enhance their overall portfolio performance.

Visualizing Option Credit Spread Trading:

To effectively grasp the mechanics of option credit spreads, envision yourself as an architect meticulously assembling a financial structure comprised of two distinct components: a sold option at a higher strike price and a purchased option at a lower strike price. This intricate interplay between the two options creates an inherent “credit” position, granting you the advantage of receiving a net premium upon entering the trade.

Understanding the Dynamics of Profit Potential:

The profit potential inherent within option credit spreads stems from the astute interplay of market movements and the strategic positioning of the options within the strike price spectrum. As the underlying asset price fluctuates within the desired range, the sold option loses value while the purchased option concurrently gains value. This asymmetry in value dynamics unveils the opportunity for substantial profit realization.

Exploring Risk Management Strategies:

While the allure of profit is undeniable, prudent trading practices demand a steadfast adherence to risk management principles. Option credit spreads, despite their inherent capacity for profit generation, are not immune to potential risks. As such, meticulously calibrating your trades, diligently monitoring market conditions, and employing disciplined position management techniques are crucial elements of a successful trading strategy.

Leveraging the Wisdom of Trading Veterans:

In the realm of option credit spread trading, the collective wisdom of experienced traders serves as an invaluable resource. Seek guidance from seasoned professionals who have mastered the intricacies of this trading discipline. Their insights, borne from years of market experience, can illuminate the path toward informed decision-making and enhanced trading outcomes.

Navigating Market Dynamics with Option Credit Spreads:

The versatility of option credit spreads extends beyond theoretical concepts; these strategies demonstrate practical applications across a diverse spectrum of market conditions. In trending markets, credit spreads can amplify profit potential through the judicious selection of strike prices. Conversely, in range-bound markets, credit spreads offer the opportunity to generate income by capitalizing on the sideways price action.

Enriching Your Trading Toolkit with Option Credit Spreads:

By integrating option credit spreads into your trading arsenal, you are not merely acquiring a trading strategy; you are embarking on a journey of personal empowerment. These multifaceted contracts provide you with the agility to adapt to varying market conditions, empowering you to navigate the complexities of financial markets with confidence and precision.

In conclusion, option credit spread trading, with its intricate interplay of profit potential and risk management, offers a potent tool for harnessing the dynamics of financial markets. Whether you are a seasoned trader or a burgeoning enthusiast, unlocking the power of credit spreads can elevate your trading prowess to unprecedented heights. Approach this trading discipline with diligence, embrace the lessons imparted by seasoned professionals, and leverage these strategies to craft a path toward financial success.

Image: fabalabse.com

Option Credit Spread Trading