Image: keeptradingit.com

Introduction:

In the tempestuous waters of financial markets, where uncertainty reigns supreme, options trading credit spreads emerge as a life raft, offering solace to investors seeking shelter from the unpredictable. Credit spreads, a potent strategy, empower traders to capitalize on market neutrality, hedging against risk and unlocking potential returns. This article, meticulously crafted with accuracy and transparency, unveils the intricate tapestry of options trading credit spreads, empowering you with the knowledge to navigate the market’s labyrinthine corridors.

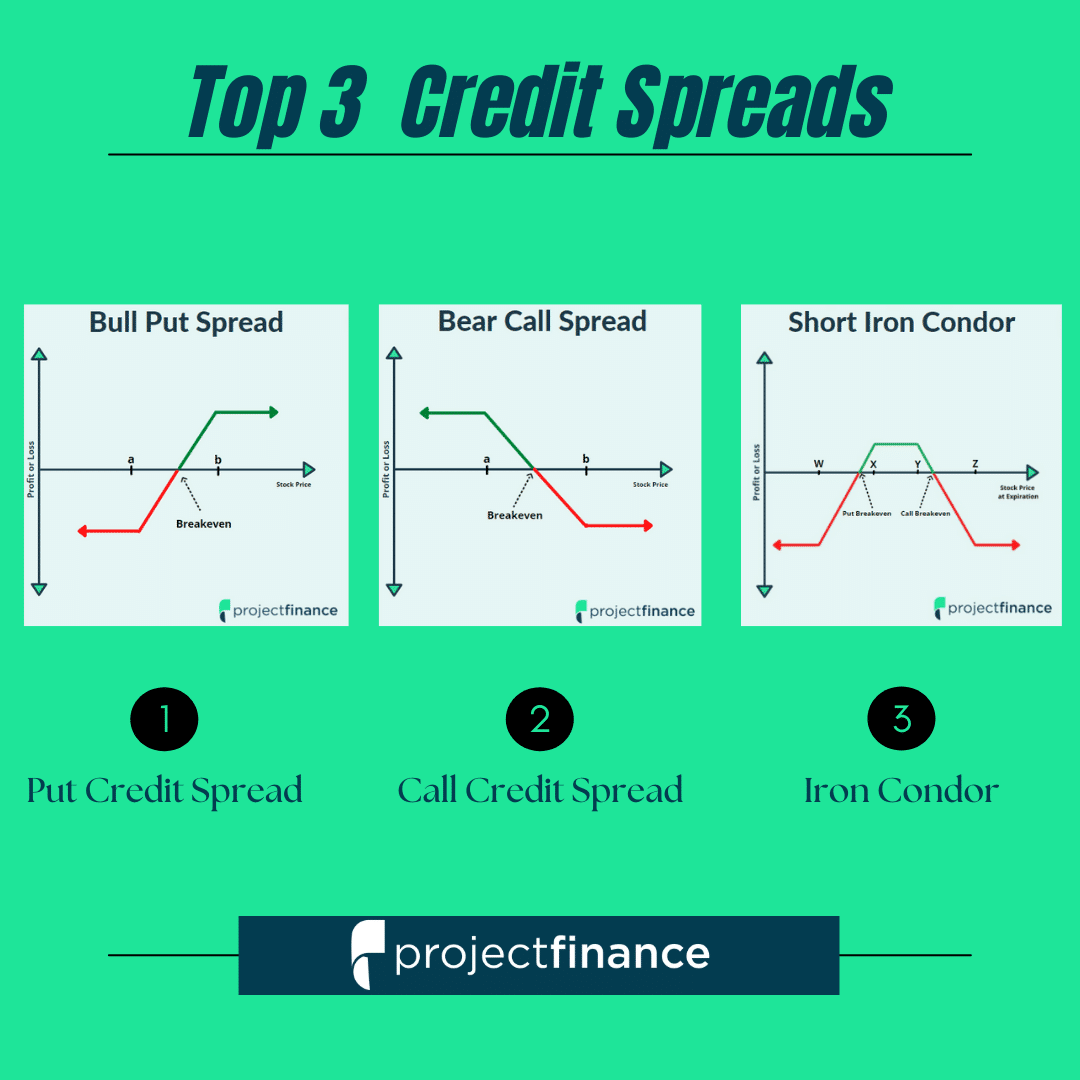

Understanding Options Trading Credit Spreads:

Credit spreads are an options trading strategy that involves simultaneously selling and buying options of the same underlying asset, at different strike prices and expiration dates. This complex yet ingenious arrangement creates a synthetic position that benefits from market neutrality, the absence of pronounced directional bias.

In essence, credit spreads allow investors to speculate on the range within which the underlying asset will fluctuate, rather than forecasting its specific direction. This hedging mechanism significantly reduces risk compared to directional trades, making credit spreads highly enticing for those seeking moderate returns with controlled exposure to market volatility.

Unveiling the Mechanisms of Credit Spread Pricing:

The intricate pricing of credit spreads hinges on several intertwined factors:

-

Strike Price Differential: The difference between the strike prices of the sold (higher strike) and bought (lower strike) options significantly impacts the spread’s risk profile and potential return.

-

Net Credit Received: When entering a credit spread, traders receive a net premium, effectively financing the spread’s construction. This premium represents the spread’s maximum potential profit.

-

Time Decay: As an option’s expiration date approaches, its time value erodes, impacting the overall value of the spread, particularly short (sold) options, which decay more rapidly.

-

Implied Volatility: The market’s projected price fluctuation is reflected in implied volatility, directly influencing credit spread valuations and potential outcomes.

Expert Perspectives on Credit Spread Proficiency:

Seasoned experts in the financial arena extol the virtues of options trading credit spreads, emphasizing their ability to generate income in sideways or mildly trending markets, their resilience against market swings, and the relatively limited margin requirements, making them accessible to a broader range of traders.

-

Michael Carr, an options trading luminary: “Credit spreads are an ideal option strategy for investors who anticipate low-volatility or range-bound markets.”

-

Lauren Simmons, a renowned market strategist: “Incorporating credit spreads into your trading arsenal diversifies your portfolio, reduces risk, and augments return potential.”

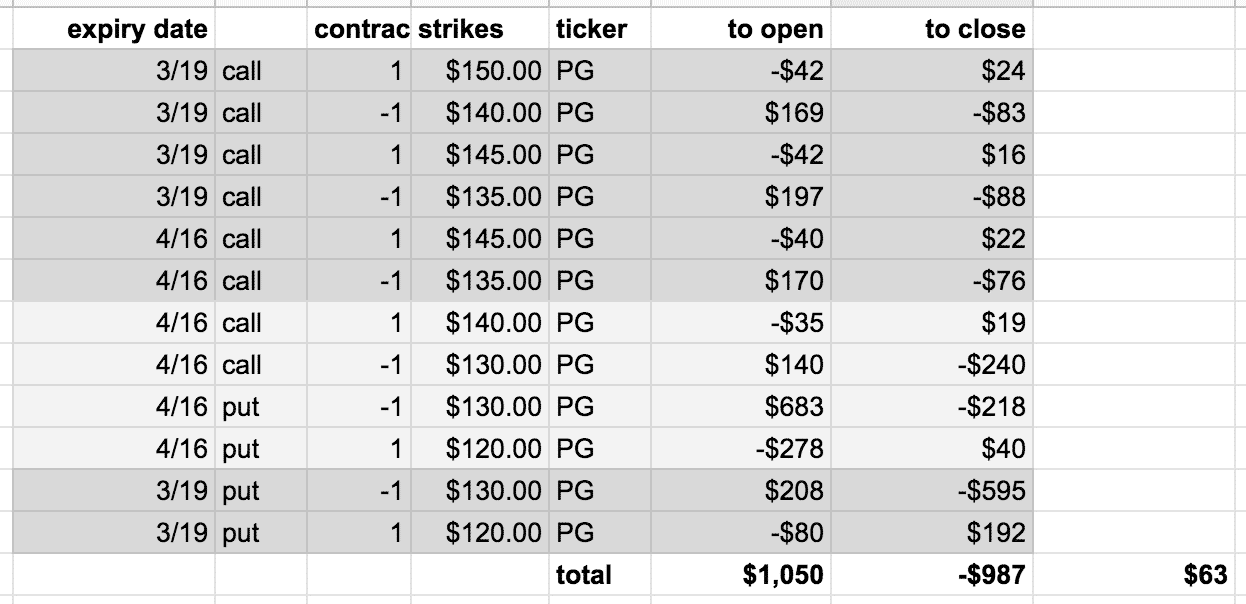

Actionable Strategies for Credit Spread Success:

To harness the full benefits of credit spreads, meticulous execution and ongoing monitoring are paramount:

-

Identify Suitable Underlying: Choose assets that exhibit predictable trading patterns and moderate volatility.

-

Determine Strike Prices and Expiration Dates: Assess the market’s implied volatility and risk tolerance to select strike prices and expiration cycles that align with your trading objectives.

-

Calculate Risk-Reward: Thoroughly analyze the potential profit, risk, and optimal holding period to ensure the trade’s suitability within your investment strategy.

-

Monitoring and Adjustments: Regularly track the performance of your credit spreads, adjusting them as market conditions evolve, such as adjusting strike prices or expiration dates to optimize returns.

Conclusion:

Options trading credit spreads are a versatile and effective strategy for risk-averse investors seeking market neutrality and steady returns. By skillfully combining the sale and purchase of options with differing characteristics, credit spreads provide a hedging mechanism that harnesses the benefits of option strategies while mitigating potential pitfalls. Embracing this masterful technique, investors are empowered to navigate market uncertainty with confidence, maximizing returns and safeguarding their financial aspirations.

Image: www.projectfinance.com

Options Trading Credit Spreads

Image: optionstradingiq.com