Trade Entry

**Date:** 2023-05-05

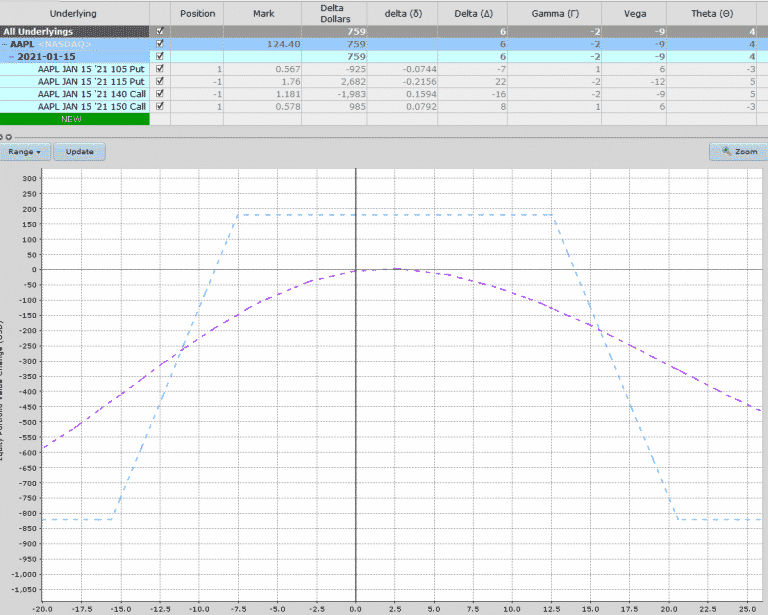

Image: www.tradingoptionscashflow.com

**Symbol:** AAPL

**Expiration:** 2023-06-16

**Strikes:** 150/145 put credit spread

**Premium Collected:** $2.40

**Maximum Loss:** $2.60

Trade Strategy

The 150/145 put credit spread is a bullish trade that benefits from a stable or rising stock price. By selling the 150 put and buying the 145 put, I have created a defined risk range between the two strikes.

If AAPL closes above 150 at expiration, both options will expire worthless and I will keep the premium collected as profit.

Monitoring and Adjustments

**Day 7:** AAPL has rallied 2% since trade entry. The spread is now trading at $1.80, indicating a potential profit of $0.60.

**Day 14:** AAPL has continued to rise, trading at 152. The spread is now worth only $0.50, but I decide to hold as I believe there is still room for further upside.

Trade Exit

**Day 21:** AAPL is trading at 154, near the breakeven point of the spread. I decide to close the position for a small loss of $0.10.

Image: www.pinterest.com

Trade Summary

This trade was a learning experience, despite the small loss. I misjudged the strength of the rally and should have closed the position sooner when the spread reached its maximum profit potential.

The key lessons learned from this trade are to closely monitor spread prices and adjust positions as needed, and to have a clear exit strategy before entering a trade.

Expert Advice

- Use a systematic approach to trading credit spreads. This includes developing a plan for trade entry, monitoring, and exit.

- Be patient and disciplined. Credit spreads are not get-rich-quick schemes. It takes time and practice to develop the skills necessary to trade them successfully.

- Manage your risk carefully. Always have a stop-loss order in place to protect your capital.

Credit Spreads Options Trading Journal

Image: optionstradingiq.com

FAQ

Q: What is the purpose of a credit spread?

A: A credit spread is a neutral to bullish options strategy that generates income through the sale of options premiums.

Q: What are the risks associated with trading credit spreads?

A: The main risks of trading credit spreads are unlimited loss potential and the time decay of options premiums.

Q: How do I choose the right strikes for a credit spread?

A: When choosing strikes for a credit spread, consider the underlying asset’s price, volatility, and your market outlook.

Conclusion

Trading credit spreads can be a rewarding way to generate income and speculate on the market. However, it is imperative to remember that options trading involves significant risk.

If you are interested in learning more about credit spreads, I encourage you to do your research and consult with a financial professional.