Diving into the World of Profitable Option Strategies

Imagine yourself at a casino, the thrill of anticipation coursing through your veins as you roll the dice. The outcome is uncertain, but the promise of a substantial reward is tantalizing. In the world of finance, option trading offers a similar adrenaline rush, promising potential gains that can amplify your investment returns. Among the various option trading strategies, “in the money” options stand out as a particularly lucrative choice for traders seeking to maximize their profits.

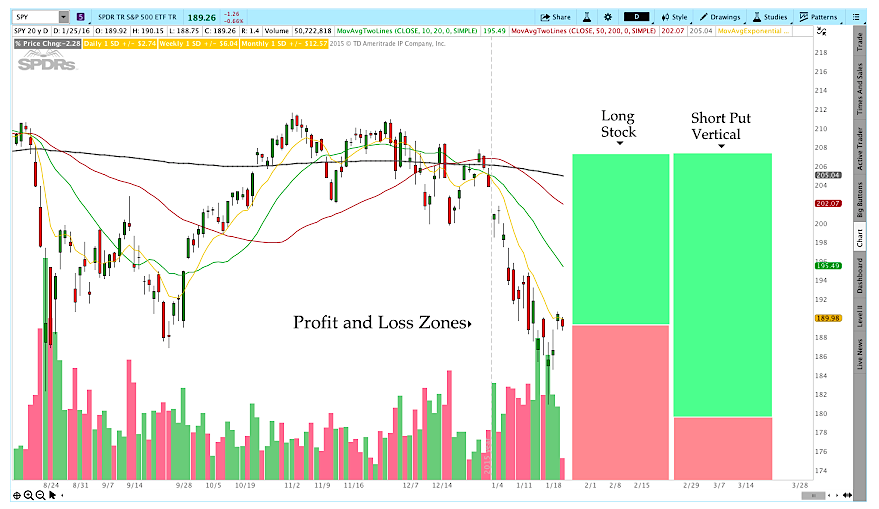

Image: www.seeitmarket.com

In this comprehensive guide, we embark on an enthralling journey into the realm of in the money option trading. We’ll delve into the intricacies of this strategy, empowering you with the knowledge and insights necessary to navigate the financial markets like a seasoned pro. So, buckle up and get ready to explore the world of in the money options.

Understanding In the Money Options

Definition:

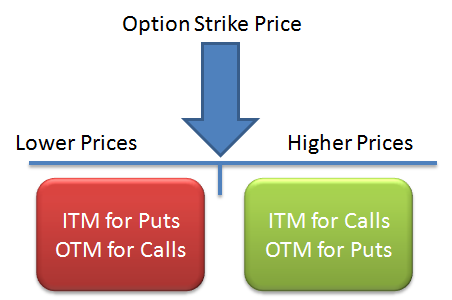

Before we delve into the trading strategies, let’s first lay the foundation with a clear understanding of in the money options. An in the money option is a type of option contract where the strike price (the price at which the underlying asset can be bought or sold) is favorable to the option holder. In simpler terms, for a call option, the strike price is below the current market price of the underlying asset, while for a put option, the strike price is above the current market price.

Historical Background:

The concept of options trading has its roots in ancient Greece, where merchants used to trade contracts that gave them the right to buy or sell goods at a specified price in the future. Over the centuries, options trading evolved and found its way into the modern financial markets. In the 20th century, the Chicago Board Options Exchange (CBOE) played a pivotal role in standardizing and popularizing option contracts.

Image: wealthdiagram.com

Significance:

In the money options hold significant importance in the world of options trading due to their inherent value. Since the strike price is favorable to the option holder, there’s an intrinsic value attached to these options, even before the underlying asset’s price moves further in the desired direction. This intrinsic value makes in the money options more expensive compared to their out of the money counterparts.

Exploring In the Money Option Trading

Strategies:

There are two main strategies associated with in the money option trading:

- Buying In the Money Calls: This involves purchasing an in the money call option, which gives the holder the right to buy the underlying asset at a favorable strike price. This strategy is typically employed when the trader expects the asset’s price to continue rising, and the option’s intrinsic value can provide a cushion against potential losses.

- Selling In the Money Puts: Here, the trader sells an in the money put option, granting the buyer the right to sell the underlying asset at a favorable strike price. This strategy is commonly used when the trader anticipates the asset’s price to remain stable or decline within a certain range. The premium received from selling the put option compensates for the potential decline in the asset’s price.

Benefits and Risks:

Benefits: In the money options offer several advantages:

- Higher Probability of Profit: Since the strike price is already favorable, in the money options have a higher probability of expiring in the money, leading to potential profits.

- Limited Risk: In the case of buying in the money calls, the maximum loss is capped at the option premium paid. For selling in the money puts, the risk is limited to the difference between the strike price and the asset’s current market price.

Risks: While in the money options offer advantages, they also come with certain risks:

- Time Decay: The value of in the money options decays over time, especially as the expiration date approaches. This time decay can erode the option’s value, reducing potential profits.

- High Cost: In the money options are generally more expensive than their out of the money counterparts due to their intrinsic value, which can limit their accessibility for some traders.

Latest Trends in In the Money Option Trading

The world of option trading is constantly evolving, and in the money options are no exception. Here are some of the latest trends:

- Increased Use of Options in ETFs: Traders are increasingly using options on exchange-traded funds (ETFs) to diversify their portfolios and gain exposure to specific market sectors.

- Growth of Binary Options: Binary options, a type of option contract with a fixed payout, have gained popularity due to their simplicity and high potential returns.

- Advanced Option Trading Platforms: Technological advancements have led to the development of sophisticated option trading platforms that provide real-time data, advanced analytics, and automated trading capabilities.

Tips and Expert Advice for Successful In the Money Option Trading

To enhance your in the money option trading journey, consider these tips and expert advice:

- Understand the Risks and Rewards: Before venturing into in the money option trading, it’s crucial to have a thorough understanding of the potential risks and rewards involved.

- Choose the Right Underlying Asset: Selecting the appropriate underlying asset for your option strategy is essential. Consider factors such as market trend, volatility, and liquidity.

- Set Realistic Expectations: While in the money options offer the potential for significant gains, it’s important to set realistic profit targets. Avoid chasing excessive profits that may lead to impulsive decisions.

Additionally, seek guidance from experienced traders or consult with a financial advisor to gain valuable insights and make informed trading decisions.

FAQ on In the Money Option Trading

- Q: What is the difference between in the money and out of the money options?

A: In the money options have a favorable strike price compared to the current market price, while out of the money options have an unfavorable strike price. - Q: How can I identify potential in the money options?

A: Analyzing technical charts, studying market news, and using option pricing models can help you identify potential in the money options. - Q: What factors affect the premium of in the money options?

A: Factors such as the strike price, time to expiration, volatility, and interest rates influence the premium of in the money options. - Q: Can I lose money trading in the money options?

A: Yes, while in the money options have a higher probability of success, it’s still possible to lose money due to factors like market fluctuations and time decay.

In The Money Option Trading

Image: investingwithoptions.com

Conclusion

In the money option trading offers a lucrative opportunity for investors seeking to enhance their investment returns. By understanding the concepts, strategies, benefits, and risks associated with this trading approach, traders can position themselves to make informed decisions. The latest trends in option trading, coupled with expert advice and a thorough FAQ section, provide a comprehensive guide for navigating the in the money option trading landscape. So, embrace the thrill, delve into the world of in the money options, and unlock the potential they hold to amplify your financial success.

Would you like to explore the fascinating world of in the money option trading further? If so, delve deeper into our blog for more in-depth articles and insights to empower your trading journey.