VIX option trading can be a complex but potentially profitable strategy for experienced traders. Understanding VIX options, their characteristics, and risk management techniques is crucial for successful trading. In this article, we will provide a thorough overview of VIX option trading, discussing its basics, strategies, and tips to enhance your trading.

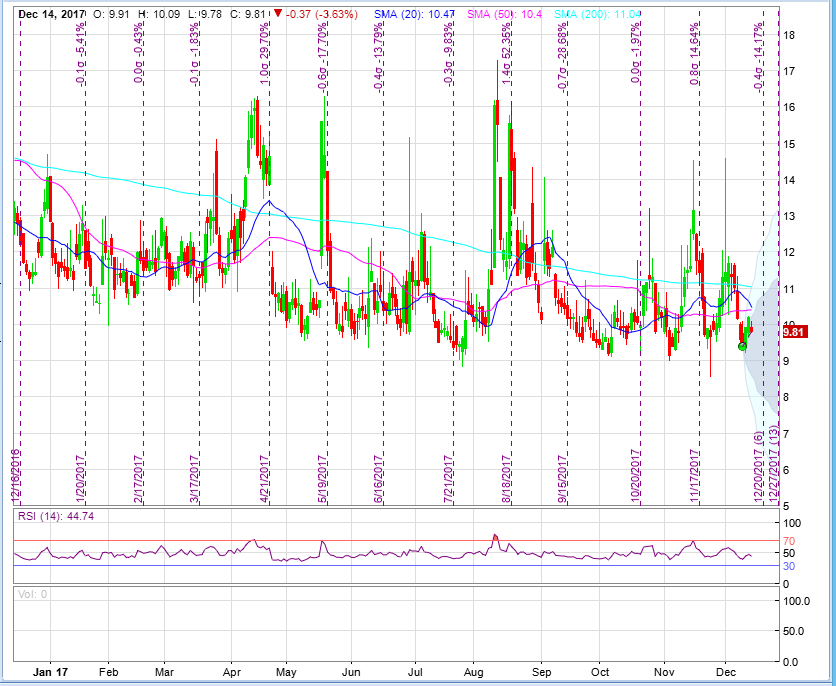

Image: tradingskeptic.com

VIX Options: Understanding the Fundamentals

VIX options are derived from the CBOE Volatility Index (VIX), a widely used measure of market volatility. These options allow traders to speculate on the future volatility of the S&P 500 index. The VIX is calculated using the implied volatility of near-month at-the-money options on the S&P 500.

Strategies for VIX Option Trading

There are several strategies that traders employ in VIX option trading. Common strategies include:

- Long VIX Calls: Purchasing long VIX calls allows traders to profit from an increase in market volatility.

- Short VIX Puts: Selling short VIX puts can generate income if volatility remains low or decreases.

- VIX Straddle: Purchasing both a call and a put option with the same strike price and expiration date can provide leverage on volatility.

- VIX Collar: A relatively conservative strategy that involves selling a put option above the current VIX level and buying a collar below it.

Tips and Expert Advice for VIX Option Trading

To enhance your VIX option trading experience, consider the following tips and expert advice:

- Understand Market Conditions: Economic conditions, geopolitical events, and major news announcements can significantly impact market volatility.

- Monitor Option Premiums: Watch for high or low option premiums, as they can indicate potential trading opportunities.

- Manage Risk Effectively: Use stop-loss orders, limit orders, and hedging strategies to mitigate trading risks.

- Seek Expert Knowledge: Seek guidance from experienced traders, brokers, or financial advisors to gain deeper insights.

Image: www.dogsofthedow.com

Frequently Asked Questions (FAQs)

- What is the VIX?

The VIX is a measure of the implied volatility of the S&P 500 index, reflecting market expectations of future volatility.

- What drives VIX movements?

Economic conditions, news events, and geopolitical uncertainties significantly influence VIX levels.

- What is the difference between VIX futures and VIX options?

VIX futures are contracts that settle in cash, while VIX options offer the right, but not the obligation, to buy or sell VIX futures at a predetermined price

- Can I trade VIX options on any trading platform?

Most major trading platforms offer VIX option trading services.

- Is VIX option trading suitable for all investors?

VIX option trading involves significant risk and is recommended only for experienced traders with a high tolerance for volatility.

Vix Option Trading

Image: steadyoptions.com

Conclusion

VIX option trading can be a rewarding strategy for experienced traders who understand the underlying principles, market dynamics, and risk management techniques. By considering the strategies and tips outlined in this guide and seeking expert advice when needed, you can increase your chances of success in this dynamic and potentially profitable market.

Are you interested in learning more about VIX option trading?